2 Stocks That Could Raise Dividends In June

Inflation may be easing according to the headlines, but it’s still pesky. You might even say downright resilient.

So why not own stocks that are equally resilient about hiking dividends?

As some of you know, I make a regular habit of looking for dividend hikes. As Chief Strategist of High-Yield Investing, it’s part of my job.

Each month, I flag these stocks first for my premium readers so that they can research them and get a head start. Then, I share them with the public. Ideally, I’m looking for hikes that could happen over the next four to six weeks. I also highlight noteworthy special distributions on the horizon.

We don’t do this just for fun. In a perfect scenario, we find great ideas for consideration in our premium portfolio… Companies posting outsized double-digit increases, and reliable dividend-payers that have been steadily growing payouts for a decade or more.

This month, I have two stocks I’d like to highlight. So if you’re looking for a potential addition to your income portfolio, consider looking at these names further…

2 Upcoming Dividend Hikes

1. Lowe’s (NYSE: LOW) – This massive home improvement retailer paid its first dividend back when John F. Kennedy was President. And it has continued to do so every year since, rewarding shareholders with an annual pay raise every 12 months along the way.

After a half-century, you’d think the pace of those hikes would be slowing down. But the payout has more than doubled since 2018. The latest uptick was a hefty 30%+ raise last May, lifting the quarterly distribution from $0.80 to $1.05 per share. Management cited the company’s omnichannel sales and consistent cash flows.

Well, not much has changed since then. Lowe’s still welcomes about 20 million weekly shoppers to its 2,200 locations. Like other big box retailers, it looks to retrench in 2023 amid flattish same-store sales. But with healthy margins, earnings are forecast to approach $14 per share.

Management plans to set aside $2 billion of those profits for capital expenditures to keep the business growing. But it is committed to sharing excess cash flow with shareholders, dishing out $16.5 billion via dividends and stock buybacks last year.

I’m expecting another meaningful dividend increase within the next month. Beyond that, there are still opportunities to consolidate market share in the fragmented $900 billion home improvement sector.

2. Stanley Black & Decker (NYSE: SWK) – Spring is in the air – the ideal time to build a backyard deck, mend that wobbly fence, repaint the guest bedroom, and complete other do-it-yourself projects.

Sprucing up the house often means a trip to the nearest hardware store for chainsaws, leaf blowers, and other essential tools. I myself just made a trip to Lowe’s to replace my Black & Decker weed eater.

Between Craftsman and its iconic namesake brand, SWK captures more than its share of this market. The company can trace its lineage back to the Civil War when it peddled wrought-iron bolts and hinges. Today, it has grown to become the world’s No. 1 supplier of tools and storage products. It sells 50 tools per second through various retail channels in sixty countries worldwide.

SWK has been working to thin out bloated inventory levels, and management has made further de-stocking a top priority for 2023. While those efforts have bit into gross margins, aggressive cost-cutting measures are on track to erase $1 billion in annual red ink from the books. More importantly, an emphasis on cash generation is expected to yield $0.5 to $1.0 billion in free cash flow this year.

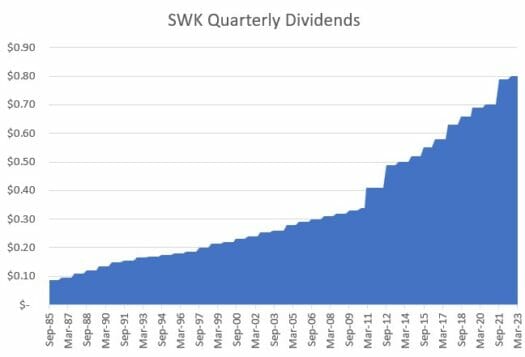

Yet, even without industry tailwinds, this well-run business has always managed to reward stockholders. In fact, it has increased dividend payments for 54 consecutive years and plans to continue returning approximately half of its excess capital through dividends and buybacks.

Action To Take

We’ve had a pretty good run of finding solid ideas from this exercise, so it pays to follow along each month. Some of them end up paying off big time. So, if you’re looking for a potential addition to your income portfolio, then I can’t think of a better place to start your research.

But remember, just because I highlight stocks that are likely to increase dividends doesn’t necessarily make them “buys.” These are merely ideas to get you started in the hunt for high yields.

And if you want to know about my absolute favorite high-yield picks, you need to check out my latest report…

You’ll learn about 12 ultra-generous dividend payers that put more money in your pocket. And the best part? They pay dividends monthly. Go here to learn more now.