Investors Ignore This Critical Metric, But It’s The Lifeblood Of Any Business…

Earlier this week, we discussed a valuation metric that many individual investors tend to overlook: enterprise value.

But another metric also tends to get overlooked that needs to be addressed. So, we’re going to take some time today to add some perspective.

Of all the information generated by the market, this can help you understand what’s going on with a business.

We’re talking about cash flow.

Free Cash Flow: The Lifeblood Of A Business

Free cash flow (FCF) measures how much cash a business generates after accounting for capital expenditures such as buildings or equipment. This cash can be used for expansion, dividends, reducing debt, or other purposes. The formula for free cash flow is:

FCF = Operating Cash Flow – Capital Expenditures

The data needed to calculate a company’s free cash flow is usually on its cash flow statement. For example, let’s say Company XYZ’s cash flow statement reported $15 million of cash from operations and $5 million of capital expenditures for the year. Then Company XYZ’s free cash flow was $15 million – $5 million = $10 million.

It is important to note that free cash flow relies heavily on the state of a company’s cash from operations. This is heavily influenced by its net income. Let’s say a company recorded a significant amount of gains or expenses that are not directly related to the core business (like a one-time asset sale). You may want to carefully exclude those from the free cash flow calculation to better understand the company’s typical cash-generating ability.

It is also important to note that companies have some leeway about what items are or are not considered capital expenditures. Investors should be aware of this when comparing the free cash flow of different companies.

Why Cash Flow Matters

Cash flow is the lifeblood of any business. A Company uses cash flow to buy new factories, invest in research and development, buy new inventory, and pay the bills. Without it, a company wouldn’t be able to be a “going concern” — in other words, have enough money to make it from month to month.

It’s also one of the only figures that a company can’t fudge. Just about all other figures that a company reports can be “massaged” or manipulated in one way or another.

A company can inflate its earnings… report fictitious revenue… but they can’t fudge the cash flow… the actual cold hard cash a company receives while doing business.

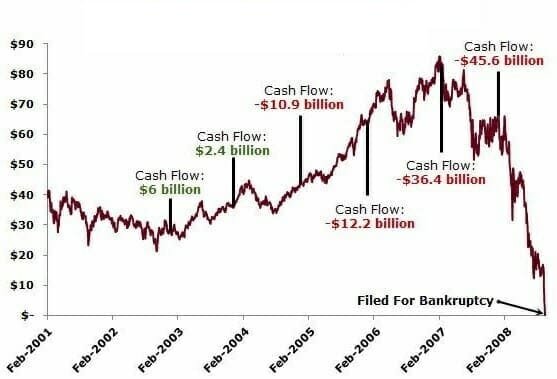

All the major corporate accounting scandals… Waste Management, Enron, Worldcom, Tyco, Healthsouth, Freddie Mac, AIG, Lehman Brothers… could have been avoided simply by looking at those companies’ cash flows before they crashed.

Our colleague Jimmy Butts has shared the chart below many times. It shows the cash flow of banking giant Lehman Brothers right up to the point of the financial crisis. As early as 2005, cash flow went into the negative — flashing warning signs over three years leading up to the firm’s collapse.

Closing Thoughts

The presence of free cash flow indicates that a company has cash to expand, develop new products, buy back stock, pay dividends, or reduce its debt. High or rising free cash flow is often a sign of a healthy company that is thriving. Furthermore, FCF directly impacts a company’s worth. So, savvy investors often hunt for companies with high or improving free cash flow but undervalued share prices. The disparity often means the share price will soon increase.

Free cash flow measures a company’s ability to generate cash, which is a fundamental basis for stock pricing. This is why Jimmy and his followers value free cash flow more than just about any other financial measure out there, including earnings per share.

We recommend you take a page from them and do likewise.

Editor’s Note: Thanks to a government-mandated “cheat sheet,” you can get the inside scoop on the moves the “elites” of this country are making. It’s like peeking over their shoulders into some of their biggest trades — for free. To see this Wall Street “cheat sheet” for yourself, go here now.