A Hidden “Picks And Shovels” Way To Invest In The E-Commerce Boom

Once upon a time, getting products to market was a challenge… regardless of whether they were measured by the bundle, bale, gallon, or ton. I’m not just talking about the means of transportation — but the containers used to safely load, store, and preserve them during transit.

Early seafaring peoples such as the Greeks and Romans depended on amphora, ceramic jars with handles for carrying grapes, olive oil, fish, wine, and other tradeable goods from port to port. The art of glass blowing was popularized later, leading to the mass production of vials and bottles filled with everything from medicine to jams and jellies. Tin cans came along in the early 19th century, partially motivated by Napoleon’s search for a way to preserve food for his army. Larger bulk items were moved in crates or wooden barrels.

But these days, the cardboard box is king.

The Most Important Material In All Of Logistics

First developed in 1895, this strong but lightweight shipping material displaced its predecessors almost overnight. Such a lowly product, given its utility. We don’t pay much attention to these boxes. Most are tossed in the trash or recycling bin the minute their contents are removed. Unless you’re preparing to move – then you can’t have too many.

I view this sturdy packaging in a whole different light. Others might look at a dumpster behind the local Circle K overflowing with boxes and see trash. I see sales receipts.

Whether it’s bags of sugar or a case of motor oil, none of the inventory on store shelves arrives loose. By some estimates, 95% of all goods purchased in the United States travel by box. That’s literally almost everything, from a can of soup to a big-screen television. Next time you walk inside a cavernous Wal-Mart or Home Depot and see merchandise piled to the ceiling, try to visualize the boxes those goods came in.

And then there are online retailers like Amazon.com, which rely on boxes for much of their delivery fulfillment. Odds are good that UPS or FedEx is dropping off a box or two at some of your homes as we speak.

Cardboard 101

First things first, let’s get the terminology right. Cardboard might be great for cereal containers or pizza delivery, but it doesn’t stand up to the rigors of heavy-duty shipping. What we call cardboard boxes are really made of corrugated materials, sometimes called containerboard.

Look closely, and you’ll see three layers. There’s an inside liner, an outside liner, and wavy fluting in between. That middle layer provides compression and cushioning to help prevent breakage. More important, it means added structural support to carry heavy loads.

According to the Forest & Paper Association, approximately 100 billion corrugated boxes are manufactured in the United States annually. By the time you read this, another 250,000 boxes will have been sold.

If laid end to end, the boxes produced in just one year could stretch around the Earth 570 times. Nearly 90% of them will be broken down and recycled. That’s fortunate because usage continues to climb at a steady 3% to 4% pace each year.

Numbers To Know…

Let’s briefly forget supermarkets and big box retailers and just look at the digital angle. U.S. e-commerce sales rose another 8% last year, topping the $1 trillion mark for the first time. Research firm Forrester is projecting that total to rise 10% this year and reach $1.6 trillion by 2027. By itself, Amazon is now delivering an estimated 7.7 billion packages annually.

That’s a lot of books. And shoes. And sporting goods. And dog food. All of which require packaging. Online order fulfillment now generates about $20 billion in annual sales for box makers. And even that pales in comparison to larger categories such as food and beverage. Estimates vary, but annual industry revenues are in the range of $66 billion in the United States and climbing.

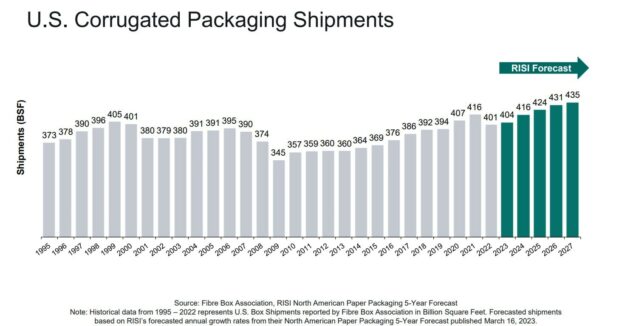

U.S. facilities shipped 400 billion square feet (bsf) of corrugated materials last year. For context, that is equivalent to 9 million acres — an area larger than Maryland. And the Fiber Box Association is forecasting production to hit 435 bsf within the next five years.

That incremental demand (35 bsf) could blanket the floor of the Pentagon 5,000 times.

How We Can Profit

A small handful of players are sharing all the spoils.

Below, I’ve included a broad screen of stocks in the Packaging & Containers industry…

There are 200 fewer corrugator plants operating in the U.S. now than there were in 1993. Heavy industry consolidation has concentrated market share among a smaller group, easing competitive pressures. That is reflected in strong returns on invested capital (ROIC), which stand in the mid-teens for some of the better-run outfits.

Of course, that can vary with economic conditions. Corrugated box shipments are closely correlated with GDP, so this cyclical industry can be something of a bellwether. Where box volume goes, retail sales may soon follow.

Production dipped 5% last quarter, lining up with previous recessions. A few large suppliers have temporarily idled some of their equipment, reinforcing fears of a broad slowdown. It’s worth noting that earnings in the manufacturing sector are noticeably lagging those in the services sector. too. That would explain the softer appetite for boxes. In any case, this slump is expected to be short-lived, with utilization rates (and pricing) rebounding by next quarter.

Action To Take

Poultry. Soft drinks. Baby formula. Golf balls. You name it… 95% of all retail goods bought in the U.S. spend time in a box. The packaging companies listed above offer broad exposure, with some particularly correlated to online shopping. In fact, you could think of them as a “picks and shovels” play on e-commerce.

Over time, shareholders in this corner of the market are betting squarely on the strength and resilience of the U.S. economy. After all, boxes accompany goods at every step of the supply chain.

I encourage you to research these names further. My favorite player in this group has been turning that demand into buckets of free cash flow and sharing it generously with investors (which is why we added it to our portfolio over at High-Yield Investing.)

In the meantime, if you want to know about my absolute favorite high-yield picks, you need to check out my latest report…

You’ll learn about 12 ultra-generous dividend payers that put more money in your pocket. And the best part? They pay dividends monthly. Go here to learn more now.