Why Investors Are Flocking Back to Real Estate

Most businesses pay a fixed percentage to the IRS and then maybe give a piece of whatever is left to shareholders — who are then subject to dividend taxes.

As pass-through entities, real estate investment trusts (REITs) avoid this double taxation.

For the record, master limited partnerships (MLPs) such as Antero Midstream (NYSE: AM) receive this same preferential treatment. So do business development companies (BDCs) — an incentive from Uncle Sam to spur investment in small private businesses.

Without a large chunk of their profits lopped off the top, REITs typically disseminate some of the market’s richest dividend yields. And many have delivered market-crushing total returns over the past decade.

But there is a tradeoff in this special arrangement. If a business must legally distribute 90% of its taxable profits each year, it can’t retain much to invest in new expansion projects or make acquisitions.

The Fed Effect

To keep growing cash flows, these companies frequently tap the capital markets to obtain fresh funding. That makes them sensitive to rising borrowing costs. And with the Federal Reserve raising rates relentlessly in 2023, that vulnerability has been on full display.

From January through October, the S&P real estate sector lost nearly one-quarter of its value. But as you can see, it has rallied sharply since then — bouncing 25% since October 23.

Buyers have returned in droves. Raymond James and other brokerages have revised their targets. Morgan Stanley just named real estate a top investment focal point for 2024, right up there with semiconductors.

So what’s going on?

Well, the interest rate headwinds that have plagued this group are now poised to become tailwinds. After nearly a dozen hikes, borrowing costs are currently sitting at a lofty 22-year peak. But this could be the high-water mark, with rates receding considerably next year.

It stands to reason that the stocks most punished when the Fed zigs will be the most relieved when it zags. Several of our Takeover Trader holdings are already getting a taste.

Americold Realty (NSDQ: COLD) has rebounded 21% since early November. Sun Communities (NYSE: SUI) has climbed 30%, rising from $103 on October 25 to $134 today.

And the Fed hasn’t yet initiated a single rate cut — this is just on the expectation that the central bank’s historic upcycle is finally ending.

Jerome Powell and his cohorts have pushed the “pause” button at recent meetings, leaving the influential Fed Funds Rate unchanged at 5.25% to 5.50%. But tightening could soon give way to loosening.

More than nine in 10 (94%) economists are now forecasting that the central bank will start dialing back rates in 2024. In fact, Fed committee members themselves foresee three quarter-point cuts next year and four cuts in 2025.

The Inflation Tide Has Turned

We are winning the fight against inflation. It took extreme measures, but the tide has finally turned.

