The 2 Main Reasons Why You Should Close A Covered Call Trade Early…

The covered call strategy has many benefits. One is that you can create income for your portfolio without constantly monitoring each trade. Of course, keeping tabs on your positions is always essential to ensure your risk is controlled. But for the most part, you can set up a covered call position and wait until the calls expire before any additional action is needed.

We gave a fairly thorough overview of covered calls in this article. But before we continue, we should briefly refresh.

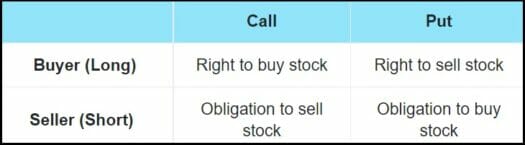

A covered call strategy is when you buy shares of stock (or already own them) and then sell corresponding call option contracts for these same shares. By selling the calls, we obligate ourselves to sell the stock at the option’s strike price should the stock price rise above this level before the option expires. This caps our potential profits at a pre-determined level. In return, we receive income from selling the call option, known as premium.

It is important to note that our maximum profit is realized if the stock closes above the strike price when the call option contracts expire. It does not matter how much higher the stock is trading, only that it is above the strike price. We must sell our stock at the strike price whether it closes at $0.02 or $200 above it.

For this reason, when covered call trades work in our favor, we typically do not close the trade early. We don’t realize more profit simply because the stock trades at a peak value. However, there are certain times when it may make sense to go ahead and close a trade. This depends on your situation and the environment for the stock or ETF you are trading.

Let’s take a look…

When To Close A Covered Call Trade Early

It may make sense to close out a profitable covered call trade early in two primary situations.

1. When the Stock is Vulnerable to a Decline

We have already noted that a successful covered call trade does not add additional profit for advances above and beyond the strike price. But the timing of the trade is still important. Suppose the stock trades significantly above the strike price. In that case, it is very likely that the majority of profit that we will receive in the trade is available now. We don’t need to wait until the call option is actually exercised.

So, if the majority of the potential profit for the trade is available now, we should consider the current reward to risk for the trade as it currently stands. There may be very little additional reward (or profit) left for us to capture. But there is a risk that the stock will trade back below our strike price. If this happens, our potential profits could narrow or even reverse. Therefore, in many cases, we may want to go ahead and take the profits now rather than waiting for the calls to expire.

2. When You Have Better Opportunities for Capital

A second consideration for taking profits off the table early revolves around the other opportunities to create income from your investment capital.

Let’s assume you have a handful of covered calls representing 30% of your capital. These trades have all moved significantly in your favor. Your realized gain in these positions is very near the ultimate profit you expect to receive. The rest of your capital is fully invested in other long-term positions you do not want to disturb.

With your capital tied up in these trades, you notice three new covered call trades that you could set up right now that offer a desirable rate of return. Unfortunately, you cannot take advantage of it for another month because you are waiting for your current positions to mature before you have free cash to invest. In this case, closing out the profitable covered call trades might make sense.

A Word About Transaction Costs

One thing to remember when closing out a covered call trade early… These trades can sometimes have significant transaction costs.

Option prices can have a wide bid/ask spread. This is the difference between the bid price (what the market is willing to pay you for an asset) and the asking price (what the market is willing to take for an asset). This is especially true for options deep in the money, which are likely the options you will buy to close out your covered call position.

Here’s why this matters. The current market price for the stock and the call contracts you have sold may be very attractive. However, executing your closing orders at the market price may be more difficult than expected. You may sacrifice more profit from your existing positions if you receive a less-than-attractive price. This may impact the net benefit in closing out these trades.

Commission costs are also essential to keep in mind. This approach doesn’t have as much activity as a day trading strategy, but the commission costs each time you set up a new transaction can add up. For this reason, doing business with a credible discount broker with reasonable fees and reliable market access is crucial, specifically for option contracts.

Action To Take

Here’s the bottom line… For most profitable covered call positions, it is best to let them ride until expiration. But in certain circumstances, it may make sense to close out the trades early to manage risk or free up capital for new opportunities. Always pay attention to transaction costs, and use a limit order when closing out your option contracts.

P.S. If you’re looking for a steady source of income amid these uncertain times, consider the advice of our colleague, Jim Pearce.

Jim Pearce is the chief investment strategist of our flagship publication, Personal Finance. Jim has unearthed a once “secret” income power play that’s giving everyday investors the opportunity to collect huge payouts, regardless of Fed policy or the ups and downs of the markets. To claim your share, click here.