Here Are 3 Top Hedge Fund Favorites For Your Portfolio…

Hedge funds are something of a mystery to many. On the surface, they are pooled investment vehicles, just like mutual funds. But any similarity ends there. These funds typically use speculative (and often arcane) tactics and strategies to reach their goals. And they employ some rather exotic instruments, like credit default swaps.

They can buy rare artwork, engage in short sales, or make highly leveraged foreign currency bets. Some focus on spinoffs, bankruptcies, and distressed debt. Others use options spreads and straddles to profit from implied volatility. There is a whole class of convertible bond arbitrage funds that “delta hedge and gamma trade” to exploit pricing inefficiencies.

Because they are risky, opaque, and sometimes illiquid, hedge funds aren’t really meant for ordinary investors like you and me. We are the hoi polloi. These funds are essentially invitation-only. They’re reserved for “accredited investors” with specific income ($300,000 for joint filers) and net worth requirements.

Investors (usually referred to as limited partners) must often hand over a minimum of $1 million to $2 million just to get in the door. And they pay exorbitant fees. The typical arrangement is an asset management fee of 1% to 2% plus a performance fee of 20% of any profits.

Can you imagine a mutual fund investor earning 8% in one year being forced to surrender 2% in fees and another 2% in profit sharing? That wouldn’t fly. Wealthy investors and institutions (who often weigh performance on a risk-adjusted basis) open their checkbooks expecting big results. And they often get them.

Many of these alternative strategies are meant to deliver positive absolute returns even in flat or declining markets. Others are designed to light up the scoreboard with triple-digit gains. To be sure, they don’t always work. Some funds backfire spectacularly and sustain billions in losses. But the hedge fund industry attracts some of the best and brightest talent. Million-dollar bonuses will do that (even junior analysts often pull in $300,000 salaries).

And let’s not forget… These shops hold more than $4 trillion in assets, so they have no shortage of financial resources.

Look Over Their Shoulder…

Who wouldn’t want to peek over the shoulders of these out-of-the-box thinkers and see which stocks/sectors have caught their eye? By reading between the lines of their public filings, we can glean some deeper insights. So that’s exactly what I did…

I recently spent some time diving into the portfolios of the nation’s top hedge funds. These acclaimed managers usually stay out of the public limelight. Still, you probably know at least a few of them: Bill Ackman at Pershing Square Management. David Einhorn at Greenlight Capital. Cathie Wood at ARK Investment Management.

It’s not surprising that many elite hedge funds post market-crushing returns. And they do so quietly, with little fanfare or media attention.

— While the S&P 500 tanked 20% in a bear market last year, Citadel’s flagship Wellington fund (run by billionaire Ken Griffin) climbed 38%.

— Over the past three years, Scion Asset Management has delivered a cumulative return of 199%. It’s led by Michael Burry, the guy who inspired the “Big Short” film by famously betting against the subprime mortgage market. Before that, he accurately called the 2000 dotcom crash.

— A mathematician from MIT who spent some time as a codebreaker with the National Security Agency (NSA) established a quantitative hedge fund called Medallion in 1988. Using proprietary computer algorithms, the fund has since chalked up an astronomical 62% annualized returns through 2021. Even after fees, investors have enjoyed 37% annual gains — turning every $100 into $4 million.

3 Hedge Fund Favorites

As you might expect, some of the same names tend to show up over and over again. Great minds think alike, I suppose. If this were a popularity contest (which the market can be at times), then we have a clear winner.

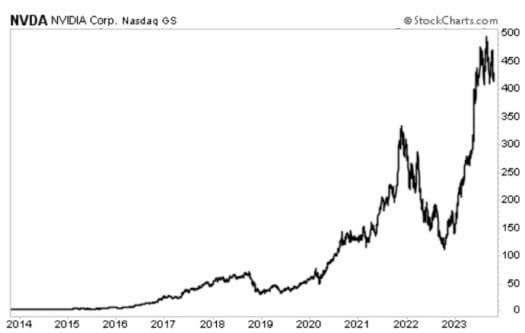

More than half of these funds cast a ballot for Nvidia (Nasdaq: NVDA). It is the single largest holding for managers like Stanley Druckenmiller, comprising nearly 15% of his portfolio. That bet has paid off handsomely. Nvidia became the newest member of the trillion-dollar club this summer, surging 24% in a single day after posting blowout earnings and issuing dazzling revenue guidance.

While best known for graphics processing units (GPUs) used in gaming applications and data centers, the chipmaker is now seeing an explosive surge in orders for products that support artificial intelligence (AI) tools and programs. Spurred by the runaway success of ChatGPT, the global AI buildout has been likened to a tech war – with Nvidia as the top arms dealer.

Just a few votes behind Nvidia is Intuitive Surgical (Nasdaq: ISRG), a pioneer in robotic-assisted surgery. The firm’s minimally invasive da Vinci systems are in more than 8,000 hospitals worldwide, with another 331 installations last quarter alone. Procedure volume continues to rise at a brisk pace, driving healthy growth.

Earning the bronze medal would be ride-sharing service Uber Technologies (Nasdaq: UBER).

Closing Thoughts

If you’re a growth-minded investor, then consider putting these three names on your watchlist.

Unfortunately, these promising companies pay little to nothing in the dividend department. So in my next piece, I’m going to dive even deeper and share more of my findings with you. As you’ll see, there are some key takeaways from these “smart money” portfolios – and dividends factor prominently.

In the meantime, over at High-Yield Investing, we own some of the market’s safest high-yield picks. These securities go undiscovered by the vast majority of investors. But many of our readers are already living a worry-free retirement.

If you want to spend less time worrying about bills and more time doing the things you want, you need to see my latest report.