Our Expert Weighs In On Savings Accounts, Treasuries, Crypto (And More)

Last week, I had a wide-ranging discussion with my colleague Jimmy Butts, Chief Investment Strategist of Capital Wealth Letter.

In our previous chat, we covered everything from the latest macro data to why it sometimes pays to ignore the financial media. We even spent some time talking about a game-changing new class of drugs that has the potential to help millions of Americans struggling with their weight.

Back when Jimmy and I lived in the same city, we would often discuss the markets (and life) over beer and wings. In fact, we arrived at some of our best investing ideas that way.

Today, we keep the discussion going.

In the conversation below, Jimmy and I cover why you may need to “fire” your bank, what you can do to earn a little more on your money, and the resurgence of crypto (and what it means for us). My questions are in bold…

Jimmy, I read somewhere that banks are paying out an average of 0.37% interest in savings accounts. You would think they would be paying more now that rates are higher. What’s going on?

Well, first I’d say that they are doing that because they can get away with it. So first and foremost, check with your bank and make sure you are in an account with the highest interest rate. You might be surprised…

Well, first I’d say that they are doing that because they can get away with it. So first and foremost, check with your bank and make sure you are in an account with the highest interest rate. You might be surprised…

For the first time in over a decade, consumers have the leverage against banks. If you have a good chunk of cash sitting at a bank, you can bet that they will work with you to offer the best rate they can. Now more than ever, banks do NOT want to lose deposits.

If they won’t play ball, then consider moving your money. This is a great opportunity for those with cash on the sidelines. Thanks to higher interest rates, that cash can actually work for us.

Capital One has a savings account with a 3.5% interest rate. Citi Bank offers 3.85%. And many online financial institutions offer even higher. A quick Google search shows CFG Bank offering folks a 5% rate.

Heck, even Apple announced (in partnership with Goldman Sachs) a high-yield savings account offering 4.15%.

We talked about I bonds last year, but their rates will continue to go down along with inflation. Should investors consider Treasuries instead?

Absolutely. If you’re willing to put in a little extra work, you can get an even better rate on your cash with U.S. Treasuries.

But it’s well worth it. I’ve bought on Treasurydirect.gov as well as through my brokerage account. (Of course, each brokerage has its own instructions for buying them, so it might be worthwhile to reach out to your brokerage’s customer service team to figure out how.)

My brokerage account only offers 0.35% on any cash that I don’t have invested. So, I bought some 4-week T-Bills and 8-week T-Bills. Now, I’m getting north of 4% on that 4-week T-Bill, and nearly 5% on the 8-week T-Bill.

To recap for our readers, U.S. Treasuries are the debt obligations of the U.S. government. They are issued by the U.S. Treasury Department. Many people don’t realize you can easily buy Treasuries with durations as short as 30 days (4 weeks). These short-term Treasuries are referred to as “T-Bills.”

We haven’t talked much about cryptocurrency lately, but there’s a lot going on. What’s the latest?

The cryptocurrency world has been a hot mess since the FTX debacle. Regulators have cracked down on the all the major players in the space, like Coinbase, Kraken, Gemini, and Binance. And banks have been more stringent with their relationships with crypto companies (some even got shut down).

Here’s a quick recap of what’s happened in just the last three months…

- Crypto’s top banking partners — Silvergate and Signature — were shut down or seized by the government.

- Signature Bank was finally sold, but U.S. regulators said its crypto business must be shut down.

- Cryptocurrency platform Kraken got sued by the SEC and was forced to shut down its staking services.

- Coinbase received a Wells Notice from the SEC for offering unregistered securities.

- Binance got sued by the CFTC for offering unregistered futures and options trading.

Oh, and U.S. Senator Elizabeth Warren announced she’s building an “Anti-Crypto Army.”

Is there anything that has you feeling optimistic amid these negative headlines?

