This “Forgotten” Social Media Stock Is Firing On All Cylinders…

Want to build a backyard treehouse? Or organize your kitchen pantry? Make a costume for a school play? Throw the ultimate Halloween party?

That’s where one of my favorite picks comes in. Users can collect and organize photos that spark their interest.

It was a social media darling during the pandemic. The unique platform is a centralized hub for users to share photo collections grouped into countless categories. On average, members pop in about three dozen times a month to get ideas and inspiration for all kinds of projects.

The image-sharing site refers to itself as a “visual search and discovery engine.”

I’m talking about Pinterest (Nasdaq: PINS).

Investors woke up on Halloween last week to find that the stock opened sharply higher and rallied even further throughout the day. The stock closed up 19% on heavy trading volume.

So what’s going on?

Well, the market was cheering stronger-than-expected results on both the top and bottom lines. Earnings for the quarter more than doubled to $0.28 per share, trouncing the $0.20 estimate on revenues that rose 11% to $763 million. But the bigger story is that after stalling out briefly, revenue growth has accelerated for three straight quarters.

PINS is sort of the forgotten stepchild of social media. But there’s a lot to like about the stock – as I’ll explain in a moment…

An Advertiser’s Dream

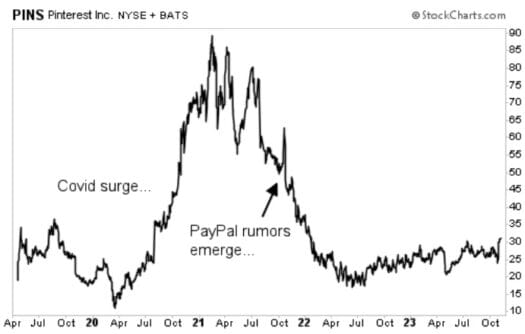

Of course, we all remember everyone had more spare time for creative projects during the lockdowns. That made Pinterest a top online destination. Between the summer and fall of 2020, PINS shares tripled from $20 to $60. A year later, Bloomberg revealed from inside sources that Pinterest was meeting with PayPal behind closed doors to discuss a possible takeover offer in the neighborhood of $45 billion, or $70 per share.

Those talks fizzled out. And as we know, the stock eventually made a full round-trip back to around $20.

There have been pervasive fears that Pinterest will never regain the popularity it enjoyed a few years ago. But that’s simply not the case.

Pinterest now has 482 million users worldwide. That’s a record high, eclipsing peaks from the pandemic days. More importantly, the company is doing a better job of monetizing that heavy website traffic.

Advertisers pay huge sums to reach the massive pool of 3.8 billion social media users worldwide. And why not? The average user now spends two hours and 25 minutes per day scrolling through pictures, posts, and videos, versus mere seconds glancing at a highway billboard or listening to a radio spot. That’s why social media captures about 30% all advertising spending each year.

Pinterest is uniquely positioned to act as a bridge between consumers and advertisers because users are actively engaged and motivated. Whether it’s hobbies or activities or travel planning, their personal interests are clearly expressed.

Firing On All Cylinders

With improved content search tools (including AI) and better measurement/analytics, Pinterest is becoming more valuable to advertisers. On the third quarter conference call, CFO Julia Donnelly cited inroads with restaurants, automakers, financial services firms, and travel providers.

Pinterest was literally created to help users categorize their shopping interests, a gold mine for targeted marketing.

We could dive into conversion rates, ad impressions, and click-throughs. But it’s revealing enough to say that average revenues per user (ARPU) have climbed 5% in North America and 26% across Europe.

With the help of a widening Gen-Z audience, Pinterest is winning more business from advertisers and stabilizing pricing. After climbing 5% in the first quarter, 6% in the second, and 8% in the third, fourth quarter sales growth is expected to accelerate to 12%. That implies revenues approaching the $1 billion mark.

More importantly, profit margins are shooting skyward. Management was initially predicting a 200 basis point (two full percentage points) increase in EBITDA margins for 2023. That figure was later doubled to 400 basis points. And now, the company is confidently forecasting an expansion of 600 basis points.

Adjustments of that magnitude typically have analysts scrambling to raise their forecasts. PINS has seen multiple upgrades recently, including a Top Pick recommendation from Evercore.

Action To Take

From investments to make the Pinterest website a more “shoppable” personalized mall to a lucrative partnership with Amazon that will showcase the latter’s products on the Pinterest feeds, the company is pushing all the right buttons right now.

Even after the recent surge, Pinterest is valued at just $20 billion, less than half of what PayPal was contemplating paying two years ago. And it has more users today. If you’re looking for a growth pick that still has a lot of runway (assuming a new buyout doesn’t come along), then investors should give it a deeper look.

P.S. Over at Takeover Trader, we made over 200% from Pioneer Natural Resources before ExxonMobil came knocking with a buyout offer. But that could be nothing compared to what’s next…

I’m targeting another megadeal in the West Texas oil fields. This little-known company is set to unlock the Mother of all Oil Booms. We’re talking about nearly a billion barrels of oil… just from one company. And in the coming days, it could unleash a surge of mega-profits. Click here for the full briefing now.