This Simple Math Shows How Dividends Can Compound Your Wealth

While many investors are drawn to the prospect of earning quick profits, true investing success is seldom found overnight. Legendary investors like Warren Buffett and Peter Lynch have proven that the path to wealth lies in thorough research and a long-term perspective. There are no shortcuts.

So, how did these legends beat the market over time? They did so by capturing steady, consistent gains year in and year out.

Investing for the long haul is really nothing more than a game of compounding by earning a consistent return and reinvesting your profits back in the market over and over again. And of course, the magic of compounding is most powerful when an investor focuses on established companies that throw off a steady stream of dividends.

You might ask why an investor should bother buying high-income stocks just to earn a few extra percentage points of return when the bond market offers a safer yield. Well, the answer is deceptively simple. Stock returns are really the product of two elements: dividends and capital gains.

Both bonds and income-oriented stocks can offer attractive yields. However, unlike their fixed-income counterparts, most dividend-paying securities also offer decent capital appreciation prospects over time. That means investors can earn stellar dividend yields and realize additional gains from rising share prices. Bonds simply cannot match that upside potential. Furthermore, bonds are much more susceptible to interest rate fluctuations, as increasing rates can quickly erode the value of their fixed interest payments.

The Importance of Compounding

John D. Rockefeller once quipped that the only thing that gave him pleasure was to see his dividend checks coming in. I suspect many investors can relate. After all, since 1930, about 40% of the gains in the S&P 500 have come from dividends. And in 2021, S&P companies shelled out a record $511.2 billion to shareholders, compared to $483.2 billion in the previous year.

The dividend payments generated by a modest investment might seem inconsequential initially, but through the magic of compounding, it won’t take long before they can begin to make a dramatic impact on your portfolio.

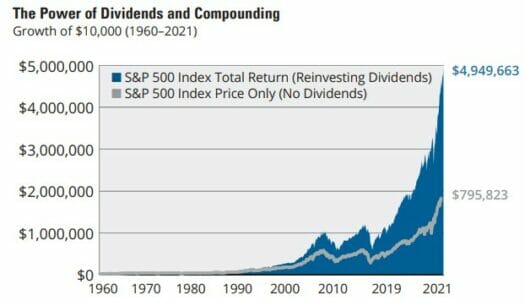

In fact, according to Morningstar and Hartford Funds, 84% of the total return of the S&P 500 Index came from reinvested dividends and compounding going all the way back to 1960.

Source: Hartford Funds

After all, these dividends can be used to purchase more shares, leading to even larger dividend checks. These larger checks can then be used to buy even more shares, and so on. In time, even a small stake in such stocks can grow into a tidy sum.

For example, suppose an investor buys 1,000 shares of stock in XYZ Corp. at a price of $10 per share (for an initial investment of $10,000). Next, let’s assume that XYZ pays a steady annual dividend of 6%. Let’s also assume that the dividend increases by a modest 3% going forward while the shares rise by 7% yearly.

The very first quarterly dividend check would be worth just $150:

$10,000 x 6% = $600

$1,000/4 payments = $150

While that amount will certainly not go very far on its own, it is enough to purchase 60 more shares at the initial $10 per share price. Of course, those 60 shares would then generate their own dividend payments.

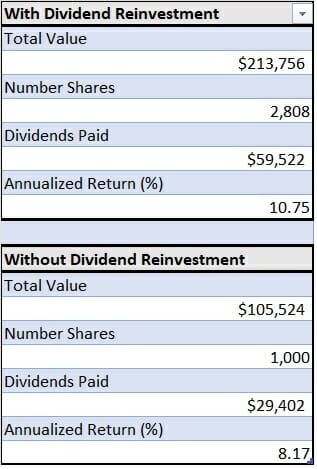

After 30 years, XYZ’s initial 1,000 share stake would have grown to 2,808 shares. At the same time, that $10,000 position would have soared to more than $213,000. That’s without ever adding another penny to the investment other than reinvesting dividends.

But what would have happened if the investor just pocketed those dividend payments year after year? Well, without reinvestment, you would only be left with the same 1,000 shares for approximately $105,000.

Even when the cumulative dividends paid of $29,401 are included, the entire investment would still only have grown to around $143,000, which is only about two-thirds of what you would have with dividends reinvested.

It’s also worth noting that by the end of 30 years, the reinvested position would be throwing off much more income because of the larger position size.

Closing Thoughts

While investing exclusively in the market’s highest-yielding securities might be tempting, this shortcut approach usually leads to mediocre or even disappointing returns. To begin, off-the-charts dividend yields are typically the result of very depressed share prices. And in many cases, the companies that offer such high yields are in poor financial shape.

In addition, poorly performing companies often see their share prices decline even further, leading to dismal overall returns. Remember that income stocks offer returns from two sources: dividends and capital gains (or losses). So while you can hold a stock that pays a mouth-watering double-digit dividend yield, it doesn’t do you any good if the underlying shares lose 20%.

Furthermore, most dividends are by no means guaranteed. Companies can reduce their dividend payouts (or eliminate them altogether) whenever they like. So a fat dividend yield alone does not ensure investment success.

Instead, if if you want to compound your wealth the easy way, then you need to have a handful of safe, reliable dividend payers in your portfolio. And in my latest presentation, you’ll learn about five safe, high-yield stocks with a proven track record of rewarding investors with more income year after year regardless of what’s happening in the market.