VIDEO: Why Crypto Is Poised for a New Bull Run

Welcome to my latest video presentation. The article below is a transcript that has been edited for concision, to provide you with a fast read. See the video for a deeper dive.

Think cryptocurrency is on the wane, or too risky for your retirement portfolio? Think again. If you ignore crypto, you’ll miss out on big profits.

For today’s Mind Over Markets column, I decided to step back from my usual day-to-day coverage of Wall Street to interview our inhouse expert on all matters pertaining to the world of crypto: My colleague Brad Briggs, editorial director of our subsidiary, Street Authority. My questions to Brad are in bold.

Every Monday, Investing Daily publishes an article by you that’s called “Crypto Roundup.” Explain the purpose of this regularly appearing feature and your target audience.

Great question, and thanks for having me.

Look, there’s so much that happens in the world of cryptocurrency in any given week. It’s hard to stay on top of everything, much less decipher what really matters versus what’s just hype.

That’s where “Crypto Roundup” comes in. Whether you’re a seasoned pro or just dipping your toes into digital assets, my goal is to deliver the “need to know” info each week to our readers. Not only that, but I break down these developments into bite-sized, easy-to-understand bits.

Plus, I don’t think investing should be a stuffy affair, so we like to have a little fun along the way.

You’re an advocate of cryptocurrency investing, which has witnessed its share of ups and downs, as well as scandals. Some investment experts heartily embrace crypto trading; others dismiss crypto as a fad or, even worse, as a scam. What do you say to crypto’s detractors?

Visa (NYSE: V) doesn’t think it’s a fad. Neither does BlackRock (NYSE: BLK), the world’s largest asset manager.

Larry Fink, who runs BlackRock, used to deride and laugh at cryptocurrency. He’s not laughing now. In fact, BlackRock has filed an application for an exchange-traded fund (ETF) based on Bitcoin (BTC), and Fink is making the rounds in the media, calling it “digital gold.”

BlackRock is home to some of the brightest minds in finance. So, either Larry Fink and his pals are changing their tune because they’re just after management fees, or he’s had a legitimate change of heart. There’s really no in-between.

There’s another thing I want to make clear. Crypto is not for the faint of heart. It’s volatile. If you can’t stand the heat, get out of the kitchen, as they say.

If you do decide to play in this space, I recommend using your “play money,” that is, only what you can afford to lose. Assuming all your portfolio ducks are in a row, then go to town.

Look, anything new and revolutionary on this scale is going to have its ups and downs. It’s going to have its bad actors, too.

Plus, these things take time to grow and mature before most people fully understand how revolutionary they’re going to be. For example, let me draw your attention to an article that ran in Newsweek magazine in 1995.

The article basically argues that the Internet is a wasteland of unfiltered data, that you can’t find anything informative on the Internet. It pokes fun of people who predict things like e-commerce, virtual communities, and telecommuting.

The point is, we can all be wrong from time to time. So let me address the skeptics directly.

Whether you think the jury is still out or not, think of the promise that crypto holds. Never before has such a disruptive technology come along that conveys the promise to empower people with greater control over their finances. That alone merits further investigation.

Yeah, the mainstream media often serve as contrarian indicators. Okay, I can understand why older, more conservative investors might express skepticism over crypto, but I certainly don’t side with those who glibly dismiss crypto as a fad or a Ponzi scheme. Crypto represents a lasting revolution in finance, investing and consumer behavior. What are some of the ways in which crypto is permanently transforming the financial world?

Oh, there are so many. But if I bring something up, I want to do it justice and explain. I mentioned Visa earlier, so let’s stick with that.

Visa has successfully tested a new system that simplifies the payment of fees required for every transaction on the Ethereum (ETH) blockchain.

Visa is also ramping up its use of stablecoins. A stablecoin’s value is pegged to a stable asset, in this case, the U.S. dollar. They allow for quick and efficient cross-border transactions without the need for traditional banking or currency conversions.

Now, you might think crypto poses a threat to Visa. So why are they doing this?

In reality, it’s the legacy payment rails that are threatened. Think about whenever you buy something or transfer funds. Credit and debit cards take 1-3 days to settle. ACH transfers (between banks) can take 1-3 days. And checks (remember those?) can take up to a week.

Under normal conditions, a payment on the Ethereum network can settle in about 13 seconds. Not posted to your account, but settled. There’s your “killer app” for crytpo. Secure, instantaneous transfer of money.

If this takes hold, then the legacy payment methods I mentioned will be considered Stone Age stuff. And Visa can have a first-mover advantage in attracting users and merchants to its platform. Pretty cool.

Crypto is made possible through computer algorithms operated on super-fast platforms called “blockchains.” Explain blockchain technology and the investment opportunities it conveys.

