One Of The Most Unique Ways To Play The Booming Energy Sector

For most of the first half of this year, I spent a good deal of time discussing the situation with energy prices and offering ideas for how investors can profit.

Lately, the energy sector has been… volatile. After a historic run, the price of benchmark West Texas Intermediate Crude (WTI) has retreated to the upper $80s. That’s a far cry from $120 oil just a few months ago.

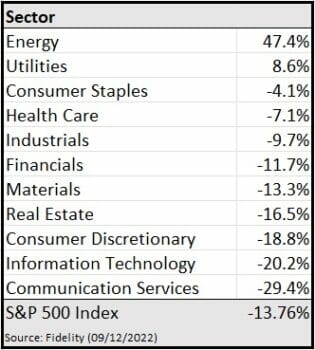

But overall, it’s been a good run for investors this year. Energy has far and away been the strongest performing sector this year, and there’s a good chance that will remain the case.

Prices could remain elevated for the near future. And at these levels, there are still ways for investors to profit. It’s just that we might have to do a little more legwork to find opportunities.

Today, I want to pass along an idea I bet not one in ten investors has heard about. That’s because it’s one of the most unique ways to play the booming energy sector you’re likely to ever come across…

A Unique Way To Play Oil…

Texas Pacific Land Corporation (NYSE: TPL) is what’s known as a royalty company. It’s the successor to Texas Pacific Land Trust, which dates back to 1888.

TPL is also one of the largest private landowners in Texas, with roughly 900,000 acres sprawled across 19 counties in West Texas.

As you probably know, West Texas happens to be home to the oil-rich Permian Basin. And any company that wants to build or operate an oil or gas pipeline, a power line, or any other type of infrastructure on TPL’s property, has to pay TPL for the right to use its land.

Any oil and natural gas below the surface where TPL owns the “mineral rights” is called a “royalty acre.” And for every barrel of oil or gas that’s pumped from TPL’s royalty acres, the driller has to pay a royalty fee to TPL.

The best part is that the drillers have to do all the work… Find the oil, drill thousands of feet down and then horizontally, pull the oil and gas out of the ground, transport the oil, etc.

TPL just sits back and collects its royalty checks. So obviously, as oil prices go up, so do TPL’s royalty checks. Roughly 71% of TPL’s sales come from land usage and oil and gas royalty fees. The remainder comes from its Water Services segment.

Many people might not know that oil and gas drillers need and produce a tremendous amount of water. Fracking requires massive amounts of fresh water, sand, and chemicals to pump down into the ground to crack open the rock, releasing the oil trapped inside.

We know the Permian basin is filled with vast amounts of oil and gas. But water is also trapped in these spaces. And even more is needed to pump down to release the oil.

For every barrel of oil produced in the Permian, usually between one and seven barrels of water also comes out of the wellbore. This is called “produced water.”

It is estimated that the Permian will generate 32 million barrels of produced water per day by 2025.

That’s a lot of water that the oil companies need to deal with. Well, TPL saw this need. So in 2017, it started providing water services to drillers in the Permian Basin. TPL sources fresh groundwater, gathers and treats produced water, disposes of water, and offers water tracking and analytics.

By The Numbers

TPL’s water-service revenues increased from $31 million in 2017 to nearly $131 million last year, accounting for nearly one-third of overall sales.

In 2021, TPL as a whole collected revenue of $451 million, a nice 49% bump over 2020. Again, this is largely due to higher oil prices. This year, the company is on track to pull in $664 million.

The best part of being a royalty company is that expenses are low, which means margins are thick. Operating margins consistently run north of 80%, and cash operating profit margins were 59% last year. So, for every dollar it collects in sales, $0.59 is cash operating profit.

Cash flow in 2021 grew 28% to $265 million and is expected to jump 81% this year to $480 million.

These strong financials have helped the stock reach new highs recently, which is exactly what we like to see from a good momentum stock…

Action To Take

So let’s sum this up. Drillers in the Permian desperately need water management solutions. TPL provides that, thus making it easier to drill on TPL’s land. TPL, in turn, collects fees for the drillers to drill on their land.

That’s like renting your house out while also being the utility provider for water, sewer, and trash. Not a bad business.

As interesting as TPL is as a company, it’s important to remember that revenue is tied closely to the price of oil. If oil tanks, we can expect shares to follow suit. But if you’re looking for an off-the-radar way to play the energy sector, TPL is a solid choice for risk-tolerant investors.

P.S. In my latest report, I uncover an “off the radar” investment that’s developing one of the most disruptive technologies we’ve seen in years…

I’m talking about flying cars. That’s right, we’re talking about a total revolution that could change the face of our way of life forever. It may sound like science fiction… but it’s coming sooner than you think.

The best part is that one of my top picks for this emerging technology is being totally ignored by most analysts right now, which means we have a unique opportunity to get in before the crowd catches on. Go here to learn all about it right now.