The Most Important Metric For Finding Big Winners…

Of all the information generated by the stock market, there’s one piece of data that I rely on more than just about anything else: cash flow.

It’s critical to the system we use in my Maximum Profit premium service, helping us reap bigger gains in less time. I also use it in my other premium service, Capital Wealth Letter. That’s because I consider it a foundational piece of any serious fundamental analysis process.

Today, I want to talk a little more about this fundamental metric because it’s so important, yet all too often ignored by most investors.

In fact, I’d go as far as to say that if I could only look at one fundamental metric to find winning picks, this would be it.

Cash Flow: The Most Honest Number In Finance

Many investors are already familiar with cash flow. But they may not realize just how important it is in relation to successful investing.

You see, cash flow is the only figure that a can’t be fudged with fancy accounting tricks.

All other figures that a company reports can be manipulated.

A company can inflate its earnings… report misleading revenue… but they can’t fudge the cash flow… the actual cold hard cash a company receives while doing business.

All the major corporate accounting scandals… Waste Management, Enron, Worldcom, Tyco, Healthsouth, Freddie Mac, AIG, Lehman Brothers… could have been avoided simply by looking at those companies’ cash flows before they crashed.

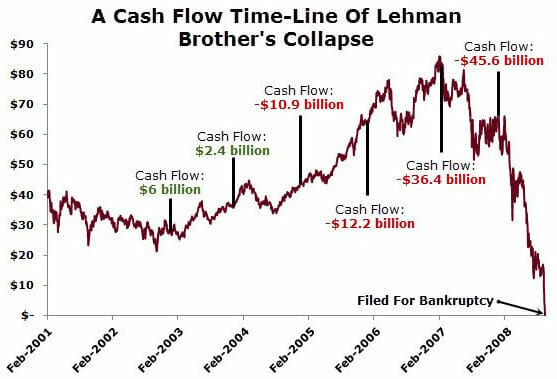

Just look at Lehman Bros for instance…

In the years leading up to the company’s collapse, the cash flow shriveled to zero and went into the negative. This alone was a huge red flag to any investor owning shares over that period.

The one thing Lehman Brothers and each of the other companies I mentioned have in common is that they were cooking the books.

They manipulated earnings… downplayed expenses… but they couldn’t fudge their cash flow figures: the actual money they were bringing in. It was the one thing that would have tipped you off to sell the stock fast. And it’s one piece of data every company generates that you can accurately rely on.

Now, knowing we can use this information to avoid losses is comforting. It greatly cuts unnecessary investment risk. But more to the point, cash flow is a key piece of data that our algorithm uses to identify winners as well.

Cash Flow 101

Let’s dive a little deeper to see exactly what cash flow’s role is in spotting winning trades in the stock market.

I like to call cash flow the “most honest number in finance.” And as we talked about in the above Lehman Brothers example, it’s the lifeblood of any company. It has the innate ability to show you when things are starting to become dire at any firm.

Cash flow is the money a business uses to buy new factories, pour into research and development, or deliver back to its investors through dividends and share buybacks.

Think of it this way — if someone you knew earned $5,000 a month but spent $7,000, they’d be in bad shape. That would make paying bills extremely tough and building wealth next to impossible.

Compare that to someone who spends the same amount but brings in $20,000 a month. They have plenty to not only meet their expenses, but also save, invest, go on vacation, etc.

It’s obvious who you would rather be.

Companies need cash flow more than earnings to survive. (Enron had earnings but lacked cash flow.) Strong cash flow allows a company to reward investors with dividends and reinvest in growth.

Bringing It All Together

There is much more to fundamental analysis than P/E ratios, earnings growth, and dividend yields. And researchers have found that cash flow is a much better indicator of future stock returns than income statement metrics like earnings. Detailed analysis shows that companies with more cash flow than earnings tend to perform better over a 12-month period.

In fact, when we were developing my Maximum Profit premium service, we did some rigorous backtesting. We found that based on this singular data piece alone, you could handily outperform the broader market. Time and time again, it identified investing opportunities by simply scanning for companies that were growing cash flow rapidly.

Now, I’m not saying you should base all of your trades or investments around cash flow alone. But I am saying that you should seriously incorporate it into your analysis when looking at investment candidates. If the average individual investor spent more time doing that instead of looking at metrics like earnings, they’d be a lot better for it.

P.S. How would you like to get paid every month from your portfolio? It’s easier than you might think…

My colleague Nathan Slaughter makes it his business to research the best income payers the market has to offer. And he’s finding dozens of high-yielding monthly dividend payers out there that most investors don’t even know exist…

In his latest report, Nathan reveals 12 of his favorite monthly dividend payers offering market-crushing yields. You could start receiving payouts every single month! Go here now to learn more…