Up 124% In Under 15 Months… And It’s Still A ‘Buy’

Investors face multiple dilemmas every day. Do I sell a stock that has declined? Do I book my gain after a rally? Is the market flashing an “All Clear” or “Stay Clear” sign? How do I make sure to stay invested despite the volatility?

None of these questions has a clear-cut answer. That’s because the market represents many influencers, from global to local to company-specific, and investors, each of whom has her own set of goals and constraints, must measure these factors daily, a near-impossible task.

What we do know from more than a century of data is that the market as a whole tends to move higher over the long term. Staying invested, through thick and thin, is, therefore, a good long-term strategy. But what about the short-term? One possible answer is to focus on stocks that are firmly on their own path, have a compelling story to tell and are leveraged to long-term, not short-term, trends.

Digimarc (Nasdaq: DMRC), one of our holdings over at Game-Changing Stocks, is a prime example.

| —Recommended Link— |

| I’ve Never Been More Excited About An Opportunity Pot stocks are dominating the headlines. But I’m not biting. Because I’ve found a safer, smarter way to make money from the legal marijuana market. It’s a unique profit-sharing plan that’s allowing everyday Americans to earn up to $55,563 a year. And the payouts are 100% backed by a U.S. Federal Law. The next check run is just days away. Get the full details here now. |

The company created and owns a new-generation barcode technology that has major potential. And since adding it to our portfolio in late March last year, my subscribers and I are up by more than 124%.

The company created and owns a new-generation barcode technology that has major potential. And since adding it to our portfolio in late March last year, my subscribers and I are up by more than 124%.

But when shares of the stock fell more than 18% on May 30 after two broker downgrades (from “buy” to “hold), investors were clearly tempted to see the downgrades as an excuse to take profits.

But while others saw a reason to sell, I see reasons to hold on — if not buy more.

Why? Well, for starters, as you can see in the chart above, we were actually losing money on this stock for a short period of time. But we stuck with it because I believed in the long-term story for this company… Prior to this, shares of Digimarc doubled in early May after the company announced it had signed a multi-year contract with Walmart (NYSE: WMT), a deal that reflected the progress the company has made with its “barcode of everything” technology. (For its part, Walmart will be using the DMRC barcode primarily for fresh products.)

Now, we’re not going to let an unexpected drop like this stop us. That’s because the long-term growth story is still in place.

Sure, as with any disruptor, the future for Digimarc is uncertain, but the potential is huge. And this sort of technology-dependent growth is largely independent of the economy, so we don’t need to worry as much about what the broader market is up to as we would with other stocks.

This can be said of many growth stocks, but here’s why I think that’s the case for DMRC…

Revolutionizing The Barcode

Today, the old-style barcode, which was a revolutionary invention on its own when it was introduced back in the 1970s, is everywhere. But as anyone who shops in a supermarket or certain other retail stores knows, barcodes can also be hard to read during checkout (they degrade, smudge, crinkle or wrap around the edges of a product you might be buying). Fraudulent use is another problem — some labels can be altered or even replaced.

#-ad_banner-#To address these challenges, Digimarc created a new barcode, which makes scanning more reliable and efficient, saves time, reduces cost, helps to record more accurate inventory data and provides a better customer experience.

But it turned out there are further potential benefits to the DMRC barcode. The latest generation of DMRC’s enhanced thermal labels, which are now used at Walmart, are designed to reduce waste (a huge financial and societal issue) and improve overall store operations. While some of the details of implementation are still confidential, the contract has an annual value of $3 million and is of unlimited duration.

This is a big deal for DMRC because it validates its platform on the highest level (Walmart is the largest retailer in the country).

But it’s worth remembering that DMRC is not a one-trick pony. Far from it.

“Barcode of Everything”

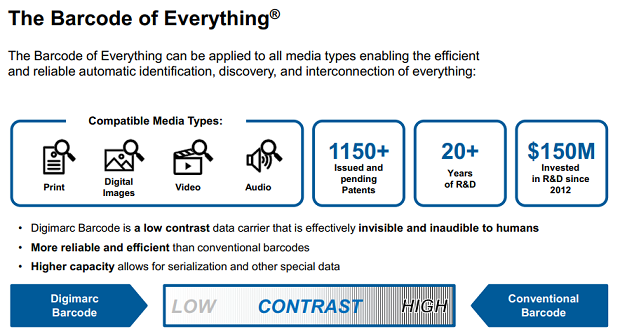

Digimarc Barcode is only a part of the Digimarc Intuitive Computing Platform (ICP). This is a comprehensive set of technologies for identifying, discovering, and interacting with digitally-enhanced media.

It does include the Digimarc Barcode, which cannot be seen by a human eye but enhances a variety of packaging and thermal labels with data. But this goes beyond retail as the barcode can be also used on audio, print, images and other objects. This data can then be detected by enabled devices such as smartphones, computers, barcode scanners, and machine-vision equipment.

But the value of the Digimarc Intuitive Computing Platform can expand far beyond retail and media. It can be easily applied to any supply chain — and, just as with the old barcode we all know so well, it can expand into every corner of the business. And because it’s mobile- and machine-vision ready, it can be used in any e-tailing operations. Better yet, DMRC’s platform can become an integral part of the Internet of Things (IoT), too. It does have this much potential.

And the further DMRC’s platform expands, the stronger will be the network effect, and the further it will continue to expand. In other words, when the number of users grows, the value of the DMRC platform will grow as well.

Action to Take

Here’s where I’m going with this… I know that some of my Game-Changing Stocks readers booked gains after the stock jumped. There is nothing wrong with that — we book gains, big and small, quite often. It’s a good way to reduce risks and to capitalize on picking a good stock at the right time. And as the saying goes, no one ever went broke taking a profit.

At the same time, there is also nothing wrong with buying back any of your old investment favorites if you understand their potential and believe the best is yet to come.

This is the case with Digimarc. I am keeping my “Buy” recommendation on the stock, and want to stress that, with its recent progress with its proprietary barcode, validated by Walmart, there will likely be more gains to come. Yes, there is a lot of work to do to make this a reality. But thanks to the high barriers to entry for any potential competitor, the likelihood that the company (and its investors) will benefit is relatively high. And this likelihood isn’t yet fully reflected in the stock. This is why I remain a fan.

If you didn’t originally get in on this stock, there’s still time to do so. And if you booked some gains earlier this month feel free to have at it again.

P.S. If you think a 124% gain in less than 15 months is great, then you need to see this…

My latest report reveals how a key vote in the House could finally lead to legalization of marijuana on a federal level. This could happen any day now, so you’ll want to know all the details before it happens, including the three stocks you need to own for the best chance of triple-digit gains. But if you wait to hear about these ideas in the mainstream financial media, it’ll be too late — the big gains will have already been made. To see the report go here right now…