How You Can Invest Like the Ultra-Wealthy

Pop quiz: What is the favorite investment class of the world’s ultra-wealthy?

Answer: Real estate!

Property is a timeless investment. After all, as the old Mark Twain saying goes, “they’re not making it anymore.”

That’s definitely the case, but the world’s population is growing by 200,000 people (births minus deaths) each day. That’s over 1 million new people a week crowding into a fixed amount of space to live, work, and shop — placing upward rental pressure on housing, office parks, and retail strip centers.

And the good news is that this asset class is available to regular investors like you and me.

Real Estate: The Preferred Asset Class Of The Wealthy

Don’t just take my word for it. Here’s what some of history’s wealthiest business tycoons had to say.

Ninety percent of all millionaires become so through owning real estate. More money has been made in real estate than in all industrial investments combined. – Andrew Carnegie

Buy land near a growing city. Buy real estate when other people want to sell. – John Jacob Astor

Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world. – Franklin D. Roosevelt

Forward-looking investors are putting their money where their mouths are, placing huge bets on land and buildings. Warren Buffett, for one, has strongly endorsed rental homes, and his Berkshire Hathaway company recently invested $377 million in a commercial property owner.

Billionaire media mogul Ted Turner owns more than a dozen sprawling ranches from Oklahoma to Montana. This collection spans 2 million acres (an area more than twice the size of Rhode Island), making him one of the nation’s largest private landowners.

Liberty Media CEO John Malone scooped up 1 million acres of timberland in Maine. And Sam Zell amassed a $5.5 billion fortune by investing in commercial office properties. His current portfolio includes housing in China, shopping malls in Brazil, and the Waldorf Astoria Chicago hotel.

Aside from generating stable monthly income, real estate can also be a great way to protect against the erosive impact of inflation and a depreciating dollar. Furthermore, its low correlation to equities can provide some buoyancy when the economy deteriorates and stocks are sinking.

Unfortunately, most of us don’t have the bankroll to buy an office tower, an apartment complex, or a retail shopping center. But real estate investment trusts (REITs) offer a great way for investors of any means to participate.

REITs: Strong Returns And High Income

These publicly traded vehicles come in many different flavors: apartment REITs, office REITs, industrial warehouse REITs, retail REITs, storage REITs, healthcare REITs. Some even own cell phone towers or highway billboards — any asset that generates rental income.

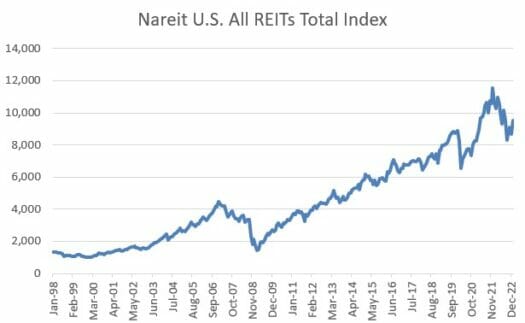

If you’ve ever bought and sold a house, you understand that most properties appreciate in value over time. In fact, REITs have been one of the best-performing asset classes for decades. In fact, the FTSE Nareit All Equity REIT Index has delivered an average annualized total return of 10.5% over the past 25 years.

Source: Nareit

As nice as that is, the primary appeal of these securities is their income-producing potential. And there’s a kicker. Real estate trusts are exempt from federal income taxes, provided they distribute at least 90% of their taxable income to stockholders.

That special perk helps explain why the average REIT offers an annual dividend yield of about 3%, double the market norm. (But if that doesn’t excite you, don’t worry — there are plenty of solid REITs that offer even more…)

Those dividends aren’t exposed to disruptive influences that other businesses must deal with… such as spiking raw material costs or changing consumer fads. Most REITs maintain stable (or rising) distributions.

Things To Keep In Mind With REITs…

There are a few caveats to consider, and they’re worth discussing.

Since REITs don’t pay corporate income tax, most of the dividends paid to shareholders are fully taxed as ordinary income. In other words, most REIT dividends don’t qualify for the reduced 15% dividend tax rate. Of course, investors can avoid taxes on these distributions entirely by holding REITs in a tax-advantaged account like a Roth IRA.

Furthermore, because they distribute most of their profits, these companies must frequently tap the capital markets to raise funding to grow their portfolios. A popular and cost-effective method to raise capital is through secondary offerings — selling additional shares of stock to the market. This typically weakens the price of existing shares (at least temporarily) and waters down earnings on a per-share basis.

Closing Thoughts

Many of you know that I’ve sung the praises of real estate before. But it’s worth repeating: this is a powerful asset class that absolutely deserves a place in your portfolio.

Overall, this asset class has been one of the best places to park your money over the long haul. Between dividends and share price appreciation, REITs have been one of the market’s best-performing asset classes over the past couple of decades. I see no reason why that shouldn’t be the case in 2023 and beyond.

After carefully screening and evaluating hundreds of REITs, I’ve identified three that deserve special consideration. I talk about each of these in a report for High-Yield Investing subscribers. If you’re seeking exposure to one of the best-performing asset classes on the market, I can’t think of a better place to start your search. To learn how to get this report, go here now.