Up 300%, This Is The Energy Pick We May Never Sell…

As the world’s top producer, the U.S. will bring 12+ million barrels of crude oil to the surface today, along with 100 billion cubic feet of natural gas.

The same thing will happen again tomorrow. And the day after that…

Moving those tremendous quantities out of remote fields to regional storage hubs and processing plants is a constant challenge. Oftentimes, the available pipeline capacity in a given region is all spoken for, forcing shippers to arrange alternate means of transportation, like trucks or railways.

From the Permian Basin in West Texas to the Bakken Shale in North Dakota to the DJ Basin in Colorado to the Marcellus in Pennsylvania, the story is the same. There just isn’t always enough pipeline capacity to meet demand.

Picture 100 people trying to crowd into a busy airport tram with only 75 open spots, and you get the idea.

But there’s no quick and easy solution. These large-scale projects are costly and can take years to bring online. That’s assuming they get the permitting green light in the first place – increasingly difficult in this contentious political climate.

A Political Hot Potato

If you haven’t noticed, it has become very difficult (impossible in some cases) to secure state and local permit approvals for new pipelines. The whole process has become politicized and often stonewalled by environmental protests and legal injunctions.

The Keystone XL Pipeline is but one high-profile example. The proposed $9 billion expansion was intended to transport more than 800,000 barrels per day from Canada to Nebraska, where it would then link with other lines traveling to Gulf Coast refineries.

The controversial project met with fierce opposition and was rejected by President Obama. It was later revived by the Trump administration but then subsequently canceled by an executive order from President Biden on his first day in office. That decision drew the ire of Canadian Prime Minister Justin Trudeau and triggered a legal challenge from two dozen states.

But ultimately, the project was scrapped.

Keystone is far from the only example. And even when Federal governments give a thumbs-up, pipeline construction can still be stymied by legal delays at the local level.

Either way you look at it, future pipeline battles will be extremely contentious (and costly). At best, they will get bogged down by injunctions and protests that can take years to resolve. Others will be abandoned altogether.

All of this plays to the advantage of midstream companies with expansive infrastructure (and customers) that are already in place. And that’s where our oldest holding over at High-Yield Investing comes in…

We May Never Sell This Pick…

Enterprise Products Partners (NYSE: EPD) is the largest master limited partnership (MLP) in America.

We’ve held it in our High-Yield Investing portfolio since 2007. And we may never sell. Here’s why…

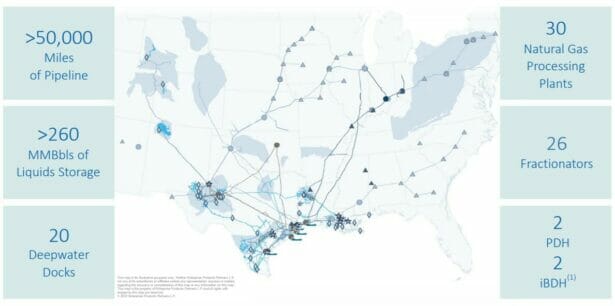

The partnership owns more than 50,000 miles of pipelines — enough to circle the planet twice. These conduits carry crude oil, natural gas, petrochemicals, and refined products such as gasoline.

EPD’s pipelines serve every major U.S. shale basin and connect to 90% of the refineries east of the Rocky Mountains – and that’s just part of the portfolio.

Source: EPD Investor Presentation

The company also owns dozens of processing plants and 260 million barrels of storage capacity, as well as marine docks and export facilities. It’s particularly active in channeling natural gas to fractionation facilities. Then, it transports the resulting natural gas liquids (NGLs) through its integrated network to domestic users or export markets.

That’s a good business to be in these days. Not only is natural gas production booming, but NGLs like ethane are the key raw material feeding the ravenous appetite of petrochemical plants on the Gulf Coast. We are in the middle of the largest petrochemical expansion wave in decades. And Enterprise is perfectly positioned to benefit from rising demand for these commodity feedstocks.

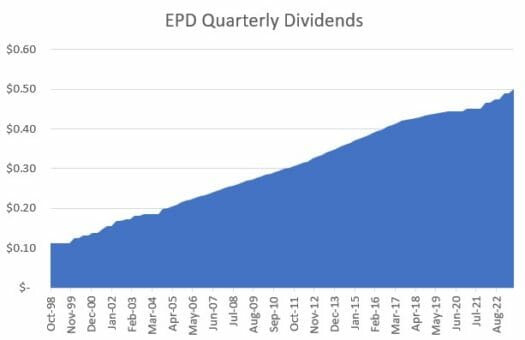

Since its market debut in 1998, EPD has closed $26 billion in acquisitions and completed $42 billion in organic growth projects. It has accomplished that without stretching the balance sheet. In fact, it boasts one of the strongest credit ratings in the entire midstream sector. And it’s hard to argue with total returns like this…

Our Economy Can’t Live Without EPD’s Pipelines

Without the vital products that EPD ships through its pipelines, our economy would rapidly grind to a halt. So regardless of interest rates and other macro factors, Enterprise always sees steady demand for its services – raking in piles of cash in return. In fact, approximately 85% of its gross profits are fee-based. That means less sensitivity to price fluctuations and steady income for every shipped through its network.

Enterprise has been busier than ever last year. The company pumped 11.3 million barrels of liquids and 17.5 trillion BTUs of natural gas per day through its pipelines last quarter. The marine terminals handled nearly 747 million barrels per day.

That massive throughput volume has helped drive distributable cash flow (DCF) to record levels of $1.7 billion per quarter. That’s good for a robust dividend coverage ratio of 160%. Even after hiking payouts to $0.50 per share (7.5% yield), EPD has generated enough cash over the past 12 months to comfortably meet its dividends with $3.3 billion left to spare.

That helps explain why the company has been in the financial position to increase dividends for 25 straight years… and counting.

Closing Thoughts

As of this writing, we’re up 300% on EPD in our portfolio. And thanks to those rising dividends, we’re earning 14% on our original purchase price.

Unless the world suddenly loses its thirst for energy, this toll collector will remain a great portfolio anchor for income seekers for years to come.

P.S. We’re about to see the “mother of all oil booms” in West Texas. And one little-known company is set to unlock it…

By now, you probably know that the Permian is home to a vast amount of untapped oil. But you’ll be shocked when you find out how much this independent producer is sitting on…

We’re talking about nearly a billion barrels of oil… just from one company. And in the coming days, it could unleash a surge of mega-profits.