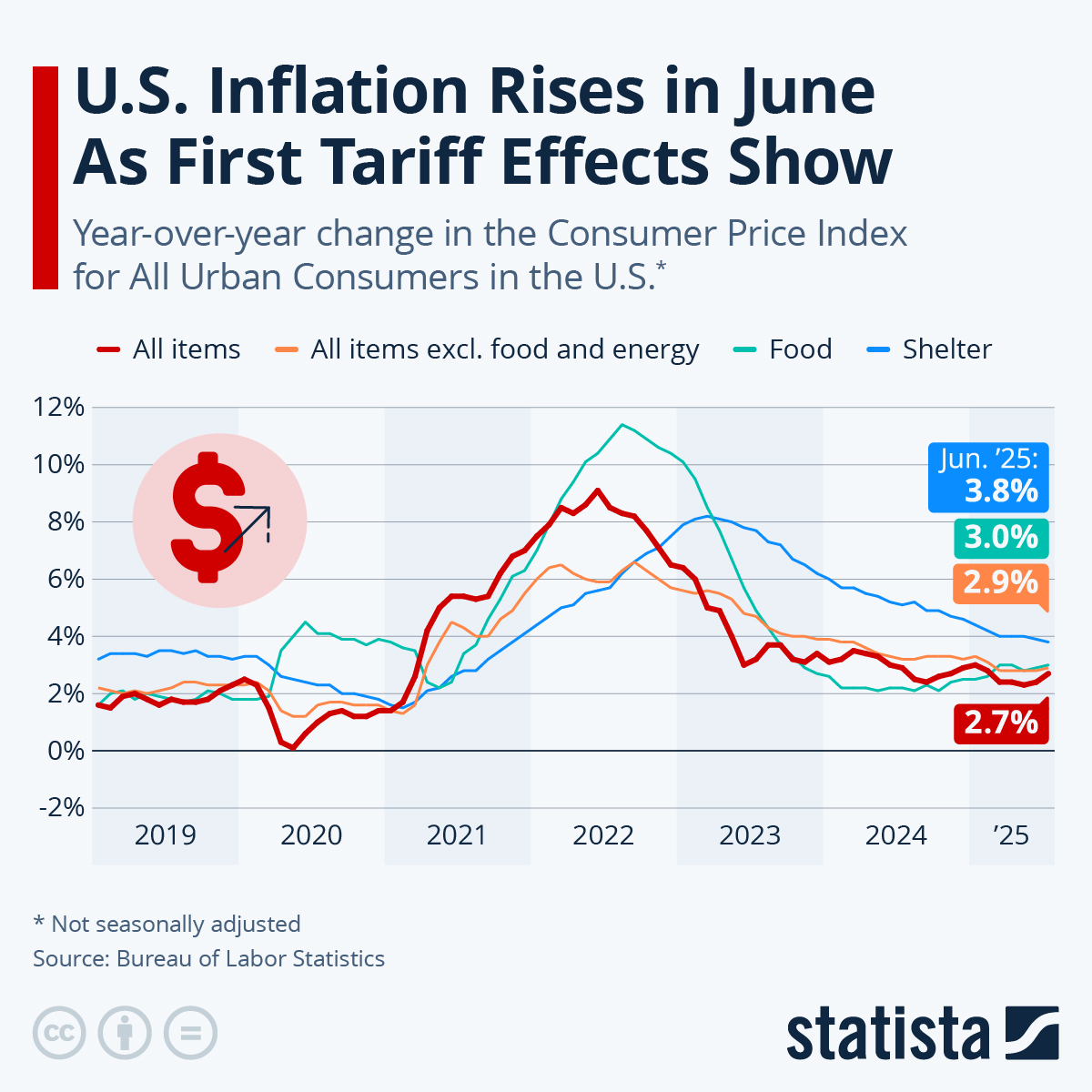

The latest Consumer Price Index (CPI) report showed the price growth for goods and services decelerating to just 3.1%, down from 3.7% in September and peak levels above 9%.

Source: Statista

Source: Statista

The Fed’s favorite barometer, the Personal Consumption Expenditures (PCE) index, has also dipped to around 3% and is expected to soften to just 2.4% within the next year.

These readings suggest that inflation has been tamed and is now easing back within the Fed’s 2% comfort zone. Historically speaking, once rates peak, the next downcycle usually starts within four to six months. And it has already been three months.

Wall Street’s Rate Cut Predictions

Charles Schwab’s chief fixed-income strategist sees the beginning of rate cuts happening by March. Goldman Sachs believes it will happen in the second quarter. But while economists differ slightly when it comes to the timing, they are almost in unanimous agreement that rates are indeed headed lower.

The biggest question is just how much cutting we’ll see. The market is currently pricing in up to six cuts in 2024, which would lower the Fed Funds Rate back down to 4.0%.

But to revive the sluggish economy, it might take even more monetary medicine. UBS Investment Bank is forecasting 275 basis points worth of cuts, nearly three full percentage points.

I think we’ll land somewhere in the middle. But politics may enter into the equation as well. Rate cuts stimulate both the market and the economy — and remember, 2024 is an election year.

In any case, the bond market (which is far more sensitive to rate vibrations than the stock market) has already reached an inflection point. Under the expectation of falling rates, the 10-year Treasury bond has rallied sharply, driving yields from near 5.0% in late October to 3.8% today.

Hot M&A Action in the REIT Space

You can understand why investors are flocking to the real estate sector. Profits in this group are determined largely by the difference between a company’s weighted average cost of capital and how much it can earn on that capital. The latter is usually expressed as a cap rate, or net operating income (NOI) from a property as a percentage of its value.

Borrowing at 6% and deploying at 7% doesn’t leave much. A drop in borrowing costs widens that spread, fattening the bottom line. It also makes REIT dividend yields more appealing compared to other interest-bearing securities.

And perhaps most importantly from our perspective, it lowers the hurdle at which accretive deals can be made.

Cheap money greases the merger and acquisition (M&A) wheels. And commercial real estate has been a very busy space. According to S&P Global, there were 10 publicly-traded REIT takeovers last year valued at $83 billion — not far from the record of $99 billion the year before.

These rent-earning assets (which span the spectrum from apartments and warehouses to retail shops and self-storage facilities) are being privatized before our eyes.

It wasn’t that long ago that Store Capital, Warren Buffett’s favorite REIT, was swallowed up by Oak Street for $14 billion.

And Blackstone (NYSE: BX) has closed a series of purchases over the past 18 months, including the $13 billion takeover of American Campus Communities.

Incidentally, my High-Yield Investing portfolio was on the receiving end of both of those deals. Trust me, there are more of these transactions in the pipeline.

P.S. Over at Takeover Trader, we made over 200% from Pioneer Natural Resources before ExxonMobil came knocking with a buyout offer. But that could be nothing compared to what’s next…

I’m targeting another megadeal in the West Texas oil fields. This little-known company is set to unlock the Mother of all Oil Booms. We’re talking about nearly a billion barrels of oil… just from one company. And in the coming days, it could unleash a surge of mega-profits. Click here for the full briefing now.