If You’re Worried About Rising Rates, Consider This Alternative Income Strategy…

Traditional income strategies are supposed to be attractive to conservative investors. In particular, sectors with a high concentration of dividend-paying stocks (such as utilities and consumer staples) are often safe havens. These are referred to as “widow and orphan” investments because they are safe enough for the most risk-averse investors.

In today’s investment environment, however, there’s a problem. Not only are the yields on traditional dividend stocks depressed, but they also have much more embedded risk.

To understand why the strategy of buying solid dividend-paying stocks could be more risky than you think, we need to take a look at the state of financial policy in the United States.

Reaching For Yield

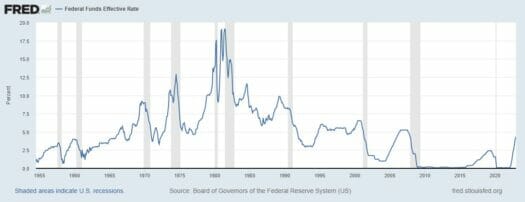

It is common knowledge that the past 20 years or so have been a period of low interest rates. The Federal Reserve intentionally drove interest rates to historically low levels in an attempt to boost economic activity. The Fed’s expectation was that if interest rates remain very low, then income investors (both individuals and institutional investors) will move further out on the risk curve as they “reach for yield.”

Source: Federal Reserve Bank of St. Louis

Reaching for yield can theoretically support an economic recovery. This is because capital naturally moves into more “productive” areas — typically out of Treasuries and into corporate bonds, or out of bonds entirely and into equities. If companies are able to raise capital, which would typically be invested in safer areas, then it can help to boost expansion and support employment.

Because of this, a lot of capital has moved into traditionally safe income stocks that would have otherwise been in Treasuries or investment-grade bonds. This has pushed stock prices (and valuation metrics) to higher levels — while pushing yields lower.

Now that the U.S. economy is beginning to recover from the pandemic, the Fed is raising rates. This is leading to lower Treasury prices and corresponding higher yields. At this point, it is likely that capital will rotate out of traditional income stocks and into fixed-income securities. With the prospects for even higher interest rates at some point down the road, investors need to be ready for the trend to shift.

This reverse capital rotation could be very challenging for traditional dividend stock investors. Some of these stocks are trading at premium valuations to historical norms, and they could see significant capital outflows once their competitive income edge is lessened. For this reason, even conservative dividend investors may be in danger of suffering losses in the months and years ahead. Fortunately, there’s something you can do about it…

A Better Alternative

One strategy that dividend investors may want to consider is selling put options. The benefits of this strategy are twofold: it can generate reliable income and also allow investors to potentially buy quality stocks at a significant discount.

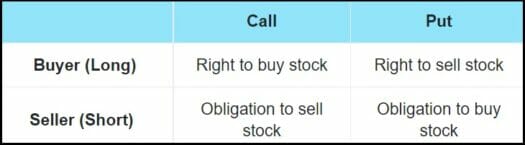

Here’s how the put selling strategy works… Income investors sell a put option, which obligates them to buy 100 shares of stock at the option’s strike price if the stock is below that level when the option expires. Typically, we choose a put option that is “out of the money,” which means the strike price is below the current stock price. That means our obligation only kicks in if the stock drops in price.

There are two ways the trade will evolve. Either the stock will remain above the strike price and the put seller will not be required to buy it, or the stock price will decline, in which case the put seller will buy the stock at a discount from previous levels.

Income is generated from this strategy through the process of selling the put option. The income we receive, which is known as “premium,” is basically compensation for accepting the obligation that comes with selling the put option.

With put options, we (the option buyer) are paying for the opportunity to sell our stock at the agreed-upon price on the option’s expiration date. If we exercise this option, the option seller must buy the 100 shares from us at the strike price.

For example, let’s say we want to buy a put option contract on shares of Intel (INTC). We choose a contract with a strike price of $40 and an expiration date of May 20. Another trader sells you the put option contract and you immediately pay them a premium. They get to keep this no matter what.

When May 20 rolls around, we can choose to sell 100 shares of INTC to the trader who sold us the option contract for $40 per share. And they must buy them.

Closing Thoughts

We are not advocating for you to sell all of your dividend-paying stocks or anything like that. The point is simply that some dividend paying stocks may not have quite the same appeal they once did. And if that’s the case, then investors should give some serious thought to other income-generating methods like selling put options. (Covered calls could also make some sense, too.)

Plus, there’s another added benefit. Investors can generate higher “yields” in less time than with traditional income stocks. At the very least, this strategy offers an attractive diversification from traditional income stocks in the current market.

In the meantime, one of our top analysts just sent his followers an email you NEED to see…

It’s all about the white-hot stealth rally in the gold market right now. And more importantly, how to get in on the action.

Want the details? What you’re about to see is EXTREMELY time sensitive. Go here now to learn more…