Crypto Roundup: Your Weekly Dose of Cryptocurrency News and Tips

As we go to press, the temperature outside is 105 degrees. Just another typical August day in Texas.

But here at Crypto Roundup, as the great ESPN personality Stuart Scott used to say, it’s as cool as the other side of the pillow.

If you’re new here, welcome! Here’s how we do this thing…

Each week, we bring you the latest news you need to know in the world of cryptocurrencies. If it’s a breakthrough in blockchain technology, we’ll break it down for you. If there’s a regulatory development on Capitol Hill, we’ll bypass the gridlock and deliver the news better than your favorite talking head.

Whether you’re a seasoned trader eyeing the next big move or a curious newcomer eager to explore the decentralized frontier, there’s something for everyone.

Whatever it may be, the goal is to leave you feeling smarter each week about all things crypto.

Got it? Ok, so what are we waiting for? Let’s jump into this week’s roundup…

🗞️ PayPal’s Big Move Into Stablecoins 🪙

PayPal is diving headfirst into the stablecoin arena with PYUSD, aiming to make peer-to-peer payments smoother than ever. The plan? To let users pay their friends in PayPal USD, a stablecoin pegged to the U.S. dollar.

What is a stablecoin you might ask?

A stablecoin is a type of cryptocurrency that is pegged to a reserve of assets like the U.S. dollar. The idea is to provide the benefits of digital currency without the wild price fluctuations. They are typically used as a means of exchange or a store of value within the crypto ecosystem. Tether (USDT) and USD Coin (USDC) are the most well-known examples of stablecoins. They are designed to be worth $1 each, backed by an equivalent reserve of U.S. dollars.

So what’s the goal here? The goal is to create a seamless payment experience, bridging the gap between traditional finance and the crypto.

“Stablecoins are the killer application for blockchains right now,” said Jose Fernandez da Ponte, PayPal’s chief crypto exec told CNBC. “You can settle in times that range from seconds to minutes, when in traditional payment methods, sometimes you’re sending a wire internationally and that can take three to five days to settle.”

But what might seem like a straightforward tale of innovation might not be quite all it’s cracked up to be. Some crypto devs decided to take a closer look at PYUSD’s code, and they found a few areas of concern. Without getting into all the nerdy details, it could be possible for PayPal to freeze addresses, wipe funds, pause all transfers, and even increase the total supply of tokens whenever they fancy.

🤔 The Verdict: PayPal’s PYUSD is an interesting new chapter in the stablecoin story, but it’s not without its controversies. We’ll have to see whether PayPal addresses these concerns. But for now, we’ll monitor things from the sidelines.

⏰ This Week’s Bitcoin ETF Update…

Mark your calendars, folks. Some big days are ahead of us as the SEC prepares to make landmark decisions on Bitcoin “spot” ETFs.

As a reminder, a spot Bitcoin ETF (exchange-traded fund) would provide exposure to Bitcoin at its current market price (known as the “spot” price). Current bitcoin ETFs utilize futures contracts, but a spot bitcoin ETF would allow investors to gain direct exposure. And they wouldn’t have to buy, store, and secure the cryptocurrency themselves. In other words, it could be bought and sold like any other stock through conventional brokerages.

As discussed before, major players like BlackRock and Ark Invest in the running. If any approval happens, most experts think BlackRock has the whip hand.

But the big date to watch is August 13th. That’s the SEC’s decision deadline on Ark Invest’s Bitcoin ETF. And if it’s approved, it could set the tone for the nine other applications — and spark a major rally.

Optimism seems to be growing. Bloomberg analysts recently put the odds of approval at 65%. Stay tuned.

📉 Bitcoin’s Sideways Dance Amid Inflation Data

The dog days of summer may not be over yet. But according to the latest inflation data, things are cooling off.

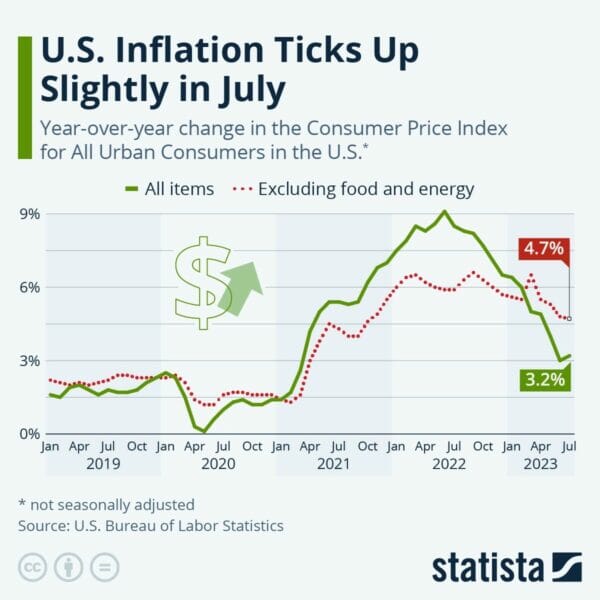

The Bureau of Labor Statistics released July’s Consumer Price Index (CPI) report yesterday, showing a 3.2% rise over last year. That’s lower than the expected 3.3%… Which is nice. Core inflation, which excludes volatile food and energy prices, showed a 0.2% month-over-month increase.

Source: Statista

The crypto market’s response? A collective “meh.” Bitcoin and Ethereum held steady at around $29,600 and $1,850, respectively.

Here’s why that’s good news. As Decrypt points out, crypto prices did not fare well when inflation numbers were coming in hot last year. For example, after annual inflation came in at a multi-decade high of 9.1% last June, Bitcoin and Ethereum immediately coughed up losses of 4% and 6%, respectively.

So while inflation fears once sent shockwaves through the crypto market, it’s good to see things stabilizing. The Fed’s fight against inflation seems to be nearing a soft landing. The market is betting that the Federal Reserve is done with interest hikes, with only a 9.5% chance of another hike in September. This, coupled with the possibility of rate cuts by the end of Q1 2024, could be a tailwind for cryptocurrencies.

Crypto Tip of the Week: Tokenized Real World Assets (RWA)

Want to own a piece of high-end art? How about a rare bottle of wine? The blockchain may help make it possible…

Tokenized real-world assets (RWA) are tangible assets like real estate, art, or commodities with fractional ownership available through the blockchain. This innovation helps make high-value assets more accessible and tradable on digital platforms.

So now, the rest of us can raise our pinky fingers and don our monocles, too. (“Why yes, I own a Renoir… don’t you?”)

The process includes asset selection, valuation, legal compliance, token creation, and trading — all backed by the blockchain’s transparency and security. It’s still early days for tokenized RWAs, though… regulatory challenges and technology risks are still being ironed out. But you’re going to be hearing about this idea more, very soon.

Closing Thoughts

Well, there you have it, folks. Like a Taylor Swift song, this week’s crypto news was full of highs, lows, and unexpected twists. But don’t worry, unlike her relationships, we are getting back together (next week).

In the meantime, the blockchain continues to push boundaries and redefine how we invest, trade, and interact with the world. As we bid farewell for now, remember that in the ever-changing world of digital currency, staying informed is your golden ticket. Until next time.

P.S. Want to know more about our favorite ways to invest in crypto — and how to do it? You need to see this…

Our team thinks a select few cryptos are about to go on another monster run. And we just released a bombshell briefing about how you can profit. Go here now to learn more…