The Turtle Traders: How A Bunch Of “Average Joes” Learned To Trade Like Pros

What if I told you a story about a ragtag group of Average Joes that were able to make millions trading in the market?

I’m going to introduce you to the “turtle traders” in just a moment.

It sounds like something out of a movie. And actually it sort of is… it was said to have been inspired by the 1983 Eddie Murphy movie Trading Places.

Except in this case, it actually happened.

I came across this interesting story awhile back… And I promise if you stick with me, then there’s a very good chance you just might rethink everything you ever thought about what it takes to be a successful investor.

Introducing: The Turtle Traders

It all started with a simple bet between two partners: Could the average person with absolutely zero Wall Street experience be taught to successfully trade the markets?

On the one hand you had Richard Dennis — a self-taught commodities trader who reportedly made his first million by the age of 25. He believed he could teach someone his trading system and that the student could be just as successful as the teacher.

Then there was his partner, William Eckhardt, who thought differently. He believed people were born with an innate skill or intelligence that made them better investors than the average person.

To settle the bet, Dennis and his partner rounded up an eclectic group of individuals (a kitchen worker, prison counselor, phone clerk, and bartender).

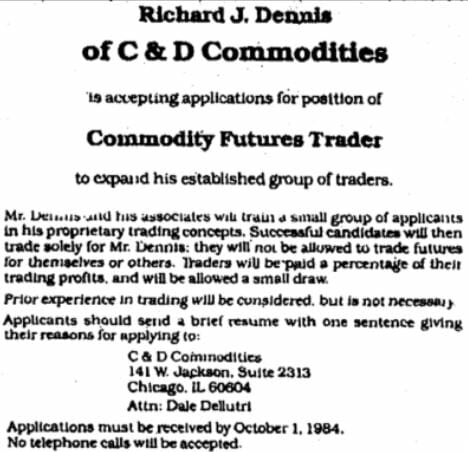

Below is one of the want-ads Dennis used to recruit the traders:

Source: TurtleTrader.com

Dennis gave them a two-week crash course. He taught them the ins-and-outs of his proprietary trading techniques with futures contracts. Then he gave this group some of his personal money and set them loose on the markets.

What happened next would become known as the story of the “turtle traders.”

Over the next five years these “turtles” were able to amass a $175 million fortune for Dennis and Eckhardt. Many of the turtles still trade today, with the most successful example probably being Jerry Parker, founder of Chesapeake Capital.

(You can read more about their story in this old archived article in Esquire magazine here.)

So how did they do it? It’s actually quite simple.

How To Trade Like A “Turtle”

Dennis didn’t believe in following the news, stock tips, or gleaning through financial statements. He told his pupils, “You don’t get any profit from fundamental analysis. You get profit from buying and selling. So why stick with the appearance when you can go right to the reality of price?”

Dennis taught his students to cut their losses short, avoid emotional investing, and above all else look at price movement. In other words, Dennis taught the turtle traders the basics of trend following. He believed that as long as his students remained disciplined and stuck to the rules they would make money. And they did.

Perhaps more important, this social experiment revealed two major facts: 1) anyone can make money in the markets, and 2) provided with the right system and set of rules — and above all, sticking to those rules — you can become a very successful investor.

My premium readers are very familiar with these rules — I preach their value and necessity just about any chance I get.

Like Dennis, I believe that what works best are rules. Leaving too many things to judgment leaves a lot of room for error. That’s why many of the rules that Dennis taught his turtles are utilized in my trading rules. Following buy and sell signals, cutting losses short, not letting emotions cloud our investing decisions and, of course, following price action, or momentum.

Closing Thoughts

Now here’s the moral of this little story…

It doesn’t take some kind of innate genius to successfully trade the markets. With the proper framework and discipline, anyone can do it. If that sounds shocking to you, it’s because that’s not what we’re told by the mainstream financial media. According to them, it’s only savvy uber-investors with inside information or high-powered computer algorithms that rack up year after year of market-beating gains.

In my experience, it’s simply not true.

I think every individual investor out there who’s struggling to find winning stock picks deserves a chance to make the kind of big-time gains we always hear about from the pros. And by using a simple set of rules and sticking to them, you can capture larger gains than the average investor — and in a fraction of the time.

This demonstrates just how powerful a simple set of rules and a powerful system can be. Sure, you may go through some rough patches from time to time — if anyone says otherwise they’d be lying — but in the end it works.

P.S. My staff and I have just released a report of “shocking” predictions for 2023 (and beyond)…

This report is easily one of the most hotly-anticipated pieces of research we release each year. And if history is any guide, it could be one of the most profitable things you read all year…

From the U.S. dollar to driverless trucks to breakthrough cancer treatments and more… If you’re looking for ideas that could turn a modest investment into a small fortune, this is where you’ll find it.