A Rare Opportunity To Lock In A 14% Yield. Here’s Why It’s Worth A Look…

One of my top-rated income picks over at High-Yield Investing has suffered quite a bit during this rate-tightening cycle.

In fact, it’s off by about 40%, sliding from $30 a year ago to around $18 today. But does the downhill stock chart reflect a corresponding decline in fundamentals?

Not from where I stand. In fact, I think it spells a compelling opportunity for investors right now.

Let me tell you about Blackstone Mortgage (Nasdaq: BXMT)…

A Unique Hybrid Company…

For the benefit of newer readers, Blackstone Mortgage is a hybrid lender/investor. Its primary function is to originate and issue mortgage loans collateralized by commercial real estate. The $26 billion portfolio is comprised of 203 loans secured by Class ‘A’ office towers, beachfront hotel resorts, biotech research labs, upscale apartment complexes, and other institutional properties.

Ordinarily, I invest in rent-collecting landlords over at High-Yield Investing. But before they can buy a property, those landlords must first obtain the funds. That’s where Blackrock comes in. The target loan is $50 million to $500 million, generates substantial interest, and is often repaid in less than five years.

Here’s a standard example. Blackstone provided $350 million for the title to Atlanta’s Selig West Peachtree, a mixed-use facility conveniently located next to major highways and transportation hubs. This building features a 180-room hotel, 64 residential condo units, and 673,000 square feet of prime office space (96% of which is leased to Google).

Considering 98% of its loans are variable rather than fixed, BXMT has positive leverage to rising interest rates. Most are tied to a benchmark like the Secured Overnight Financing Rate (SOFR) plus a spread of at least 250 basis points. And the SOFR has marched from 0.16% a year ago to 4.57% today. Simply put, borrowers are paying more for their mortgage loans now than they did a year or two ago.

What The Numbers Really Say…

That is clearly evident on the bottom line, as earnings have risen sequentially in each of the past four quarters.

Source: BXMT Q4 Earnings Presentation

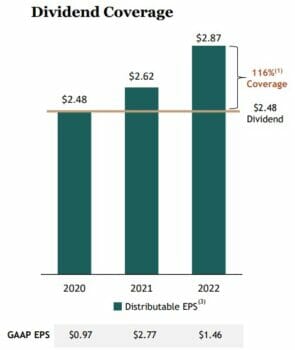

Far from receding, distributable earnings per share have actually swelled from $0.62 to $0.87 per share over the past four quarters. The current dividend coverage ratio stands at a lofty 140% ($0.87/$0.62).

At $0.62 per share, BXMT is throwing off a towering dividend yield of nearly 14%. Ordinarily, double-digit yields are on financially shaky ground. But for every dollar of dividend payments, Blackstone Mortgage is generating $1.40 in internal cash profits.

That’s actually an improvement from the full-year 2022 coverage ratio of 116%. In other words, the dividend is safer now than a year ago. Yet, the stock has lost 40% of its value.

Source: BXMT Q4 Earnings Presentation

The Selling Is Overdone

I believe the market is unduly concerned about credit quality. There is no doubt that higher interest rates make interest payments far more burdensome for borrowers. Anybody who has taken out a car or mortgage loan over the past 12 months would likely agree. So there is certainly a correlation between the Fed funds rate and bad loans.

But concerning Blackstone Mortgage, those worries are premature at this point. The company collected 100% of its contractual principal and interest payments due last quarter. Every last penny was accounted for. I should note that eight loans (out of 203) were downgraded in quality last quarter. But an equal number were upgraded.

At this point, 97% of the portfolio is performing. Better still, the weighted average loan to value (LTV) stands at 64%, providing some cushion if loans sour and/or property values depreciate. Even in the event of default, these loans are secured by high-quality real estate that can be sold to recover any credit losses.

Like most lenders, BXMT sets aside more money for reserves to cover potential credit losses. But if those losses don’t materialize, the reserves will be released. The company has some liabilities of its own, but no material debt maturities until 2026.

In the meantime, it out-earned distributions by $66 million last quarter, retaining the excess in support of book value — which now stands at $26.26 per share. Compare that to the discounted share price of $20.50.

Closing Thoughts

Due to the floating nature of its loans, the company will see a $0.05 increase in quarterly profits ($0.20 annually) for every 100 basis point increase in short-term rates. And Powell seems determined to take us there.

I normally tell my subscribers to stay away from double-digit yields. Oftentimes, they’re too good to be true. But there’s always an exception for every rule. While volatile, I think BXMT is an attractive buy for risk-tolerant investors at this level.

And if you’re looking for more high-yield picks like this, then you need to check out my latest report…

You’ll learn about 12 ultra-generous dividend payers that put more money in your pocket. And the best part? They pay dividends monthly. Go here to learn more now.