3 Macro Headwinds I’m Watching Right Now — And What To Do About Them…

The macro headwinds are beginning to mount. Understandably, this has investors feeling a little nervous. So today, I want to spend some time talking about what I’ve been watching that concerns me.

But before we go too far, understand that I don’t want to be overly dramatic – it’s not time to sell everything. We just need to be aware and be prepared.

So, with that said, let’s take a look.

The American Consumer

Over the past few months, I’ve written extensively about the fatigued American consumer.

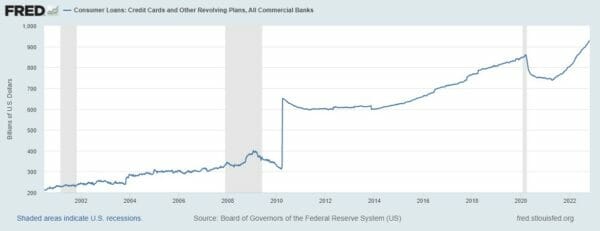

Excess savings accumulated during the pandemic have largely been depleted, and many households are turning to credit cards – even for necessities like groceries and utilities. Card balances just topped the $1 trillion mark for the first time a few months ago.

Source: Federal Reserve Bank of St. Louis

Having exhausted other options, many workers are making emergency withdrawals from their retirement accounts to make ends meet. While there are still pockets of strength (like travel and live events), retailers are seeing a steep falloff in demand for discretionary items, particularly big-ticket goods like furniture and appliances.

Of course, a $100 pair of shoes won’t break the bank. But for many, this is seen as an extravagance that can be put off for a while. Even with heavy sales promotions, VF Corp (NYSE: VFC) is struggling to spark interest in its Vans footwear line these days.

Nike (NYSE: NKE) is still moving inventory but is mostly just spinning its wheels in this environment. Wholesale revenues were flat last quarter, while the digital sales channel logged a tepid 2% increase. With the top line stuck in neutral, operating overhead takes a larger bite, pinching margins. Marketing costs rose 13% last quarter to $1.1 billion.

The company’s rising expenditures aren’t covered by operating cash flows, which explains the declining cash balance ($8.8 billion today versus $11.9 billion a year ago).

A Terrible Time To Buy A House…

Imagine how McDonald’s (NYSE: MCD) might react to a new survey showing that 84% of consumers believe this is a terrible time to eat hamburgers. Or the reaction from American Airlines (NYSE: AAL) upon hearing that four out of five people think now is a bad time to travel.

That’s purely hypothetical, of course. But it’s exactly what one industry is facing.

A recent poll conducted by Fannie Mae found that 84% of respondents believe now is the wrong time to buy a home. Not surprisingly, that’s the highest percentage on record for this particular survey.

It could be the fact that median home prices have skyrocketed from $329,000 to $416,000 over the past 36 months.

Source: Federal Reserve Bank of St. Louis

Others might be deterred by unaffordable mortgage rates, which just touched 7.57% last week – the highest level since December 2000.

Source: Federal Reserve Bank of St. Louis

Or maybe it’s just the lack of selection. According to the National Association of Realtors, only 1.1 million units are listed for sale nationwide, exactly half of the normal inventory of 2.2 million. Good luck if you’re looking for a new home in, say, Omaha, Nebraska. There is a shallow pool of just 2,300 listings versus 4,000 to choose from normally.

Many homeowners feel trapped and don’t want to sell right now. That’s understandable – doing so might mean trading in a 3% mortgage for a 7% mortgage. Builders have picked up some of the slack. Still, they’re grappling with this rate environment, too. In fact, homebuilder sentiment just sank to the lowest levels of the year last month. Many are resorting to rate “buy downs” to lure potential buyers.

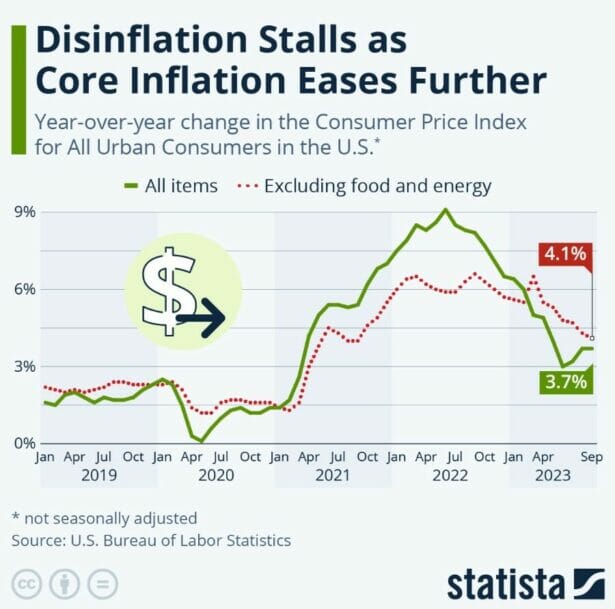

You may have seen the September Consumer Price Index (CPI) report, which showed inflation remaining at 3.7% – double the Fed’s comfort zone. What the headline didn’t reveal was that shelter costs were the single biggest contributor.

But this problem is much more pervasive than that – and it may be getting worse. The economy added another 336,000 jobs in September, shockingly higher than the 170,000 economists expected. The red-hot payroll report will only reinforce the Fed’s hawkish bias towards further rate tightening.

Rising Treasury Yields…

None of this is welcome news for weary investors. And I haven’t even gotten to the most worrisome development.

Treasury auctions have been met with lukewarm demand here lately. The 10-year Treasury rate soared to 5% recently, the highest level in 16 years.

To make matters worse, the most voracious buyer in recent years (the central bank itself) has stepped away from its bond purchases amid quantitative tightening.

Closing Thoughts

So, let’s bring this all together.

I used Nike as a proxy for retail for a reason. There is no disputing Nike’s entrenched brand equity or its two decades of uninterrupted dividend growth. But with building headwinds, the shares (at more than 30 times earnings) are vulnerable to further profit-taking. They’re not alone.

Housing is about 15% of the economy. And that’s before we even address the second and third-order effects.

And lastly, access to capital is a make-or-break proposition for some businesses right now. Simply put, weakened demand for Treasuries equals higher yields. That equals more expensive borrowing costs for consumers and corporations.

Again, I’m not here to cause panic. Just caution. In this environment, you should scrutinize balance sheets and capital structures even more closely. Also, cash is king – so I am strategically closing out positions to raise some cash for opportunities when they arise.

In the meantime, if you want to know about my absolute favorite high-yield picks, you need to check out my latest report…

You’ll learn about 12 ultra-generous dividend payers that put more money in your pocket. And the best part? They pay dividends monthly. Go here to learn more now.