Why It Can Make Sense To “Rent” Out Your Portfolio (And Get Paid For It)

Last week, I wrote about some of the incredible gains my followers and I have made with call options.

I didn’t do this to brag — but rather to show you that learning how this stuff works is worth it.

Shortly after that piece, I followed up by talking a little bit more about the basic mechanics of how options work.

In that piece, we stuck with buying calls in our examples. But today, I want to look at the other side of the coin.

I’m a fan of this using strategy to earn supplemental income during periods when the market (or an individual stock) isn’t going anywhere fast. We all have slow movers. Utilizing options is a bit like “renting” them out for a while to make a few extra bucks.

And if you ask me, it’s a strategy that’s perfectly suited to the kind of market we’re in right now.

Let me explain…

Protect Your Portfolio (And Get Paid For It)

Let’s be honest. I can’t tell you exactly what will happen in the market next. I can only offer an educated guess. (If there’s anybody else who claims they can do better than that, you should be highly skeptical.)

If you ask me, while we’re officially out of bear market territory now, we’re not out of the woods yet.

So what if you have long-term positions in your portfolio that you just don’t want to sell? How do you protect your gains?

That’s where selling covered calls comes into play.

Let me explain using an example. We’ll stick with our fictional Company XYZ (NYSE: XYZ) from my previous article.

Let’s say the stock currently trades around $47 and offers a respectable yield of 3.3%.

Suppose I like its long-term prospects. But I also don’t see the stock shooting a lot higher, at least over the next few months. One way to mitigate risk — and generate extra income at the same time — is by selling a covered call option.

Don’t be scared by the terminology if you’re new to options. It’s really quite simple.

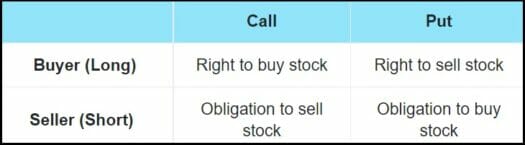

Call options convey the right (but not the obligation) for one investor to purchase stock from another at a pre-designated price. Let’s say there is a call option on XYZ that expires on August 18th, with a strike price of $50. The cost (or premium) is $1.00 per share.

Since each contract involves 100 shares, this one would cost $100. But as the seller, I would collect that cash from the buyer upfront. In turn, they can buy 100 shares of XYZ from me at $50 per share.

Suppose I think there’s a decent chance that XYZ fails to reach $50 between now and August 18th. The stock might slide, stay flat, or post a slight gain. The option would expire under any of those scenarios, and I would keep my shares. Nobody will voluntarily exercise their right to pay $50 for a stock that can be bought on the open market for less.

So, I would happily pocket an extra $100 profit for my trouble and move on.

That might not sound like much. But by itself, $1 on a $47 stock represents an income stream of about 2%. But that’s just a holding period of about 8 weeks. After the contract expires on August 18th, I could immediately sell a second call option for another time, possibly another, and so on…

The longer XYZ stays below $50, the more income I can harvest. Or I can pick an option with a higher strike price the next time. Repeating this strategy just four times would bring in $4.00 per share in premium income, or 7%. Of course, market volatility plays a big role in option premiums, so they could rise or fall. But remember, I would also still collect the regular dividend yield of 3.3% along the way.

Either way, I should have no problem doubling XYZ’s income stream in this scenario.

Why You Should Consider This Strategy

Whenever I talk about this strategy, I always point out that dividend investing is a waiting game anyway. We buy to get a paycheck every quarter and hopefully sell the stock in the future at a higher price. If the stock reaches that target price quickly, great. If not, writing call options offers a way to collect more income while you wait.

In this case, you could more than double the payout on XYZ over the next 12 months.

And contrary to popular belief, these call options aren’t risky. Actually, they reduce your downside exposure. Let’s say I bought XYZ today at $57. If I can collect $4 per share in premium income on XYZ, my breakeven price drops from $47 to $43.

I know what you’re thinking… What happens if XYZ moves sharply higher and exceeds the $50 strike price? Let’s just say I wouldn’t complain about that scenario, either. After all, that would represent a 6% gain. But just one premium earned from a covered call trade would lower the cost basis to $46 (for a total return of 8.6%). Not a bad tradeoff.

What’s the catch? I would have to sell my XYZ shares at the agreed-upon price of $50 and forgo any additional upside beyond that. So, if XYZ streaks to $55, then the rest of the gain would accrue to the option buyer. But that might be a fair tradeoff, depending on your goals and the state of the overall market.

Closing Thoughts

There are really only four scenarios once we buy a stock: it can decline; stay flat; rise a little; or rise a lot. Obviously, we prefer option four. But in any of the other three, covered calls can boost returns.

That’s a pretty good tradeoff.

In the meantime, if you want to get your hands on some of my absolute favorite high-yield picks, then you need to check out my latest report…

You’ll learn about 12 ultra-generous dividend payers that put more money in your pocket. And the best part? They pay dividends monthly. Go here to learn more now.