Cheap, Hated, And “Dirty” — It’s Time To Buy These Energy Stocks…

Today I’m going to tell you about a group of stocks that are quite literally hated in today’s environment (both from a valuation standpoint as well as what they do to make money).

But as I said in my previous article about the so-called “ESG” movement, my job isn’t to give you picks that meet arbitrary “socially acceptable” standards. It is to provide you with the best money-making picks that I can find.

What you do with that information is up to you.

Our Most Dominant Power Source (Still)

But first, remember the company I told you about in my previous article — Enviva?

As I explained, it turned out Enviva was clearcutting forests and gathering biomass in the Southeastern United States (they weren’t even bothering to replant). Then, they would manufacture this stuff into wood pellets and ship it all the way over to Europe to be burned for electricity.

This was all possible because of a controversial loophole that allowed for burning wood instead of coal to meet emissions targets.

Well, Europe’s biomass subsidies have come under attack since they essentially put taxpayer money into wide-scale deforestation to produce an energy source more polluting than coal — all under the guise of promoting “clean” and “renewable” energy.

Now, here’s where I’m going with all this…

Despite trillions spent globally on various “renewable” energy investments and tax incentives, alternative energy sources like wind and solar haven’t made a dent in fossil fuel consumption.

According to this Reuters article, the share of fossil fuels in global energy consumption remained at 82% in 2022. Want to know what it was 10 years ago? 82%.

Want to know the most dominant source for power generation? Coal at 35.4%.

One thing I want to point out is that there are generally two different types of coal: thermal coal and metallurgical coal.

Thermal coal is used to generate power. It’s what competes with natural gas for the cheapest source of baseload power generation around the globe. Obviously, coal is less environmentally friendly. It generates about twice the amount of carbon dioxide emissions as natural gas to release the same amount of energy.

But when we’re talking about coal to generate power, that’s thermal coal. (Metallurgical coal, or coking coal, is primarily used in steel production.)

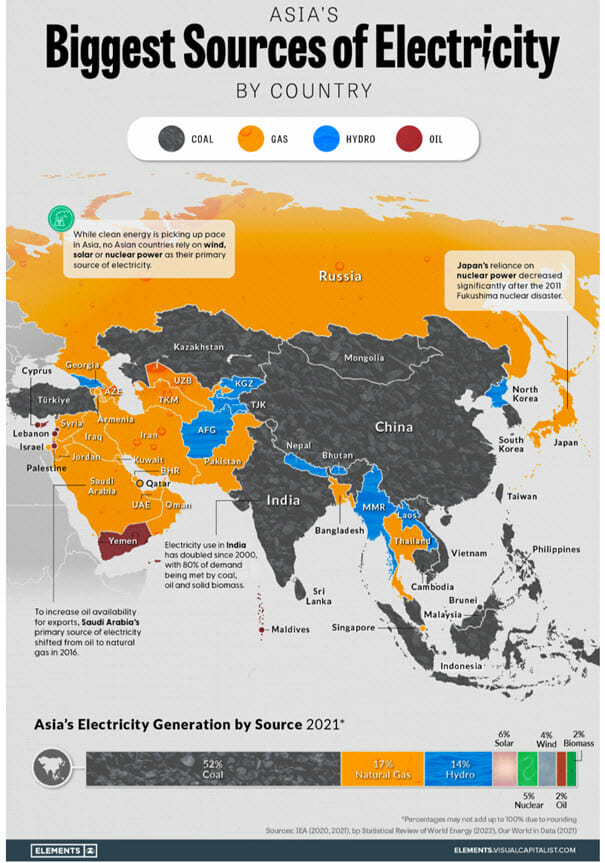

Perhaps nobody wants to admit it, so nobody talks about it. But coal remains the most dominant source of power in the world. Here’s a neat chart showing the biggest source of electricity by country in Asia:

Here’s the same thing for Europe:

And North America:

How Coal Became Europe’s Unheralded Savior

Since Europe stopped investing in fossil fuel infrastructure, with many countries outright banning fracking for oil and gas, they rely heavily on imports to keep the lights and heat on. In 2021, 83% of European gas was sourced from foreign suppliers, with Russia accounting for 45% of European gas imports.

