The Damaging Effects Of Inflation — And What We Can Do About It…

I have to confess, I feel a bit like the boy who cried wolf too many times. Just like the parable, I’m afraid my warning may fall on deaf ears because there have been too many false alarms.

I’m talking about inflation.

In my post over at High-Yield Investing, I’ve been harping about the dangers of inflation for years. To be fair, fixed-income securities are highly sensitive to their erosive effects. But make no mistake, it can infect all corners of the market, leaving nowhere to hide. And besides, if you’re a retirement-age investor, it’s just too risky to not think about inflation at all. It has to be somewhere in your consideration.

That’s not to say we have an immediate problem. But with the dovish Federal Reserve keeping short-term rates near zero and running the printing presses at full speed, it’s a matter of when, not if.

To counter the impact of the pandemic and stimulate the economy, the central bank has been purchasing government bonds and other securities on an unprecedented scale, pumping huge amounts of money into the system ($120 billion per month). The M2 money supply (which includes physical notes in circulation, savings accounts, and bank reserves) surged from $15 trillion at the start of 2020 to nearly $20 trillion today.

Source: FRED

In percentage terms, we haven’t seen a flood of new money like this since 1943 in the middle of World War II. John Greenwood, Professor of Applied Economics and Chief Economist at Invesco, referred to this sudden expansion of money as a “looming danger for the economy.”

Inflation And Your Pocketbook…

I don’t want to talk about monetary policy and quantitative easing. In this case, I’d rather let the numbers speak for themselves.

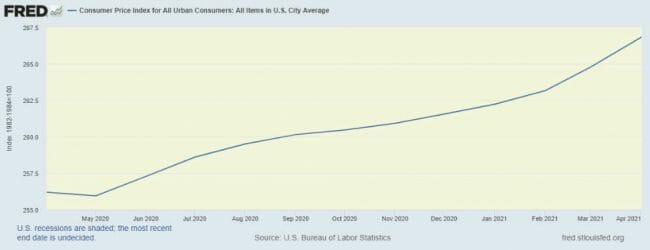

The consumer price index (CPI), the best yardstick to measure changes in what we pay for goods and services, rose 4.2% in April – the sharpest increase since 2008.

Source: FRED

That’s well above the Fed’s “comfort zone” level of 2%.

It’s even more alarming at the wholesale level. The producer price index (a broad measure of what manufacturers pay for raw materials) jumped 6.2% last month, accelerating from March’s 4.2% uptick. April’s increase was the largest on record.

You’ve probably heard about the crazy surge in lumber prices. My colleague Brad Briggs has covered it, while my colleague Jimmy Butts reminded readers that he predicted as far back as last year when he got the research team together for his annual investment predictions report.

Well, it’s not just wood products that are shooting higher. Earlier this year, I predicted that we were in the early innings of a “super cycle” with a whole host of commodities. And we’re definitely seeing it… It’s everything from copper to steel to fuel to plastics. Chicken wings, for example, have doubled from $1.50 per pound to $3.00 per pound due to shortages – get ready for higher menu prices at your favorite sports bar.

To say nothing of a new car or home.

So it’s not terribly surprising that investors are keeping a wary eye on inflation right now. In fact, it’s safe to say that inflation concerns have been roiling the market lately. And companies of all shapes and sizes are pointing to inflation as a strengthening earnings headwind. Many are already responding with price hikes.

Whirlpool (NYSE: WHR), the maker of refrigerators, dishwashers, and other appliances, referred to them as “cost-based pricing actions.” A 12-pack of Coca-Cola may also cost you a bit more thanks to rising input expenses for corn syrup and packaging materials.

Closing Thoughts

According to FactSet, 175 members of the S&P 500 mentioned the word “inflation” on their latest earnings report calls – a record high. The most pronounced impact has been in the consumer staples and industrial sectors.

The question, of course, is what can investors do about all this. For starters, there’s no reason to panic just yet. I’ll also reiterate the pick I mentioned back in my previous article: BlackRock Resources & Commodities Trust (NYSE: BCX). This fund should give investors broad exposure to commodities while offering a nice dividend to boot.

Needless to say, I’ll be watching this trend closely in the weeks ahead. Once unleashed, inflation is tough to put back in the bottle. But equities and real assets (like commodities) have always been the best way to stay a step ahead.

Another step you can take is to make sure you’re earning enough yield to beat inflation. And you’re certainly not going to get that with the average S&P 500 stock, which yields less than 2%. That’s where my premium advisory, High-Yield Investing, comes in. Right now, we’re earning 7%, 8%, even 10% yields from securities that most people don’t even know about — yet they still offer safety and reliability.