A Rare Opportunity Is Setting Up With Lithium (And Lithium Miners)…

Let me tell you about Kings Mountain.

This town is in the foothills of the Blue Ridge Mountains in North Carolina.

It’s also home to the Kings Mountain Tin Mine, which operated from 1938 to 1988. Granted, today, the mine is dormant and filled with water. But at one point (in the 1980s), it was one of the biggest lithium producers in the world.

Back then, the lithium and the secondary commodities that came out of the mine (namely feldspar and silica) went to industries like glass and ceramics.

Fun tidbit… The lithium mine also played an important part in the Manhattan Project in World War II, helping develop nuclear power and the atomic bomb. But this article isn’t about the Manhattan Project, nuclear warheads, or some top-secret government lab.

This is about lithium and the ginormous demand for the soft, white metal. More specifically, it’s about how we have a rare, incredible opportunity to profit.

Let me explain…

Lithium’s Boom-And-Bust Cycle

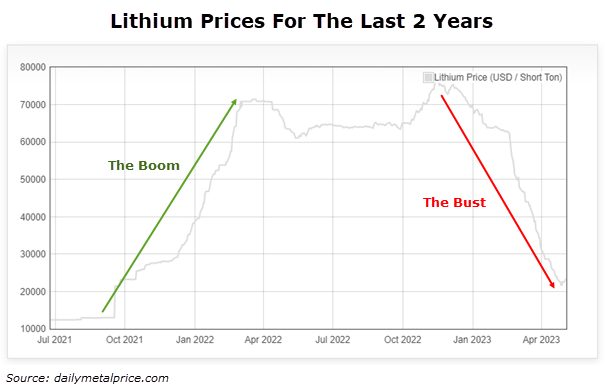

If you haven’t been keeping tabs on this commodity, you need to know that lithium prices go through boom-and-bust cycles, as all commodities do.

Right now, lithium prices are in bust mode.

Take a look:

As you can see, after prices took off in 2022, they came crashing back to earth.

Falling lithium prices aren’t completely surprising (for reasons I’ll explain in a moment). What is surprising is just how fast it happened. But perhaps it shouldn’t be because we’ve seen this happen before…

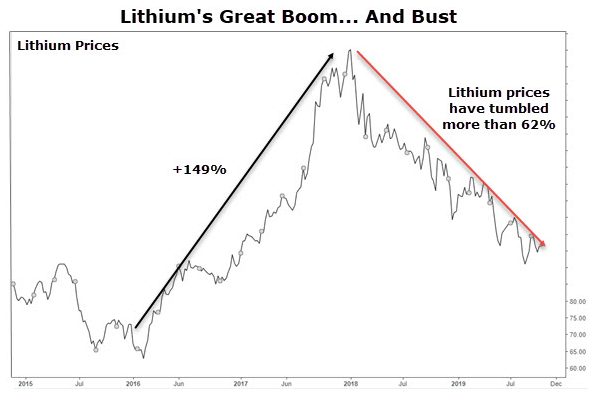

In fact, the last time I wrote about lithium in November 2019, prices had tumbled more than 62%. Here is the chart I showed then…

Over at Capital Wealth Letter, we capitalized on this selloff and doubled our money in one year. I don’t see any reason why a similar story won’t play out.

Surging Demand For Lithium

The demand for lithium really picked up steam in 2016. That’s when Tesla (Nasdaq: TSLA) unveiled its Model 3. The excitement was huge. One week after the unveiling, reservations for the electric car totaled 325,000. By comparison, in 2015, Tesla produced less than 50,000 vehicles.

More importantly, it kicked off a massive shift toward electric vehicles, or “EVs.” Today, every car manufacturer has an electric vehicle. And last year, Tesla sold over 1.3 million EVs.

This has kicked the demand for lithium into overdrive. For example, in 2015, the biggest user of lithium was the glass and ceramics industry, scooping up 35% of the lithium supply. Lithium batteries were growing in popularity by this time, but mostly in portable electronic devices, tools, and grid storage, which claimed 31% of lithium.

Today just 7% of lithium goes towards glass and ceramics. And 80% of lithium goes to batteries.

In 2015, worldwide lithium consumption was 32,500 tons. Last year, that figure was roughly 134,000 tons.

