Why Relative Strength Investing Is One Of The Best Ways To Pick Winning Stocks

What’s the first rule of successful real estate investing? Of course, you just said to yourself, “location, location, location.”

Well, when it comes successful equity trading, the first rule that should come to your mind is “price, price, price.”

More specifically, we’re talking about the share price performance of a stock or ETF relative to other stocks and ETFs. This is also known as relative strength investing. And in our opinion, it’s one of the most important metrics to put in your favor.

Let’s say you are looking at a security that is outperforming others in the broad market or within its specific industry group. This should tell you that others on Wall Street think there is something special that makes it worth buying. It’s that simple…

This “something special” could be a variety of things. It could include a proven track record of strong revenue and earnings growth, a breakout product or game-changing service, or a high-demand personal technology product.

Whatever the reason, or combination of reasons, you should pay attention to recent price performance. In our experience, this will tell you more about what the market thinks about that security than any other fundamental ratio or so-called “valuation” metric you will ever use.

Quantifying Relative Performance

The chief way to assess share price performance relative to the rest of the market is an indicator called relative strength (RS). This indicator assigns a numerical score to a stock based on its price performance relative to other stocks in the market.

The RS rank gives you a great sense of how strong a stock has performed compared to the rest of the market. And though past performance isn’t a guarantee of future results, a stock or ETF with a strong RS rank is far more likely to continue outperforming the rest of the market than those with a low RS rank.

So, what is a “strong” RS rank? RS ranges from 0 (weakest) to 100 (strongest). When we look for stocks to trade, we want to see a RS rank of at least 70. This means it has outperformed 70% of all other stocks in the market over the past six months.

The 70 threshold is generally considered the minimum level. After all, with so many stocks to choose from, why try to pick one that hasn’t shown market-beating performance?

Why Relative Strength Investing Works

Over the past several decades, there have been numerous academic studies demonstrating the importance of relative strength when it comes to successful stock selection. One of the most prominent is the work of Prof. Eugene F. Fama at the University of Chicago. He showed that relative strength was one of the three factors identified as the biggest drivers of stock prices.

Before Prof. Fama, there was James P. O’Shaughnessy, who studied 46 years of market history. He concluded that stocks with high relative strength significantly outperformed the overall stock market.

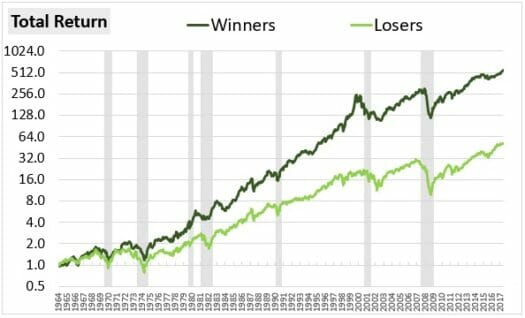

In fact, O’Shaughnessy Asset Management recently studied the market over a 53-year period (1964-2017). They found that a momentum strategy of investing in the top 20% of large cap stocks based on trailing six-month returns would have returned about 12.58% annually. Of course, this far outpaced the “losers” strategy of investing in the bottom quintile of stocks.

Source: O’Shaughnessy Asset Management

Other high-profile research advocating for the use of relative strength investing includes market luminaries such as Investor’s Business Daily chairman and founder William O’Neil, famed investor Jesse Livermore, and market pros H.M. Gartley and Robert Levy.

Action To Take

There are a number of ways to gauge relative strength. The rate of Change (ROC) indicator is one, while a simple percentage change scan (like the one we described above) is another. The later is our preferred method, and you could employ your own version of this if your broker offers the necessary tools.

But the larger point you need to take away is that winning stocks tend to keep winning. It may sound simplistic, but we tend to ignore this when it comes to investing in the market.

Think of it like trying to bet on professional sports. When you are looking to pick winning teams, do you look at the teams with losing records? If you bet this way, constantly banking on an upset win, you’re bound to lose in the long run. Or, do you look at teams with winning track records?

Any successful sports gambler will tell you the odds of success are greater when you bet on teams with a winning record. Sure, you may be the victim of a big upset occasionally. But most of the time betting on the team with the better record (particularly over time) will net you the best results. It’s the same for equity trading. And in this sport, relative strength is the way to keep track of a winning record in the markets.

P.S. There’s a simple way to build massive wealth without technical analysis, cryptos, or meme stocks…

If you’re ready to finally achieve financial peace of mind, just take a moment to review our latest presentation. You’ll learn about some of the strongest, safest and most generous income-producing stocks we’ve ever uncovered. Click here to learn more.