Absolutely. Cryptocurrencies have been under the microscope (and under attack) from the U.S. government. But here’s the thing… unless you closely follow the crypto world, you may not have heard much about any of this. And that has me excited…

Crypto is no longer dominating headlines. In fact, I very rarely hear about it anywhere in the financial media.

As far as those folks are concerned, the crypto craze is over (at least for now).

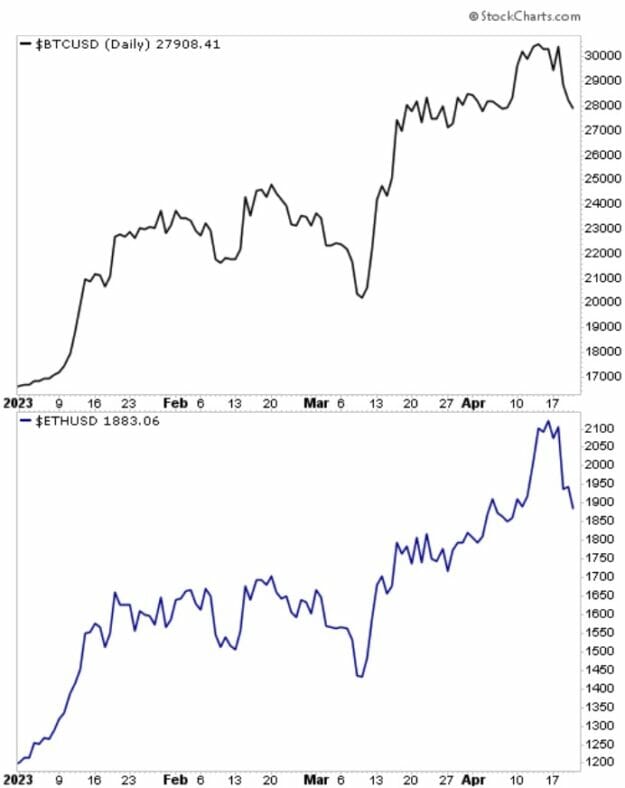

But Bitcoin and Ethereum have quietly been rallying…

Also, let’s talk about the fact that Bitcoin’s hash rate recently hit an all-time high. Hash rate is a way to measure how much computing power is needed to mine Bitcoin.

Why does this matter? Well, the hash rate is used to measure things like how active Bitcoin miners are and how secure the network is. An increase in hash rate means two things:

1: Miners are getting back in the game. After a terrible 2022 that saw many miners go bankrupt or turn their machines off because bitcoin was crumbling, they are getting back in…

Bitcoin is up over 50% this year, and miners are turning their machines back on. This shows that miners are confident in Bitcoin in the near term. It also means…

2: Bitcoin’s network is getting more secure. Miners all compete to solve hard, complex problems. The first ones to get them correct win and get to mine that specific block on the network.

The higher the hash rate, the harder the problems, and the more difficult (and costly) it is for someone to hack the network.

Bottom line is that both are good signs for Bitcoin’s growth.

What can we take away from all of this? Is it time to get back on the crypto train?

There’s been a lot of drama in the cryptocurrency world, much of it going underreported by the mainstream media.

There has also been a lot of heat coming from the government. And while we don’t want to mess with the U.S. government — a usually unprofitable endeavor — it also tells me that cryptocurrencies are here to stay. After all, the government doesn’t go after something it deems “worthless.”

Bottom line, there are a lot of things happening in the cryptocurrency space that I’m keeping a close eye on. And when some of this dust settles, it will be time to jump back in. Stay tuned…

Editor’s Note: If you’re looking for game-changing investment ideas with serious upside, then you should check out my investment predictions for 2023…

This report is full of research that challenges the conventional wisdom. And while we don’t have a crystal ball, many of our past predictions have come true, allowing investors the chance to rake in gains of 622%, 823%, and even 1,168%.

From the U.S. dollar to driverless trucks to breakthrough cancer treatments and more… If you’re looking for some “home-run” ideas for your portfolio, then I can’t think of a better place to start.