Only A Few Names Are Powering This Rally, But I’m Still Optimistic…

You may have heard by now that there’s a new member of the exclusive Trillion Dollar Club.

Nvidia (Nasdaq: NVDA) just reached that milestone after posting blowout first-quarter results and dazzling guidance last week. The stock streaked 24% higher on the release day, adding an astounding $184 billion in market capitalization – just shy of a new 24-hour record.

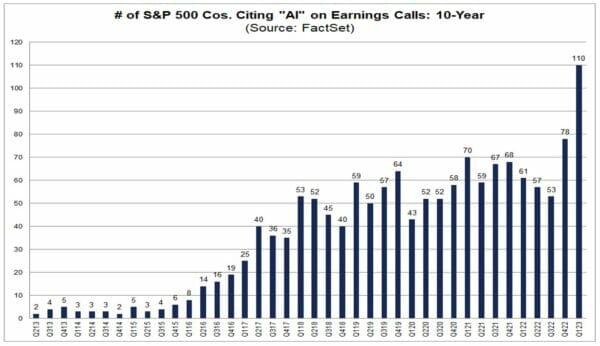

While best known for graphics processing units (GPUs) used in gaming applications and data centers, the chipmaker is now seeing an explosive surge in orders for products that support artificial intelligence (AI) tools and programs. Spurred by the runaway success of ChatGPT, the global AI buildout has been likened to a tech war – with Nvidia as the top arms dealer.

Source: FactSet

One analyst at Stifel describes Nvidia’s position as “the sweet spot of AI infrastructure wallet share.” And the proof is in the numbers. Wall Street had expected the company to deliver $7 billion in sales next quarter, but management is now steering for $11 billion.

With a market value greater than the GDP of Switzerland, Nvidia isn’t exactly in play as a takeover candidate. But we will certainly explore emerging stars in this new frontier, which could soon usher in a wave of M&A activity.

This Market Is Top-Heavy

For now, I want to talk briefly about a peculiar pattern – one that could have a direct impact on your portfolio. It involves the trillion-dollar club. These five behemoths are crowding out the rest of the market right now. If you’re curious about the other four, I’ll save you the trouble of a Google search. Actually, Google parent Alphabet is one of the charter members, along with Apple, Amazon, and Microsoft.

Combined, this group has gained $2.87 trillion in market cap since the start of the year.

Fortune just put out an enlightening piece noting that the entire S&P 500 has increased its aggregate market cap by $2.98 trillion year-to-date. That means the remaining 495 constituents have risen by $0.12 trillion, accounting for a scant 4% of the index’s gains – versus 96% for the “Big Five.”

Technically, the S&P is showing a decent gain of around 10% thus far in 2023. But remove a few names rallying around AI, and the rest of the market is actually down between 1% and 2%. The small-cap Russell 2000 is just on the plus side of flat.

Remember, the S&P 500 is a capitalization-weighted index. Every week, millions of 401(K) holders and other investors deposit a piece of their paycheck into the plethora of vehicles tethered to this closely-watched gauge, thinking they are investing across a broad spectrum of America’s most profitable businesses… Industrials. Healthcare. Finance. Real Estate.

In reality, these contributions are mostly diverted into a handful of pricey tech stocks. The bottom half of the top-heavy index holds little sway on returns, with none of the cohorts accounting for more than 0.08%.

What This Means For Investors…

I’ve seen this phenomenon before, although not this exaggerated. It usually doesn’t end well. Narrow market leadership masks weak performance elsewhere and isn’t exactly a positive sign. There are more losers than winners in the S&P this year, and poor market breadth is often a harbinger of a correction.

To underscore that point, Dollar General (NYSE: DG) shares just recently tanked 20% following a bleak sales forecast. The discount retailer is often viewed as countercyclical because consumers trade down when times are tough. But when even dollar shoppers aren’t filling their baskets, the argument for recession grows louder.

Closing Thoughts

Fortunately, over at Takeover Trader, our portfolio is on track for a solid year. There have been some laggards, of course, but most of the portfolio is in the green, and nearly a dozen holdings have delivered market-beating double-digit returns.

Take Pioneer Natural Resources (NYSE: PXD), for example. As I explained in this article, the company is reportedly in the crosshairs of Exxon Mobil (NYSE: XOM). And with prime contiguous acreage, thousands of promising drilling targets, and the highest returns per barrel among its peer group, it’s easy to see why…

The stock has been among our top performers Takeover Trader. Between share price gains and a whopping $33.92 per share in dividends, our total return is 160%.

Macro risks aside, I’m excited to see what the second half of the year brings. And one of the reasons why is because of the “mother of all oil booms” taking place in the West Texas oil fields. And I’ve got my eye on one little-known company that will have a front-row seat…

By now, you probably know that the Permian is home to a vast amount of untapped oil. But you’ll be shocked when you find out how much. We’re talking about nearly a billion barrels of oil… just from one company. And in the coming days, it could unleash a surge of mega-profits.