[Video] Our Expert Answers Questions About AI, REITs, A 600% Winner (And More)

Last week, I sat down with my colleague Nathan Slaughter for a special Q&A session for readers of his premium newsletter service, High-Yield Investing.

Our discussion was wide-ranging. We fielded questions from subscribers about everything from AI in investing, how to value a real estate investment trust (or REIT), whether we should sell our biggest portfolio winner and more.

And today, I’d like to share it with you.

To watch our Q&A, click play on the video. You can also read a transcript below this video (my questions are in bold).

OK, Nathan, I hope you’re ready because I’m gonna fire away here.

Charles is a relatively new investor, and he says he’s been a subscriber for about two years and he wants to know what you think about AI as it relates to investing. Specifically, is there any merit to this? And do you recommend a way to take advantage?

That’s a great question. I’m going to mainly hit the highlights on these so we can cover more ground. There’s no doubt that AI, just like 5G or cloud computing before it, is radically transforming many different industries. It’s a disruptive game-changer that will create huge economic impacts. I hesitate to even put a number on it. Some are forecasting this could be well over a trillion-dollar market by 2030.

But this evolution is still in the early stages, especially when it comes to stock picking. These platforms are far more geared to language than financials. One day, maybe, but we’re not there yet. And since few of the players in this space pay dividends, AI isn’t exactly compatible with High-Yield Investing at this point.

I’m keeping an eye on future developments.

Alright, so next up we’ve got someone writing under the name Investing for Income, and they want to know what’s going on with VF? It’s down about 15% since we added it to the portfolio. You know, that happened back in April and it’s a dividend Aristocrat, so what’s the deal?

VF (NYSE: VFC) is a collection of active lifestyle brands, including North Face and Timberland. Most of these products are gaining traction with consumers — 10 out of its 12 Brands produced positive sales growth last quarter. But the core Vans lines continue to slump, and I think that’s a bigger reason why the stock has struggled lately.

But we knew going in that these turnarounds take some time. They don’t happen overnight, and there are growth initiatives underway. Looking ahead, management’s forecasting $5-plus billion in cumulative cash flows over the next five years, and it plans to return every penny of that to shareholders through dividends and buybacks.

For now, there’s also some excitement around the recent hiring of a new CEO with a great track record, so I’m being patient.

Next up is Jeffrey, and he’s got a question about a REIT that I think will be beneficial for a lot of folks. He wants to know why is the p/e ratio for DLR so high? Now, that’s Digital Realty for folks that don’t know. We added that one back in March, and it looks like it’s up about 35% since we added it, and it’s yielding about 4% right now.

Hey Jeffrey, good to have you on board. P/E ratios can be a useful yardstick for measuring valuation. But it’s not a one-size-fits-all tool. P/E doesn’t work too well for real estate trusts, master limited partnerships, and a few other groups. That’s because these businesses own assets that rack up hefty depreciation charges, which can cloud earnings and understate how much cash the company is truly bringing in.

Most analysts pay closer attention to metrics like operating cash flow or distributable cash flow. Digital Realty’s (NYSE: DLR) data centers are a perfect example. Net income is only projected to be around $300 million this year. But when you add back non-cash accounting entries, the business will really generate $1.9 billion in profits, a huge difference.

I hope this clears things up.

OK, so next question is from Greg, and he’s asking about the merger between MMP and OKE. And for people who may not remember, that’s our longest holding, Magellan Midstream Partners, an MLP. We’ve held that since 2005 and it’s up close to 600%, so a lot of long-time subscribers probably want to know what they should do with this.

Oneok recently came out with an offer to merge the two companies, so Greg is writing, “What’s your advice concerning these two stocks?”

Great question, Greg! The proposed merger between Magellan (NYSE: MMP) and Oneok (NYSE: OKE) has hit a snag due to tax concerns from a few big shareholders. Normally, acquisitions are tax-free events, but with Master Limited Partnerships like MMP, that’s not the case. When this deal is finalized, it’s going to create a tax liability for MMP investors.

Some subscribers have considered selling now before the transaction concludes to avoid the tax bill. But whether you exit now or wait for the deal to close, it will be treated as a sale either way. Uncle Sam will still take his cut.

For those who’ve held the stock a long time (like we have since 2005), this tax could wipe out most of the 22% premium linked to the buyout, especially since a good chunk of the profits may be taxed at ordinary income rates rather than capital gains rates.

But tax concerns aside, there are some compelling strategic motivations behind this deal. These two energy infrastructure giants could be much stronger together than they have been separately.

Whether the deal proceeds or not, I wouldn’t lose too much sleep. Magellan has already given us a 550% return and increased its dividend 58 times since we bought in. The company is perfectly capable of standing on its own. But unless something changes, I plan to stay the course and ultimately exchange my Magellan stock for Oneok as the deal is completed.

Alright, last question. This one comes from Narasimhan, and he wants to know what you think about OZK. He says he read a report naming that bank as one of the ones with a large percentage of loans secured by office properties, so he wants to know your opinion of the report and the potential risk to OZK.

That’s true. Bank OZK (NYSE: OZK) may be headquartered in Little Rock, Arkansas, but it has helped finance more Manhattan skyscrapers than Citigroup. Construction and development loans account for about 40% of the bank’s portfolio.

That specialty has paid off – OZK has been named the best performing bank in the nation 13 times. But we’re starting to see mounting signs of stress in the commercial property markets and more defaults could be coming industrywide. Banks are already setting aside larger loan loss provisions just in case.

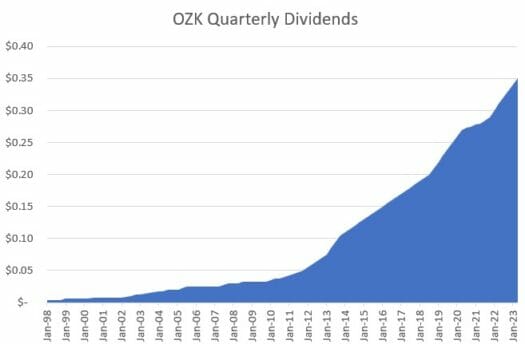

Bank OZK is a very disciplined lender that takes steps to mitigate risk. And right now, credit quality is outstanding. Just a tiny percentage of its loans, about 0.15%, are non-performing. It has also raised dividends 52 quarters in a row.

But I’d rather be proactive than reactive here. So out of caution, I have put in a protective stop loss to lock in profits.

Well, that’s it for today, folks. I hope you found it helpful. If you did, don’t forget to give us a like and subscribe to our channel. And remember, you can always email Nathan or me with your questions. Until next time.

Editor’s Note: I hope you enjoyed this Q&A. If you have any questions or comments, you can email me or Nathan.

In the meantime, over at High-Yield Investing, we’re finding yields of 6%, 8%, and even 11% from securities you won’t hear about anywhere else. Go here to learn more now.