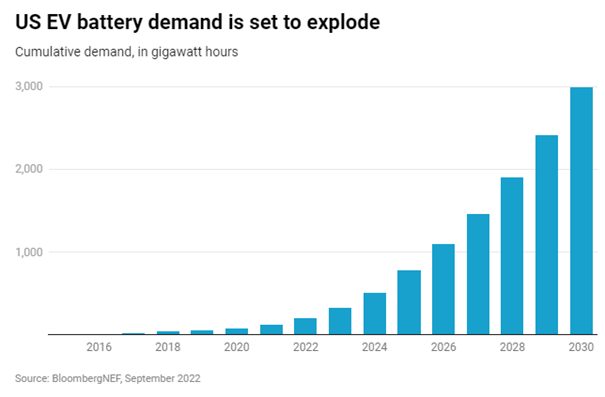

And barring a breakthrough in battery chemistry or the sudden embrace of public transit in the U.S., the transition away from fossil fuels will require lots of lithium-ion batteries. With the EV revolution well underway, demand for lithium-ion batteries is already exceeding supply, and experts predict shortages will continue for the next few years.

By 2030, BloombergNEF estimates 40% of cars sold globally will be EVs. And lithium supplies simply can’t keep up with demand. In fact, according to Benchmark Mineral Intelligence, by 2030, there could be a lithium deficit of nearly 160,000 tons.

According to the Alliance for Automotive Innovation, EVs accounted for 10% of U.S. vehicle sales in December, up from 2.3% in 2020. In 2022, 10.5 million EVs were sold worldwide, up nearly 60% from the previous year, according to research firm Rho Motion, which expects global sales to jump nearly 40% this year.

In short, the EV market is here. And it’s here to stay. That’s driving demand for lithium-ion batteries. According to Benchmark, investments in battery gigafactories totaled nearly $130 billion by the end of last year.

That means lithium remains (and is forecasted to remain) in high demand.

Sure, prices have tumbled along with the miners. But that just opens a door of opportunity, in my opinion.

But Why Are Lithium Prices Falling?

If the demand is so strong and expected to outpace supply, Econ 101 tells us that prices must rise to meet that demand. You know, something about equilibrium, elasticity, and some other words I barely remember from college.

Does lithium fall outside of the law of supply and demand?

No. After two years of high prices, the demand for lithium has cooled. Remember, supply rises as price increases (because those mining lithium make more money), but eventually demand declines (consumers aren’t willing to pay higher prices). We reached that tipping point, and demand is declining… at least for now.

A big reason is that the demand for electric vehicles has slowed, particularly in China. The market for many consumer electronics has cooled as well.

But there’s a lot of interest in lithium. For example, General Motors (NYSE: GM) recently invested $650 million into the startup Lithium Americas Corp. (NYSE: LAC) for the right to obtain material from a planned mine in Nevada.

Piedmont Lithium (Nasdaq: PLL) — a Tesla supplier — has been fighting tooth and nail to get a lithium mine up and running in North Carolina (locals have been pushing back).

The U.S. government is pouring money into the sector to support domestic production, making billions of dollars of loans and grants available to suppliers to incentivize them to build production plants in the U.S. And last year’s climate legislation offered new tax credits for electric cars tied to their domestic content.

How We Can Profit

There are a handful of ways to invest in lithium — like with Lithium Americas (LAC) and Piedmont Lithium (PLL), both mentioned above. But both are unproven. Neither has collected a dollar in revenue, and they bleed cash.

Their hopes hinge on regulatory approvals to begin mining and building facilities. Analysts project that both companies are slated to begin generating revenue this year. But they are far from a sure bet, and if lithium prices remain low, they will have a hard time paying their debts back.

Sociedad Quimica y Minera de Chile (NYSE: SQM) is a major lithium producer that’s trading for cheap. However, rumblings out of Chile that the government will nationalize its lithium make this a riskier investment.

Instead, we’re sticking with a former winner over at Capital Wealth Letter. It’s a well-managed company that’s proven to be shareholder friendly. It’s also the only company with a lithium mine in the United States.

Oh, and it’s trading for dirt cheap. In fact, the last time a setup like this happened, we doubled our money in just a year.

P.S. If you’d like to get the name of this pick, then I invite you to join us over at Capital Wealth Letter. You’ll get a copy of my annual investment predictions report just for trying us out…

While we don’t have a crystal ball, many of our past predictions have come true, allowing investors the chance to rake in gains of 622%, 823%, and even 1,168%.

From the U.S. dollar to driverless trucks to breakthrough cancer treatments and more… If you’re looking for some “home-run” ideas for your portfolio, go here to learn more.