Imagine a digital ledger, similar to an accounting book, where transactions are recorded. This ledger isn’t stored in one place or controlled by one person. Instead, it’s distributed across many computers all over the world.

When someone sends or receives cryptocurrency, like Bitcoin, that transaction is broadcasted to this network.

Now, every time a transaction occurs, it’s recorded in a “block.” To add this block of transactions to the blockchain, a specific mathematical puzzle needs to be solved.

This is where crypto miners come in. They use powerful computers to solve this puzzle. The first one to solve it gets the right to add it to the blockchain and be rewarded with newly minted crypto. But it has to be verified by other nodes, which ensures only valid transactions are added.

One of the key features of blockchain is its security. Once a block is sealed and added to the chain, it’s nearly impossible to alter. Now, as far as investment opportunities are concerned, the list is nearly endless.

Of course, you have the cryptocurrencies themselves. Then there are DeFi projects and “staking” your crypto to earn a yield, which we won’t get into today.

Bitcoin was the first and remains the best-known crypto. But there are thousands of others including Ethereum, Ripple (XRP), and Litecoin (LTC). Each one has its own features and operates a little differently. This is where doing your homework is important.

We have our favorites over at my publication Capital Wealth Letter, but you can’t go wrong with Bitcoin. Right now, the best way is to own Bitcoin directly through an exchange like such as Coinbase (NSDQ: COIN), but ETFs that track the price of Bitcoin are coming soon.

From my perspective, one of the best ways to profit from crypto is through picks-and-shovels plays as represented by blockchains. Would you concur?

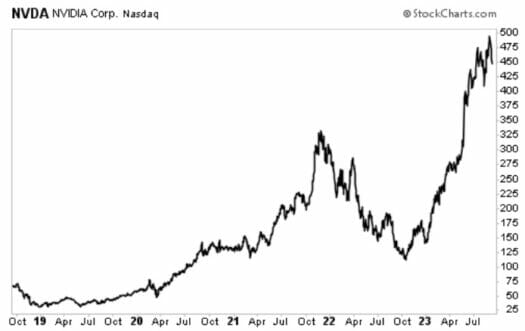

Sure, there are some opportunities like chipmaker Nvidia (NSDQ: NVDA), which makes the GPUs used to mine crypto. When there’s a surge in crypto prices, demand for GPUs often spikes as mining operations ramp up.

The share price of Nvidia has soared recently, largely thanks to the artificial intelligence boom. And while this stock can be pretty volatile, the company has so many things going for it that I wouldn’t rule out more gains over the coming years.

Then you have companies like Block (NYSE: SQ) and PayPal (NSDQ: PYPL), which integrate crypto payments and allow merchants to accept cryptocurrencies. There’s Coinbase, which operates as an exchange where you can buy and sell your crypto. It’s up triple-digits this year.

But if you’re really curious about cryptocurrency, I encourage you to open an account at an exchange, like Coinbase, and buy a small amount of Bitcoin first as a test. There’s no better way to get a feel for how this works.

Trust me, anyone can learn this. We even have a full report explaining the proper way to buy, secure, and store crypto over at Capital Wealth Letter.

What’s your prognosis for crypto, for the latter part of 2023 and into 2024?

Crypto is in a bear market right now, no doubt about it. The industry is still recovering from recent scandals and is currently slugging it out with the SEC over how it should be regulated.

But we are already seeing some signs of hope. There have been a few recent legal victories that should serve as a wake-up call to regulators that crypto is here to stay and that the two sides need to work together. Even some members of Congress are getting up to speed on crypto, too.

At the end of the day, the best thing for investors is that we get some clarity. As more news comes out related to things like regulation and a Bitcoin ETF, I expect bullish sentiment to return later this year and into next year.

My eye is on 2024. That’s when the “halving” happens for Bitcoin. See, every four years the reward for mining Bitcoin is cut in half. Historically, these halving events have led to significant price surges.

The next one is expected in April 2024. Pantera Capital, a leading blockchain investment firm, did an analysis on this based on previous “halvings.”

This led to a bold prediction. They think Bitcoin could rise to $35,000 leading up to the halving, which would be a 40% rally. Then to $148,000 by July 2025.

Time will tell whether they’re right, of course. But there are plenty of other reasons to be bullish over the long run. And I wouldn’t want to miss out on the ride either way.

Thanks for your time.

P.S. Want to know more about our favorite ways to invest in crypto?

We believe NOW is the most important time to buy… if you haven’t yet. That’s because our team thinks a select few cryptos are about to go on another monster run — and we just released a bombshell briefing about how you can profit. Go here now for details.

John Persinos is the editorial director of Investing Daily.

To subscribe to John’s video channel, click this icon:

This article originally appeared on Investing Daily.