After 2 Big Hikes, This Company Just Raised Dividends AGAIN In March…

As longtime readers know, I make a regular habit of looking for dividend hikes.

After all, as Chief Strategist of High-Yield Investing, searching for stocks that are set to put more cash in your pocket is part of my job.

Each month, I flag these stocks for my premium readers so they can research them and get a head start. Then, I share them with the public. Ideally, I’m looking for hikes that could happen over the next four to six weeks. I also highlight noteworthy special distributions on the horizo

We don’t do this just for fun. In a perfect scenario, we find great ideas for consideration in our premium portfolio… Companies posting outsized double-digit increases and reliable dividend-payers that have been steadily growing payouts for a decade or more.

This month, I have one stock I’d like to highlight. And even though this dividend was raised in March, I’m going to tell you about it anyway. So if you’re looking for a potential addition to your income portfolio, consider looking at these names further…

This Company Hiked Dividends In March

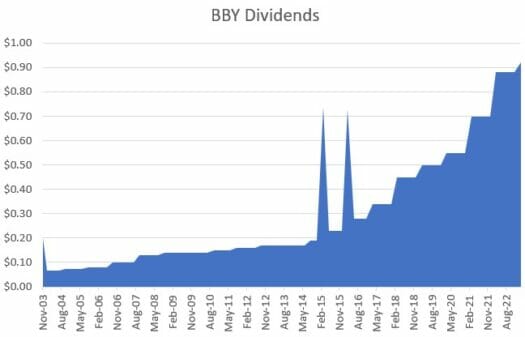

Best Buy (NYSE: BBY) has just approved a 5% dividend hike. Starting with the March payment, the quarterly distribution will bounce from $0.88 to $0.92 per share.

As we know, post-Covid demand has slumped across several product lines, most notably phones, PCs, and televisions. Still, the nation’s top electronics retailer is holding its own. The company just posted fourth-quarter sales that were in line with expectations, while earnings of $2.61 per share were comfortably ahead of Wall Street’s $2.10 target.

Of course, the market is always more interested in the future than the past. On that front, there is some cautious optimism for fiscal 2024.

Management expects the macro environment to continue weighing on revenues, which are forecast to slip to around $44 billion versus $46 billion last year. Comparable same-store sales are likely headed for a 3% to 6% decline. But most of the pressure was expected to come in the first quarter. So with that behind us, comparisons should “ease” over the remainder of the year.

Looking Ahead…

Initiatives to trim costs and improve efficiency are taking hold and could lift gross profit margins by as much as 70 basis points this year. That should help adjusted earnings stabilize in the $6 per share neighborhood, a modest downturn from the $7 pocketed this past year.

But I’m not too concerned by the soft macro outlook, not as long as Best Buy continues to win the larger market share battle and stay ahead of the curve as the competitive warfare trenches move from storefronts into the home.

Getting there required big investments in personnel and technology (including strategic acquisitions) to provide shoppers with expert service and customized advice. The over-arching goal was to differentiate Best Buy from other vendors while deepening customer relationships.

Your average consumer lacks the time, inclination, or technical know-how to wire a home theatre system or install live streaming security monitoring equipment. Best Buy’s new Total Tech Support program provides complimentary installation backed by a network of expert advisors, free shipping, discounted repairs, and other perks. The service launched nationwide last year and has already attracted more than four million subscribers.

Even before that, BBY controlled a dominant 40% share of all brick-and-mortar electronics sales — to say nothing of its digital sales channels.

Action To Take

After strong hikes of 26% and 27% the last two years, this latest 5% dividend bump reflects the more challenging near-term outlook. Big box retailers like Target are seeing some of the same consumer spending headwinds.

Still, an increase is an increase. Meanwhile, Best Buy pushes all the right buttons and wins shoppers’ loyalty with its concierge services. The bar has been set fairly low, positioning the retailer for an upside surprise over the next few quarters. With a yield approaching 5%, BBY remains a “buy” for any investor looking for a combination of growth and income.

In the meantime, to know about my absolute favorite high-yield picks, you need to check out my latest report…

You’ll learn about 12 ultra-generous dividend payers that put more money in your pocket. And the best part? They pay dividends monthly. Go here to learn more now.