How Learning The Art Of “Crisis Investing” Can Lead To Huge Profits

Yesterday, I told you a little bit about the process I undergo to find potentially winning investments.

As I said back then, I wish I could tell you I had some crystal ball that pointed me to winning picks. But the truth is, I simply roll up my sleeves and dig through everything I can put my hands on whenever I find a new company that interests me.

This sort of “bottom-up” approach can lead to a lot of dead ends. But it can also lead to some diamonds in the rough that pay off big-time.

Today, I want to touch on another method I use to find winning picks that’s along the same lines.

I’m talking about “crisis investing”.

Similar to my bottom-up approach, this method still involves a lot of research. And to top it off, it requires that we act boldly and venture where many investors won’t. That said, this investment thesis has done quite well for us over the years…

Crisis Investing 101

When trouble strikes, you can often find excellent investing opportunities… And over the years, this approach has worked well for us over at Capital Wealth Letter.

Every once in a while, a company might fall on hard times. Or succumb to some sort of crisis. The company name is in every news headline, and for not the right reasons.

Think of the debacle Southwest Airlines (NYSE: LUV) is going through right now. It experienced a computer outage that impacted flights across the nation and cost the company north of $220 million. Now the company is under federal investigation.

When these disasters happen, investors dump shares and send the stock price in a downward spiral.

Sometimes shares stay down for good reason. But other times, shares only stay depressed because investors simply forget about the companies after leaving them for dead. But if it’s a temporary crisis — something the company can fix — then it provides us with an opportunity to swoop in and pick up shares at bargain prices — setting us up for some wonderful returns.

“The Time To Buy Is When There’s Blood In The Streets”

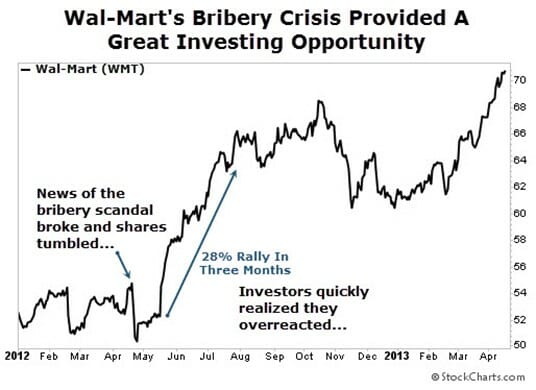

Sometimes that window of opportunity is slim. Take Wal-Mart (NYSE: WMT), for example. In 2012 shares of the retail behemoth suffered a small blow when news came out that it was involved in a massive bribery scandal. Shares tumbled roughly 9% in only three days. Investors quickly realized that they overreacted and piled back in… but those that bought when others were fearful were rewarded for their contrarian view:

We’ve even witnessed how this “crisis investing” can pay off with our current holding , American Express (NYSE: AXP). You may recall from my original write-up that American Express had gone through numerous scandals throughout its history, the most prominent being the Salad Oil Swindle of 1963.

After the stock price had collapsed from the scandal, Warren Buffett stepped in and took a 5% stake in the company, on which he made a cool $20 million profit. (Then later regretted selling and bought more shares.)

When I first recommended shares of American Express, the company wasn’t going through a scandal per se, but many investors considered it a crisis. American Express lost its co-branding partnership with Costco (Nasdaq: COST). Investors fled the scene, essentially leaving it for dead. The stock tumbled 45%.

We stepped in and picked up shares for only about seven times cash earnings, a valuation the stock hadn’t seen since the 2008-2009 financial meltdown.

Since taking advantage of the “Costco Crisis,” we are up a market-crushing 190%…

There are numerous stories like Wal-Mart and American Express. Of course, not every company undergoing a crisis makes a great investment. It’s a fine line to walk, and you have to be able to spot what separates a winner from a dud.

Here are a few things I look for in potential winners…

- A Wonderful Business. I realize this first one is subjective. But it’s key. And you don’t even need to know the business inside and out. For example, with American Express, was its entire business reliant on Costco? No. American Express would continue issuing credit cards to higher credit-worthy customers while delivering exceptional customer service. Did its business take a hit on the Costco loss? Yes. But it wasn’t going to put it out of business.

- Operational Efficiency. Is this a company that can quickly get back to generating cash? Sure, its crisis might lead to a temporary earnings or cash flow loss. But once this crisis is behind it, how quickly can the company get back to generating free cash flow?

With American Express, the company’s earnings took about a 50% haircut but grew 153% the following year — higher than before the Costco crisis. Same with cash flow. Cash flow took a hit, then soared 52% the following year, and hasn’t looked back. - Shareholder Friendly. Is the company focusing on shareholder growth either through dividends or share repurchases? When crisis strikes, it often provides a nice reset of priorities for companies. They once again focus on and deliver shareholder value. Many companies talk about delivering shareholder value, but it’s often just talk. You want to see management execute on their promises.

American Express didn’t waver in their dividends. In fact, it continued to increase its dividend as it worked its way through its Costco Crisis. The company also reduced its outstanding shares from over one billion pre-Costco crisis to 747 million today.

Closing Thoughts

As I walked through my latest recommendation over at Capital Wealth Letter, I realized it went through its own crisis. But management remained focused on the three keys I discussed above. And while it still isn’t out of the darkness yet, I believe the risk/reward setup is too good to pass up.

I doubt everyday investors have heard of this company. And he ones that have, have left it for dead. That’s okay. As Warren Buffett always says, “Be greedy when others are fearful…”

In the meantime, if you are looking to for big-time growth opportunities, my team and I have just released a report you need to see…

Our list of predictions for 2023 (and beyond) is “live”. This annual report is easily one of the most hotly-anticipated pieces of research we release.

From the U.S. dollar to driverless trucks to breakthrough cancer treatments and more… If you’re looking for ideas that could turn a modest investment into a small fortune, this is where you’ll find it.

We can’t guarantee that every idea will pan out. But if history is any guide, it could be one of the most profitable things you read all year…