2 Stocks That Could Raise Dividends In September

When the kids are going back to school, you know fall is right around the corner. It’s also when things in the stock market begin to pick back up, and that means it’s time to hunt for stocks raising dividends in September.

As some of you know, I make a regular habit of looking for dividend hikes. As Chief Strategist of High-Yield Investing, it’s part of my job.

Each month, I flag these stocks first for my premium readers. That way, they can research these names and get a head start. Then, I share them with the public. Ideally, we like to find potential hikes that could happen over the next four to six weeks. I also highlight noteworthy special distributions on the horizon.

We don’t do this just for fun. In a perfect scenario, we find great ideas for consideration in our premium portfolio… Companies posting outsized double-digit increases, and reliable dividend-payers that have been steadily growing payouts for a decade or more.

This month, I’d like to highlight two stocks raising dividends in September that you might want to consider. If you’re looking for a potential addition to your income portfolio, you might want to take a look…

2 Upcoming Dividend Hikes For September

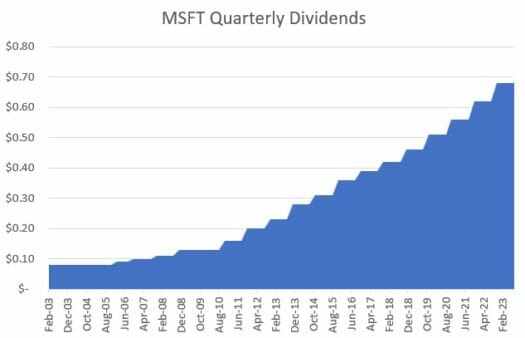

1. Microsoft (Nasdaq: MSFT)

What can you say about Microsoft that hasn’t already been said? Sure, the company still rakes in more cash from its ubiquitous Windows architecture and Office subscription products in a month than most software companies could dream of in a year. But the Azure cloud computing services division is propelling the company to new heights.

Total revenues smashed through the $55 billion mark last quarter, driven in part by the rapid adoption of Artificial Intelligence (AI) tools. And thanks to sky-high gross profit margins near 70%, the software giant gushes free cash flow, returning billions to stockholders each quarter.

Microsoft likes to boost dividends in September, approving 10% hikes in 2018, 2019, 2020, 2021, and 2022. With a low payout ratio and multiple growth drivers ahead, including the pending takeover of video game maker Activision Blizzard, the board could approve another such increase soon, taking the quarterly payout to $0.75 per share, or $3.00 annually.

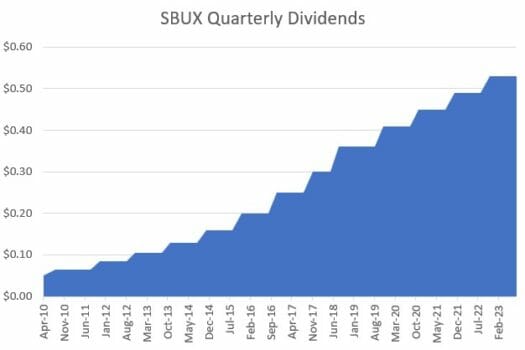

2. Starbucks (NYSE: SBUX)

You gotta love the fall. The leaves begin to turn. The baseball pennant races heat up. And cash generators like Starbucks reward faithful shareholders with a wake-up jolt to their dividends.

The ubiquitous coffee chain has raised its distributions from $0.36 per share in 2018 to the current $0.53. That’s a five-year boost of nearly 50%, keeping the yield a bit north of the S&P 500 average.

So what can we expect this time around?

Well, business has never been better, with last quarter’s sales hitting a record $9.2 billion. Not only is store traffic on the rise, pushing the number of transactions up by 5%, but customers are also spending a bit more. There has been a similar uptick in average ticket size – producing a combined 10% growth in comparable same-store sales.

More important, the company is pocketing a larger percentage of those sales, leveraging a 12% increase on the top line into a 19% improvement on the bottom.

Starbucks just added another 4 million U.S. customers to the ranks of its Rewards loyalty club program, pushing the total to 31.4 million. But the brighter growth opportunities remain in under-penetrated markets overseas, where comps spiked 24% last quarter – three times the growth rate of U.S. operations.

You can understand why management has prioritized international expansion, particularly in China (where Covid restrictions have finally eased, juicing profits). The company has opened more than 1,700 new foreign locations over the past 12 months, lifting the worldwide total to 37,000.

A year ago, the intermediate-range plans called for expansion to 45,000 stores by 2025. Don’t expect that aggressive pace to slow too much. On the latest conference call, management laid out unprecedented new development plans. It now expects to have 55,000 locations running by 2030.

Between now and then, the java vendor will deliver quite a few dividend hikes, perhaps starting with an increase from $0.53 to $0.58 sometime next month.

(Check out our analysis for August and July.)

Action To Take

We’ve had a pretty good run of finding solid ideas from this exercise, so it pays to follow along each month. Some of them end up paying off big time. So, if you’re on the hunt for stocks raising dividends in September, these suggestions are a great place to start your research.

But remember, just because I highlight stocks that are likely to increase dividends doesn’t necessarily make them “buys.” These are merely ideas to get you started in the hunt for high yields.

And if you want to know about my absolute favorite high-yield picks, you need to check out my latest report…

You’ll learn about 12 ultra-generous dividend payers that put more money in your pocket. And the best part? They pay dividends monthly. Go here to learn more now.