How To Double Your Income AND Lower Risk With This Simple Strategy

Would you rather boost your yield or reduce your downside exposure? That’s a tough call. What if I told you there was a door number three that offers both? And it works best in environments just like this.

It’s no secret that stock prices are driven largely by the economy’s health. Well, real (inflation-adjusted) GDP growth is expected to inch ahead by just 0.7% in 2023. Stocks might trudge along at a similar pace. Yet, there is a big difference between deceleration and outright contraction. So, while the market might have a ceiling, it might also have a floor.

In other words, trading could be directionless and range-bound. Notice I said, “could.” We are not in the market timing business here. If selling intensifies, knowing this strategy can help cushion the blow is reassuring. And if the bulls take control and stocks soar to new heights? Well, that wouldn’t exactly be a problem, either.

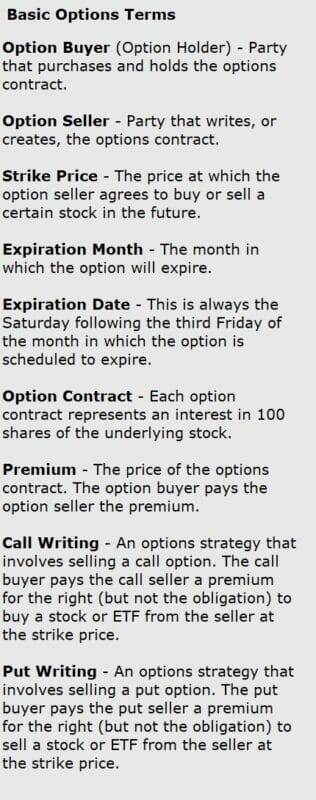

First, let’s cover some background information on stock options, which play a central role. These instruments have an undeserved reputation for being risky. Yes, they can be a gamble. But they can also reduce risk and generate income.

It’s all about how they are used.

The Nuts and Bolts

Let me explain using a popular stock like Coca-Cola (NYSE: KO). The shares currently trade around $60 and offer a respectable 3% dividend yield. Suppose I buy the beverage giant and like its long-term growth prospects but think it could be in for a bumpy ride over the next few months. One way to mitigate risk — and generate extra income at the same time — is by selling a covered call option.

Don’t be scared by the terminology. It’s really quite simple.

Don’t be scared by the terminology. It’s really quite simple.

Call options convey the right (but not the obligation) for one investor to purchase stock from another at a pre-designated price. In this case, a call option on KO expires June 16, 2023, with a strike price of $65. The cost (or premium) is $0.50 per share. Since each contract involves 100 shares, this one would cost $50.

As the seller, I would collect that cash from the buyer upfront. In turn, they have the right to buy 100 shares of KO from me at $65 per share. Simple.

Given market headwinds, there’s a good chance KO will fail to reach $65 between now and mid-June. The stock might slide a bit, stay flat, or possibly gain a few dollars per share. Under any of those scenarios, the option would expire, and I would keep my shares. Nobody will voluntarily exercise the right to pay $65 for a stock that can be bought on the open market for, say, $63.

So, I would happily pocket an extra $50 profit for my trouble and move on.

That might not sound like much. But remember, the stock’s regular quarterly dividend is $0.46. So the $0.50 call premium would be equivalent to receiving a fifth dividend. And that’s just for a 3-month holding period. After the contract expires in June, I could immediately sell a second call option for another 3-month period and then possibly another.

The longer KO stays below $65, the more income I can harvest.

Repeating this strategy four times over the next year would bring in $2.00 per share in premium income, or 3.3% ($2.00/$60). Of course, I would also still collect the regular dividend yield of 3.0% along the way, pocketing a total of 6.3%.

Dividend investing is a waiting game, anyway. We buy to get a paycheck every quarter and hopefully sell the stock in the future at a higher price. If the stock reaches that target price quickly, great. If not, writing call options offers a way to collect more income while you wait. In this case, they could more than double the payout on KO over the next 12 months.

Now that’s making your money work harder.

The Best Of Both Worlds…

Remember, this strategy is ideal for earning supplemental income when the market (or an individual stock) isn’t going anywhere fast. We all have slow movers. Utilizing covered calls is like “renting” them out for a while to make a few extra bucks.

And contrary to popular belief, these call options aren’t risky. Actually, they reduce your potential downside. If I can collect $2.00 per share in premium income on Coke, my breakeven price drops from $60 to $58. So, if I end up selling at $50, the option would reduce my loss on this position from 16.6% to 13.3%.

I know what you’re thinking. What happens if KO moves sharply higher and climbs above the $65 strike price? Well, I wouldn’t complain about that scenario, either. After all, that would represent a $5 per share profit over my purchase price – and I’d still keep the $50 premium income as a parting gift.

What’s the catch? I would have to sell my Coke shares at the agreed-upon price of $65 and forgo any additional upside beyond that. So, if the stock streaks to $70, the rest of the gain would accrue to the option buyer. But that might be a fair tradeoff, particularly in a market showing signs of topping out.

There are really only four scenarios once we buy a stock: it can decline; stay flat; rise a little; or rise a lot. Obviously, we prefer option four. But in any of the other three, covered calls can boost returns.

Editor’s note: Have you seen our latest market predictions for 2023? What we’ve uncovered could shock you…

Fair warning: These annual forecasts are the most controversial market calls we publish all year. But because they challenge conventional wisdom, they’re also the most hotly anticipated, and for good reason. Past predictions have handed investors a shot at raking in 622%, 823% and 1,168%. And this year could be our most profitable yet…

Discover all 7 of our startling investment predictions — NOW.