As Inflation Cools, Here’s An Important Reminder About The Power Of Dividends…

Back in January, I ordered an omelet at my favorite breakfast spot and almost needed to take out a loan. Back then, the average nationwide price of a dozen grade-A eggs soared to a record $4.82 per dozen.

Don’t look now, but egg prices have finally come back down to Earth. As I write, prices have eased back to $2.22.

It’s not just eggs (which were severely impacted by a deadly bout of Avian flu). Pork and beef have also pulled back a bit from highs reached earlier in the year. So have fruits, vegetables, and dairy products. According to the June Consumer Price Index (CPI), a broad basket of grocery items is now running just 4.7% ahead of the same cost a year ago.

That’s the smallest uptick in nearly two years.

Aggressive rate hikes have cooled inflation from category to category, albeit unevenly. Airfare, for example, has dropped 19% over the past year. And you might have heard about the retreating prices for used vehicles. At the other end of the spectrum, hotels, and rent continue to stubbornly climb, rising 4.5% and 8.3%, respectively.

That reinforces some of the motivating points behind my recommendations of a hotel REIT (real estate investment trust) and an apartment REIT over at High-Yield Investing, my premium newsletter.

Source: U.S. Bureau of Labor Statistics

Overall, the headline inflation figure rose 3.0% in June, a far cry from the dangerous 9.1% pace registered exactly 12 months ago. Of course, there is a big difference between disinflation (a slowdown in the rate of increase) and deflation (an outright decrease) in goods and services.

Looking Ahead

We’re still well above the Fed’s 2% comfort zone, which is why the futures market is pricing in a 90% probability of another rate hike at the upcoming July meeting. Still, investors cheered this latest report and remain sanguine that with runaway inflation largely corralled, we are nearing the end of this rate-tightening cycle.

Source: CME Fedwatch Tool

That being said, the macro risks that have been weighing on the market haven’t gone anywhere.

While resilient, U.S. consumers have grown fatigued. Many are running up credit card bills to cover basic necessities. Just today, Wharton professor Jeremy Siegel said he believes that many families are depleting the last of their available cash reserves this summer and will soon retrench in the fall. That sentiment has been echoed by others like Jamie Dimon, head of JPMorgan Chase.

That’s why I am keeping plenty of dry powder in the cash column and also maintaining protective stop losses. Nevertheless, at this point, our High-Yield Investing portfolio value is close to its high point for the year.

The Power of Dividends

Which brings me to my next point…

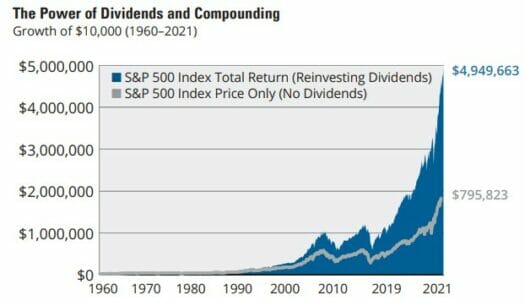

In all my years in this business, I’ve shared dozens of charts and graphs that show the long-term wealth-creating power of dividends. And, of course, if you have the option of reinvesting those proceeds into more shares, which in turn yield their own dividends, which then purchase more shares… even better.

One of my favorites comes from Hartford Funds. Take a look…

As you can see, dividends (and dividend reinvestment) play a major role in boosting your long-term gains. If you’re not taking advantage, I urge you to start now. As I’ve said before, it’s the only “free lunch” when it comes to investing — and one of the surest ways to create wealth.

Now, nothing is foolproof, of course. But there’s nothing quite like the feeling of collecting a dividend. It’s almost like a paycheck – but without any of the work.

But what if you could get paid monthly?

It is possible… You just have to know where to look.

Who wouldn’t rather collect 12 dividend checks per year than four, especially knowing the power of compound interest? Of course, it’s never a good idea to invest based on yield alone. That’s is why I put every High-Yield Investing candidate (regardless of dividend frequency) through a gauntlet of background checks involving balance sheet health, cash flow projections, competitive analysis, valuation, and other critical factors.

Thus far, about a dozen have made the final cut into my portfolio. If you owned all of them, you’d be looking at 144 monthly payments a year.

For the first time ever, we’ve compiled the full list into a report. Go here now for details.