Why I’m Taking A Cue From David Einhorn For My Next Takeover Target…

Back-to-school shopping is in full swing. Next to Christmas, this is the busiest season on the calendar for many retailers. According to accounting firm Deloitte, spending per child is expected to total around $600, driven by supplies, shoes, clothes, backpacks, and maybe even a new laptop computer – you know, for homework, not video games.

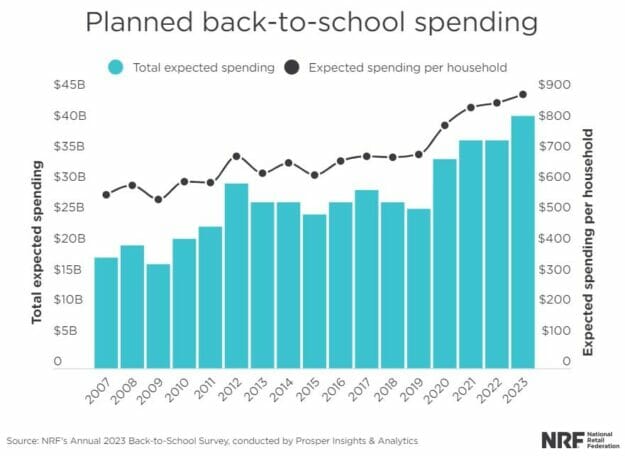

Most parents surveyed plan to spend about the same or less this year compared to 2022, although 60% indicated they would splurge if they ran across the right deal. The National Retail Federation (NRF) projects aggregate spending for kindergarten through high school grade kids to rise by 12% to $41.5 billion.

Source: NRF

Families will part with even more cash to get their college students ready for next semester. The NRF projects spending of $94 billion (shattering the previous record by $20 billion), spurred in part by dorm room and apartment furnishings.

Good news for brick-and-mortar vendors: Nearly two-thirds (62%) of those polled intend to stock up on consumable supplies at physical stores, while clothes and accessories will come from an omnichannel mix of in-store and online transactions.

As a parent of three, I usually grumble at the added strain on the household budget this time of year – but secretly find something nostalgic about shopping for folders, binders, pens, and pencils. It’s also the first harbinger of fall, my favorite season.

If the projected surge in electronics spending pans out, Best Buy’s (NYSE: BBY) checkout aisles could be much busier than usual in the next few weeks.

I’m thinking one of its strip center neighbors might also see more customer traffic… potentially reviving takeover talks.

Taking A Cue From David Einhorn

But before I get to that, take a look at this chart, which shows a handsome 300% return over the past couple of years. Believe it or not, it belongs to Dillard’s (NYSE: DDS). Far from crumbling to online competition, the stock has quadrupled since early 2021. Clearly, the market sees something its likes.

That’s not to say that old-school retailers don’t face challenges – permanent changes in consumer shopping behavior being just one of them. Today’s recommendation isn’t immune. In fact, its earnings actually dipped into negative territory recently. But that’s exactly why the stock can now be picked up for less than half of its fair value.

That’s not just my opinion. A year ago, the company received multiple buyout offers in the $60 per-share range. Today, the shares are changing hands for around $25. And that’s after a 40% bounce since the beginning of June – a rally that could continue to pick up steam.

But first, Dillard’s may hold a few clues.

In July 2019 (months before Covid entered the picture) DDS vaulted 24% in a single day on reports that hedge fund manager David Einhorn had taken a large position. Through his comments, we can glean that Einhorn wasn’t just motivated by profits on the firm’s income statement – but rather overlooked assets on the balance sheet.

You see, Dillard’s owned most of its stores’ properties. Sure, it leased a couple dozen locations but it owned hundreds more outright, around 44 million square feet in total. Einhorn calculated (based on valuations at the time) that this real estate was selling for less than $30 per square foot – a meaningful discount. To underscore the point, Dillard’s had recently sold one of its closed stores in Ohio (not exactly a prime location) for $50 per square foot.

Further monetization could unlock hidden shareholder value – hence all the activist investors poking around. Even before Einhorn, another hedge fund was derided for claiming Dillard’s was more of a real estate company than a retailer — with holdings worth $200 per share.

Today’s share price of $316 would seem to vindicate that assessment.

A Preview Of Our Next Target

So why bring this up?

Well, for one, over at Takeover Trader, I told my premium readers about an iconic retailer with a rich heritage and a nationwide chain of 1,200 upscale department stores across the country.

I can almost hear the groans now. Department stores are seen in some circles as obsolete, a relic from a bygone era (nevermind the fact that only 5% of these stores are mall anchors). Besides, remember the Dillard’s example I mentioned earlier. If anything, this is a real estate play.

Another reason I bring this up is because it’s my job to uncover huge paydays, as fast as possible, from the takeover market. And in my latest research, you’ll learn about the wave of takeover activity we’re about to witness in the energy sector…

To put it bluntly, I think we’re about to see the “mother of all oil booms” in West Texas. And one little-known company is set to unlock it.