How to Protect Yourself When A Covered Call Trade Moves Against You…

The covered call strategy can be a very effective approach to boosting your income. It takes a certain amount of maintenance, especially if you follow our preferred strategy of trades that expire over a four-to-eight-week time frame. However, the minimal time commitment usually turns out to be worth the reliable income stream.

Although the covered call strategy is fairly easy, there’s one true key to long-term success… And that’s managing risk when trades do not go as planned.

It happens sometimes. Proper risk management, however, will allow you to keep your capital base intact. This allows you to make up any losses quickly and continue generating income.

Let’s take a look at how you can do just that…

A Brief Recap

Before we explain how to manage risk when stocks decline, let’s first quickly recap how the covered call strategy works.

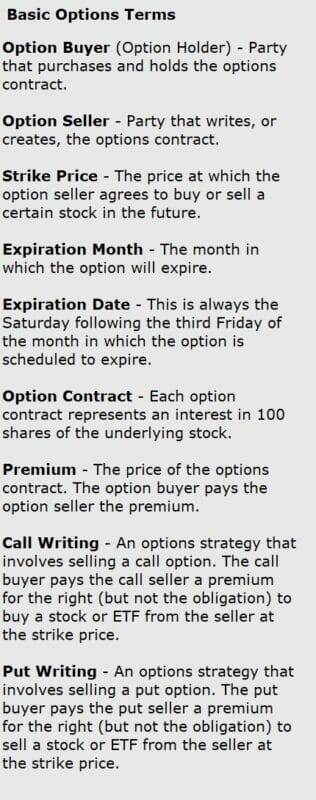

To begin with, we purchase shares of a stock that we believe will be stable or move higher. We then sell call options against this position, generating income in our account.

By selling the call option, we are giving the buyer the right (but not the obligation) to purchase shares from us at the option’s strike price. In return, we have an obligation to sell our shares at the agreed-upon price if the stock trades above this price when the calls expire. Keep in mind that each call option contract represents 100 shares. So we will want to own 100 shares of stock for every call option we intend to sell.

As payment for taking on the obligation, we receive a premium. Depending on the strike price, the date the contract expires, and the volatility of the underlying stock, that premium can be very lucrative.

Using A Strike Price Near The Market Price

As a general rule, we like to sell call contracts with a strike price that is in the neighborhood of the current market price. Depending on the market environment, the volatility of the underlying stock, and the fundamentals of the company, we may sell call options with a strike price slightly above or slightly below the current stock price.

One of the reasons we do this is because these call options typically have the highest time value. This is the portion of the options value that is not “intrinsic,” or already reflected by the current stock price.

As an example, take a stock that is currently trading at $51. A two-month call contract with a $50 strike price may have a premium of $4. This would represent $1 in intrinsic value (the value of the call simply from exercising the right to buy stock at $50 and sell it at $51), and $3 in time value. On the other hand, a $55 call option would likely trade close to $1, representing zero in intrinsic value (because there is no value in being able to buy stock at $55) and $1 in time premium.

In addition to the extra income, call contracts with more premium give us more protection if the stock price falls. For instance, if the stock were to fall to $45, we would lose $6. But that would be offset by the premium we collected when selling the option. So, if we sold an option for $4, we may only lose $2.

[Related: The Important Greek Word Every Options Trader Needs To Know]

Adjusting A Position for Lower Prices

Let’s consider what to do when we have a covered call trade that begins to move lower. The first thing we do is calculate how much protection we have with the current call option. The key is to make sure the money we gained from selling the call is material compared to what could be lost as the stock moves lower.

One of the best ways to mitigate losses when the stock is moving lower is to sell an additional call option at a lower strike price. This lower strike price will naturally have more premium. That’s because the buyer of this call option will have the right to buy stock at a lower (i.e., more attractive) price. For traders with a margin account, it is possible to sell the additional call option contract while still leaving the original call contract in play.

Of course, this introduces a new risk. If the stock remains below the strike price of the first option contract, then we won’t be at risk. However, if we have two sets of call contracts sold, then we could lose additional money if the stock trades higher. Whenever you have two sets of call contracts sold, it is important to monitor the stock. And if it begins rebounding, it is usually best to either close out one of the call contracts or buy additional stock.

Closing Thoughts

For this reason, most non-margin accounts (including IRAs and other qualified accounts) will not allow you to sell multiple call options against a stock position. In this case, the best way to protect yourself from a falling stock price may be to buy back the call option you originally sold (at a lower price because the actual stock price is lower), and then sell a new call contract with a lower strike price.

Most online brokerage platforms have a function that allows you to execute these trades simultaneously. You can even set a limit order for the net price you would like to be paid for the entire transaction. We recommend taking advantage of this feature to minimize the amount of slippage when exiting one contract and entering another.

As with most investment strategies, the most important concept is not determining how to actually generate the profits. Instead, the most important skill to learn is how to protect your profits when things aren’t going as planned.

P.S. If you’re looking for a way to generate steady income with reduced risk, then you need to turn to our colleague Robert Rapier…

Robert can show you how to use strategies like the one we discussed above to squeeze up to 20 times more income out of dividend stocks, with just a few minutes of “work” each week. Click here for details.