Tired Of Watching Big-Time Gains Disappear? Do This Instead…

I get quite a few emails from subscribers about the idea of trailing stop losses. I always appreciate feedback from readers, and I try to personally respond to as many emails as possible.

These kinds of emails tend to come in whenever the market has had a long bullish run, but then suddenly runs into a roadblock.

Regardless, I’m glad that they ask… It shows they are thinking with a clear head. If you’re already thinking that maybe you should implement some sort of stop in order to protect your profits, you’re already miles ahead of the average investor.

So today, I want to address this in more detail, including why I’m such a big proponent — as well as give you a few ideas how you can implement a stop-loss strategy today.

Buying Is Only Half The Battle

As I’ve said countless times before, in order to become a successful investor, you need to have an exit strategy. Buying stocks is easy. There are thousands of strategies, indicators or theories out there on what, why and when to buy. But that’s only half the equation when it comes to making money.

Nobody ever talks about the hard part: knowing when to sell.

We’ve all made expensive mistakes before, whether by missing the full upside of a stock by selling too soon or taking a huge loss by holding a falling stock too long.

The ironic thing is that most people put enormous amounts of time and effort researching an investment to buy, yet they don’t give the sell side of the equation any thought. That needs to change. The same sort of due diligence that goes into buying a stock should go into when to sell.

Of course, that’s the beauty of my Maximum Profit system — it gives us clear buy and sell signals for each stock in our portfolio. But what about your other holdings?

I want to be clear on this… I believe that a trailing stop-loss should be a part of just about any investing strategy. That’s true for any stocks you hold. The truth is, you should also have a plan in place that forces you to methodically cut your losses and let your winners ride. It may be more difficult without a proven system in your corner, but it’s certainly doable with a little discipline.

That’s where a trailing stop-loss comes into play.

The Trailing Stop-Loss

Over at Maximum Profit, we implemented a 15% trailing stop-loss across the board for our holdings a couple of years ago. This was different from our normal sell signal, which is based on a proven momentum indicator. That indicator has worked very well for us since the inception of that newsletter, but I was getting increasingly wary of the extended bull market. And I didn’t want to leave anything to chance. Besides, it’s always good to have a backup exit plan in place — even if it proved to be redundant more often than not.

I wanted to keep as much of our profits as possible. I also wanted to give my readers some course of action in the event that one or more of our stocks went into freefall.

The basic premise of the 15% trailing stop-loss is to sell any position that falls 15% off its highs. As the term implies, a 15% trailing stop-loss “trails” the price of the stock. So as the price moves up, so should your stop-loss.

You may ask, “Why 15%?”

To be honest, there’s nothing magical about this number. It’s really the discipline that matters. Your trailing stop-loss can actually fluctuate depending on the investment. For example, some traders use a trailing stop-loss as high as 30% on small-cap stocks, since they tend to be more volatile. Other more conservative traders use tighter stops, like 10%.

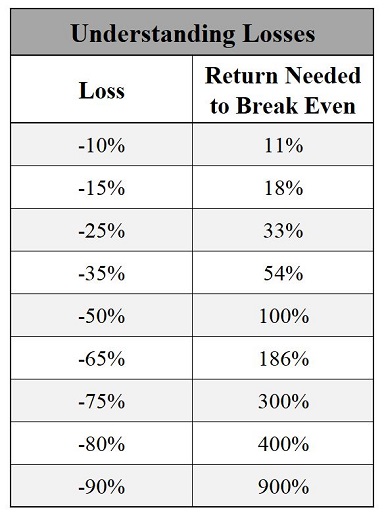

Again, the point is really the discipline. Ultimately, you don’t want to be in the position where a stock has fallen by more than what’s in your comfort zone. Keep in mind a stock that has fallen by 50% means it has to rise by 100% to just get you back to where it was when you bought it. Trust me, you don’t want to be in that situation.

By implementing trailing stops, and dutifully following them, chances are you’ll never need a 100% return just to get back to even.

Keep Track Of Your Stops

Now I should mention something important. When using a trailing stop-loss, or even a “hard” stop-loss, I DO NOT recommend placing the actual stop-loss order into your brokerage account. Of course, there are exceptions — maybe you’re leaving on vacation or will otherwise be preoccupied — and you don’t want to leave your portfolio unattended. But for the most part, I don’t recommend placing them with your broker.

My reasoning here is that I don’t want to a stop to be executed during intraday trading. We’ve all seen “flash crashes” and watched stocks tumble, only to close higher. If you have a stop placed and something like this happens it will likely execute at a terrible price. That’s why I use closing prices and keep track of them myself.

If a stock closes below the 15% trailing stop-loss, simply sell it the next trading day.

In order to track trailing stops, I personally use Excel. I find it easier to manipulate than my brokerage account, plus I don’t have to worry about getting signed out. You can actually pull in stock information right into Excel (most brokerage services even offer an excel file download of your portfolio). There are also Excel add-ins that allow you to type in a ticker symbol and pull in nearly any data point you want.

If you don’t want to go that far, most brokerage platforms have alerts that you can set up to notify you instead.

Closing Thoughts

Just remember that there’s no magical number to use. You can adjust it to find your “sweet” spot. Remember that the stop-loss is based on the stock’s highest recent close, and I base my sells off of the closing prices only. Also, as the stock rises, so should your stop price. And last, but not least, don’t place your stop losses in your brokerage accounts.

The point is, setting a stop-loss for each of your holdings is a great step to getting a better handle on your portfolio. You’ll sleep better at night — what’s more, you’ll find that your portfolio performance will be better in the long-run.

P.S. I just released a new briefing about cryptocurrencies — and how you can profit…

My team and I think cryptocurrencies will surge again in the coming months. That’s because three “blue chip” cryptocurrencies are getting major upgrades this year, and they could unleash a massive crypto boom…

This could easily be a once-in-a-lifetime chance to take a small amount and turn it into a life-changing gain. Sounds unbelievable, I know… but the numbers don’t lie. Get the details here…