One Of My All-Time Favorite REITs Is A ‘Buy’…

In March 2019, I had some positive things to say about the data center industry over at my premium newsletter, High-Yield Investing.

More devices, wider bandwidth, larger files, richer graphics, faster download speeds – a recipe for mind-boggling data consumption. That original piece introduced data center owner CoreSite Realty, which leased space to thousands of customers, including wireless providers like Verizon and cloud services behemoths like Amazon.

At that point, CoreSite had already raised dividends by 877% since its creation a decade earlier.

I wasn’t surprised when American Tower (NYSE: AMT) came forward two years later with a generous $10 billion ($170 per share) takeover offer. I hated to see CoreSite depart from our portfolio, although we did walk away with a nice gain of around 75% after that transaction.

But there’s good news: The time has come to revisit this booming sector.

This Old Favorite Is A ‘Buy’

The world isn’t streaming fewer shows or posting fewer social media videos than in 2019. E-commerce activity hasn’t suddenly stopped. Heck, even our refrigerators are connected to the internet these days. No wonder Internet traffic is now measured by the zettabyte (one trillion gigabytes).

That brings me back to my old friend Digital Realty Trust (NYSE: DLR). DLR is a former holding in one of my previous newsletters, Daily Paycheck. With a $27 billion market cap, this is one of the biggest players in this niche (swallowing smaller rivals left and right). Unfortunately, its yield has been in the 3% range the past few years (give or take). That’s shy of my 4% minimum requirement over at High-Yield Investing.

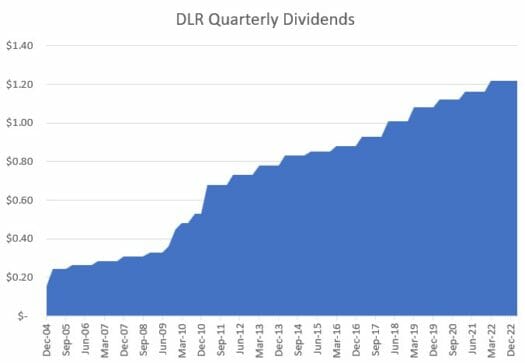

But quarterly dividends have steadily marched from $1.08 to $1.12, to $1.16 to $1.22 per share. Meanwhile, this broad tech selloff has discounted the share price from $150 back to $90. All of a sudden, DLR is now throwing off a yield of 5.3%.

One more bump in the payout could send that figure above 6%. And it’s likely on the way. The company has faithfully hiked its dividend every year since its 2004 IPO — typically in March.

The Outlook

Your favorite songs and videos might be stored in the cloud, but all that data has a physical home, most likely in a rack of servers somewhere. That hardware takes up a lot of space. It also draws exorbitant power and needs cool environments to keep from overheating. Most IT departments have found that instead of keeping all this equipment in-house, renting space in a dedicated facility makes financial sense.

Numerous renters typically occupy a single building known as a colocation center. Plenty of interested parties exist, ranging from tiny website hosting companies and online retailers to colossal data storage providers and telecoms. Some of the biggest users include content distributors such as Disney and Netflix, as well as cloud companies like Microsoft and IBM.

Once the hardware has been installed on these campuses, renters are reluctant to move – and not just because of the hassle and expense. They often make connections with neighbors. Furthermore, every minute of website downtime can mean millions in lost revenues, so companies are reluctant to do anything that could disrupt network availability.

That switching cost can be a powerful competitive advantage for incumbent leaders.

Shared infrastructure means lower costs for renters. And there are other advantages… reduced IT staffing, ample bandwidth, and ultra-high reliability. Demand for data-center space has snowballed around the globe, fueling strong returns for the companies that own these specialized properties.

Between acquisitions and new development projects, DLR now owns 316 data centers worldwide. The global platform covers most of the world’s largest metro markets: Los Angeles, Paris, Madrid, Hong Kong, and Tokyo. The recent acquisitions of Interxion and Teraco have expanded its territory across Europe and South Africa.

Inside The Numbers

Digital Realty has cultivated relationships with more than 4,000 customers on six continents, including heavyweights such as AT&T, Comcast, and Meta. It has picked up about 100 new clients per quarter in the past few years. It also signed $500 million in annualized new lease revenues last year, driving backlog to a fresh record high.

A recent forecast for fiscal 2023 suggests improvements across the board. With occupancy lifting to 86%, the top line is expected to rise by more than $1 billion, from $4.7 to $5.7 billion. Core funds from operation (FFO) are targeted at $6.70 per share, amply covering the $4.88 distribution. DLR is distributing approximately three-fourths of its earnings, which is generous but has a safety cushion for economic downturns.

There is a fair amount of debt on the balance sheet, equal to more than six times annual EBITDA. But 81% of that borrowing is locked in at low fixed rates (weighted average coupon of 2.7%) at staggered maturities. And DLR’s debt is rated investment-grade.

Valuations are compelling too. DLR is trading at 15 times this year’s cash flows as of this writing, versus 23 for rival Equinix. And looking ahead, the growth drivers are almost too numerous to list: cloud computing, streaming, e-payments, artificial intelligence, and the internet of things (IoT), just to name a few.

Action to Take

You might call DLR the internet’s landlord, collecting steady rental income from data center tenants and converting it into a dividend stream that has been growing at a double-digit pace for the past 17 years.

The company has considerable exposure to pounds, euros, rands, and other foreign currencies, which can present headwinds. But that is reflected in the stock price at this point. After a difficult 2022, the growing backlog and stronger pricing environment (reflected in leasing renewal spreads) bode well for the coming year.

This is a business with daunting barriers to entry. Not to mention other structural competitive advantages. Digital Realty is an exemplary holding for any income-oriented portfolio.

P.S. I’m not waiting around for Uncle Sam to take care of my retirement needs, and you shouldn’t, either…

Let this be the year you decide to free yourself from depending on a fragile system and take charge of your own retirement. That’s why I created my latest report about an “alternative” system that delivers the income you need. Go here now to get the full details…