But then, in February 2022, Russia invaded Ukraine. The diplomatic fallout was immediate. Europe and its Western allies, including the US, imposed a series of financial sanctions against Russia, including restricting imports of Russian oil and gas.

Yet, Europe still desperately needed gas. They turned to liquified natural gas (LNG), which they imported in record volumes from the US.

Natural gas prices soared. Over at Capital Wealth Letter, we got sort of lucky as I recommended natural gas producer Chesapeake Energy (NYSE: CHK) to my premium readers in February 2022 — just 20 days before Russia’s invasion. The investment has done well for us (despite the recent pullback in shares). We are up 42% compared with the S&P 500’s meager 3% return.

Natural gas prices have come back to earth (hence the pullback in shares of CHK). But the demand for natural gas is still there, and it’s expected to remain undersupplied through at least 2026. Plus, according to a report by energy research and consultancy firm, Wood Mackenzie, the LNG market is expected to grow 70% by 2050.

But here’s the thing… despite record imports of LNG from the United States, Europe was still facing a shortfall in electricity generation. So, with tails tucked between their legs, European leaders quietly turned to coal.

Here’s a headline in France’s Le Monde from last year:

German Chancellor Olaf Scholz gave the green light to restart 27 coal-fired power plants. Austria, Italy, the Netherlands, and France all announced their intent to do the same.

Other countries like Pakistan returned to coal for a reliable energy source because they couldn’t compete with European countries for natural gas. In February, Pakistan announced new investments to boost its coal-fired power generation.

Bangladesh was in the same boat as Pakistan, as the country was outbid for LNG by its European counterparts. So they announced plans to add coal-fired power plants, which will more than double coal’s share in its power grid from 8% to 17% of electricity generation.

All Signs Point To Profits (For Now, At Least)

The bottom line is that coal saw a resurgence last year, which sent coal prices to new all-time highs above $400 metric ton last fall. Prices have since reversed lower as record-setting warm winter weather in Europe provided temporary relief to both gas and coal prices:

The forecast is for coal demand to remain strong until at least 2025. Here’s the latest coal market outlook from the International Energy Agency (IEA):

“The current forward markets indicate that the marginal costs of coal-fired power plants will be far below those of gas-fired power plants in the next few years… This would only change in 2025 when forward gas prices are low enough to place efficient gas-fired power plants ahead of inefficient coal-fired ones. However, (coal-fired) power plants are expected to remain very competitive until 2025.”

Now don’t get me wrong, coal demand will eventually dwindle as other energy sources — natural gas other renewable resources — ramp up. In fact, the pick we recently made over at Capital Wealth Letter won’t be in our portfolio for years — perhaps a couple at best.

To be blunt, coal stocks deserve to be valued lower than oil and gas companies, utilities, and certainly tech stocks.

But with that being said… I’m blown away that they are trading for this cheap. The industry average price-to-earnings (P/E) ratio is 3.7. Same with price-to-cash flow… EV/EBITDA… Forward P/E… However you want to slice it, these companies are trading for cheap.

Closing Thoughts

But it’s hard to ignore the catalysts for coal, right? Yet this is something no one is talking about. In fact, coal stocks are so hated that they’re trading as if they will be going out of business tomorrow. Even though everything is lining up for these companies to generate “historic” amounts of cash flow.

All signs point toward a strong demand for coal. Remember, countries like Germany are firing their coal plants back up. Pakistan, Bangladesh, South Korea, Japan, China, India… pretty much every country in the world is looking at coal to help keep their lights on and their homes heated. All because of its low cost and efficiency.

Invest accordingly.

Editor’s Note: I just released an urgent briefing about the next crypto boom…

Three “blue chip” cryptocurrencies are getting major upgrades this year. And practically all the big names in finance are getting into the game this time around… which means they could unleash a massive bull run. This could easily be a once-in-a-lifetime chance to take a small amount and turn it into a life-changing gain. Get the details here…