Inflation May Be Cooling, But You Still Need To Supercharge Your Income…

I recently had to swap out the batteries in our family vehicles. I blame it on the Texas heat — it was 103 degrees (or hotter) for five straight days.

The dog days of summer may not be over yet. But according to the latest inflation data, things are cooling off.

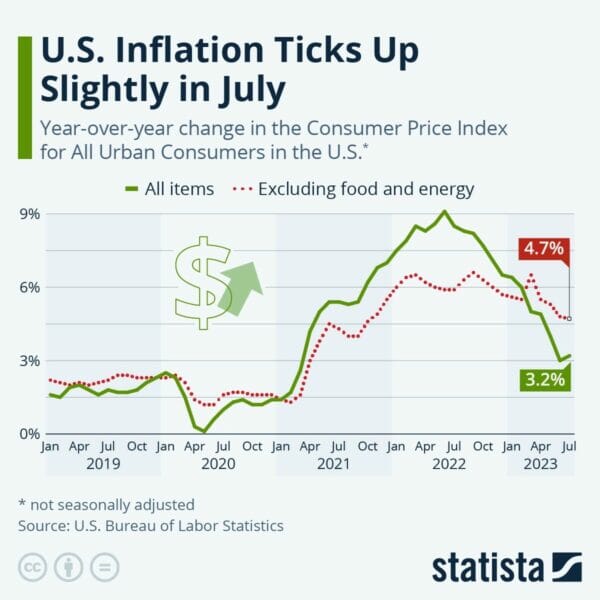

The Bureau of Labor Statistics released July’s Consumer Price Index (CPI) report, showing a 3.2% increase in July. That’s a slight uptick from the 3.0% in June. But before you start sweating, let’s do some digging.

July’s 3.2% was lower than the expected 3.3%. It’s also lower than any other month since March 2021.

On a month-over-month basis, prices increased by 0.2%, which was in line with expectations. The Federal Reserve’s preferred measure, “core” CPI, which excludes volatile food and energy prices, increased by 4.7% year-over-year. That’s the lowest rate since October 2021.

Source: Statista

Now, here’s where things get interesting. The largest driver of inflation in July was shelter. Rents and owners’ equivalent rents of residences increased 8.0% and 7.7% in July, respectively. All told, shelter accounted for more than 90% of the increase.

If we were to nix that out, inflation would have been just 1.0% last month.

“It is not quite ‘mission accomplished’ yet, but significant progress on the inflation front has been made,” said Sung Won Sohn, chief economist at SS Economics, per CNBC.

What’s The Upshot?

It’s good to see things stabilizing. Economists seem to think the chances are increasing that we may indeed see a “soft landing” after all. But while inflation has come well off the 40-year highs of mid-2022, it’s still above the 2% level where the Federal Reserve would like to see it.

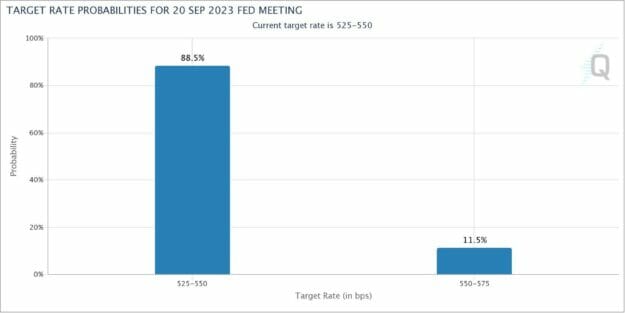

After hiking benchmark interest rates 11 times since March 2022, markets are pricing only a 11.5% chance of another hike in September. But what happens next is anyone’s guess.

Source: CME Fedwatch

In the meantime, there’s an upside to all these rate hikes.

As Bespoke Investment Group pointed out recently, the S&P’s dividend yield of 1.79% was more than 45 bps higher than the highest yield on the Treasury curve (the 30-year at 1.33%) three years ago in August 2020. Every Treasury note shorter than 5 years had yielded less than 0.20%.

It’s no wonder then that all the talk was about “TINA” (there is no alternative). But how things have changed…

Today, the average S&P 500 stock yields about 1.55% right now. That’s still pretty puny, but it looks downright pathetic when you consider that “risk-free” Treasuries are blowing that out of the water these days. Take a look…

The average S&P yield is 265 basis points (2.65%) less than the lowest point on the yield curve right now (the 10-year at 4.2%). Pretty remarkable.

Action To Take

To my mind, there are two big takeaways here.

1) If you have any spare cash, the 6-month T-Bill is one of the biggest no-brainers around. At 5.5%, it is nearly four percentage points higher than the average S&P stock’s yield. If you are struggling to find good ideas to deploy capital in this market, why not put it here? Don’t overthink this one…

2) If the average S&P 500 stock pays so little, that doesn’t mean you should abandon stocks. It just means you need to look beyond the usual suspects…

Of course, investing based on yield is never a good idea. But when you find an income-payer with a proven history of raising payouts year after year, you give yourself an excellent chance for success (Plus, you might be surprised by the growth, too.)

That’s where our “Monthly Money-Makers “ report comes in…

In this special briefing, you’ll find the names of 12 ultra-generous income payers to add to your portfolio.

The average yield? 7.8% as of this writing. When it comes to income, that’s head and shoulders above the so-called competition. But even better, unlike most income stocks (which pay quarterly), these pay you every single month.