Is The SVB Collapse A Repeat Of 2008? Here’s What You Need To Know…

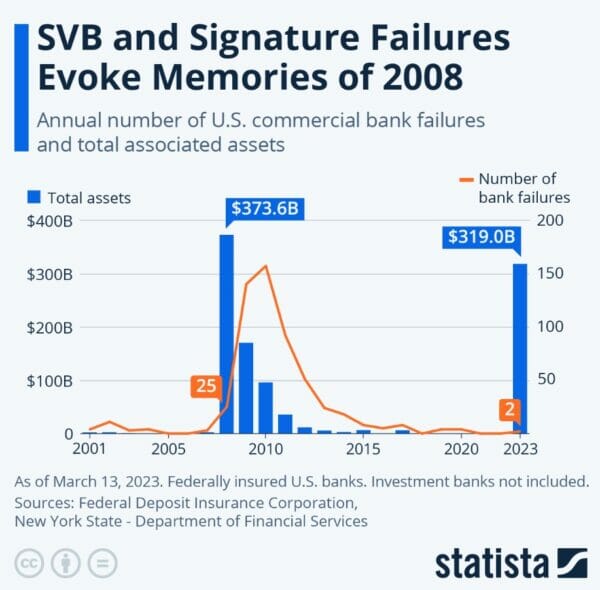

The markets were rattled on Friday by the swift implosion of Silicon Valley Bank (SVB). It was the second-largest bank failure on record. The Santa Clara-based lender survived the dotcom crash but couldn’t withstand the crippling rate-tightening cycle unleashed by the Fed.

Not even with $200+ billion in assets.

Like many financial institutions, SVB parked huge sums of cash into long-term Treasury Bonds. Rising rates has crushed this normally calm asset class. By itself, the damage wouldn’t have been fatal. SVB could have avoided the unrealized paper losses simply by holding these bonds until maturity.

But this particular bank caters primarily to tech startups and venture capital firms with their own liquidity issues. Deposits had slowed in recent quarters, and many clients were making sizeable withdrawals. To accommodate those requests, the bank liquidated its bond portfolio early and absorbed a $1.8 billion loss.

Source: Statista

What Happened?

In hindsight, there were signs of stress. Shares of parent company SVB Financial (Nasdaq: SIVB) were already down by more than half over the past year. And a recent attempt to raise capital flopped. The troubles boiled over last week after an old-fashioned bank run fed into a panic and left the company insolvent, forcing regulators to step in – creating a nightmare for some 40,000 customers.

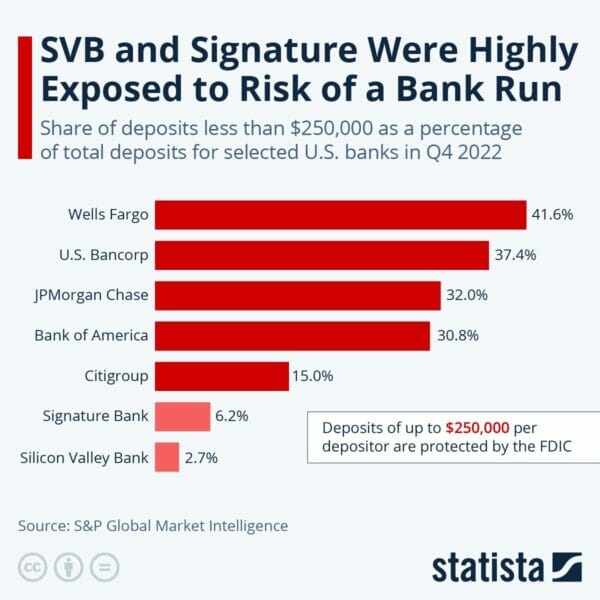

Depositors like Roku held far more than the FDIC insurance limit of $250,000 in their accounts. In fact, nearly 90% of the bank’s $175 billion deposit base was technically uninsured. But over the weekend, the Fed and the Treasury Department intervened with a plan that, while not a bailout, would fully backstop deposits and grant full access to funds starting today.

Source: Statista

Regulators have established a new Bank Term Funding Program (BTFP) to ward off future threats. This will provide banks with quick funds in exchange for collateral. Instead of dumping bonds at less than face value (like SVB did), these securities can now be pledged against a fresh infusion of Fed cash. This lending facility may prevent runs on other imperiled banks.

The announcement soothed accountholders and pacified investors somewhat. So it was a bit surprising (and jarring) to see regional bank stocks getting hammered even harder on Monday.

Despite the Fed’s efforts, a second bank has now toppled. Investors awoke to the news that Signature Bank of New York has closed its doors and been seized by regulators. But again, this particular financial institution had a unique and concentrated clientele, catering heavily to crypto investors. There might have been a third failure had First Republic Bank not secured emergency funding from JP Morgan Chase.

What Now?

There is blood in the water right now, particularly with technology-facing lenders. PacWest Bancorp (Nasdaq: PACW) was down 40% at the opening bell this morning. Western Alliance (NYSE: WAL) is plummeting by almost 50% as I write. Even banks at a safe distance from the epicenter of this quake are still feeling the tremors. Memphis-based Regions Financial (NYSE: RF) has slid about 7%.

John Hancock Financial Opportunities (Nasdaq: BTO) has pulled back about 4.4%, but the fund has already bounced from lows hit earlier this morning. It remains a long-term “Buy.”

To paraphrase the great Warren Buffett, you don’t see who is swimming naked until the tide goes out. Well, the banking waters have receded, and quite a few lenders have been exposed. But unlike the financial crash of 2008, these breakdowns are idiosyncratic in nature, not systemic.

In other words, this disease may not be too contagious. I’m actually more worried about a lack of funding (and M&A capital) in the tech world.

There is already a sense that the knee-jerk sell-off may be overdone. Brokerages are advising their clients to be on the lookout for opportunities. Bank of America released a note saying, “we believe that the sharp sell-off in bank stocks was likely overdone as investors extrapolated idiosyncratic issues at individual banks to the broader banking sector.”

And that was before today’s drubbing.

Closing Thoughts

My first reaction was to check on Bank OZK (NYSE: OZK), a former High-Yield Investing holding we sold for a 50% gain in 2020. The well-run regional bank has now increased dividends for 50 consecutive quarters. I was hoping for a short-sighted pullback into the upper-$20s. But alas, this best-in-class bank is showing its colors today and is actually in the green, gaining about 2%.

But once the dust settles, there will be bargains. Take Comerica (NYSE: CMA), which plunged from nearly $60 to $45 this morning, driving the 4.8% yield beyond 6.2%. The bank has some unrealized losses on the books (who doesn’t) but has shown sharply improved commercial loan growth and a marked increase in net interest margins.

That doesn’t mean we should gloss over these developments. According to the FDIC, U.S. banks are sitting on $620 billion in aggregate unrealized losses on securities available for sale. That’s not a trivial amount. And the inverted yield curve has pinched margins. As mentioned in my last update, “further rate hikes could stress…the credit quality… of retail and commercial lenders.”

But therein lies the silver lining. The Fed was determined to quash inflation by tightening until something broke. Well, something just broke — triggering government intervention we haven’t seen in 15 years. There is a very strong possibility that these events may put future rate hikes on a temporary hiatus or at least reduce the next increase from a half-point to a quarter-point.

For now, I will be looking for ways to capitalize on this frenzied sell-off.

In the meantime, how would you like to get paid from some of my absolute favorite high-yield picks?

If that sounds appealing, then you need to check out my report. You’ll learn about 12 ultra-generous dividend payers that put more money in your pocket. And the best part? They pay dividends monthly. Go here to learn more now.