Analysts Are Going Crazy For This Ag Stock

In the last two mid-month updates of my premium newsletter Extreme Tech Profits, I shared with subscribers a scan built around a discovery I learned from Dr. Len Zacks, founder of Zacks Investment Research. He is the one who taught me to look for what I call a “valuation disconnect”; that is, an event in the life of a company that takes place whenever new earnings information arises unexpectedly. If this new information is positive – e.g., an increase in earnings growth that had not been foreseen by the analysts – it typically causes the stock price to rise over the next few weeks as investors strive to price in that new information.

| —Recommended Link— |

| JUST RELEASED: The 9 Biggest Things To Happen To Investing In 2019 Your 2019 investment “cheat sheet” is ready… Our annual Game-Changing Stocks Predictions have left many readers stunned. Some wondered if we had some kind of crystal ball on the market… others asked if we were getting away with insider trading. And this year… could hold our biggest reveal yet… Click here to see what 2019 has in store for you. |

I also showed you how, once we add a valuation filter to the scan (I used the Price-to-Sales ratio) we can improve the returns of the scan greatly. If you recall, with our basic scan composed of the following two filters:

% Change in Q(1) EPS Estimates over 4 Weeks > 10%

Price/Sales = Bottom #5 Stocks

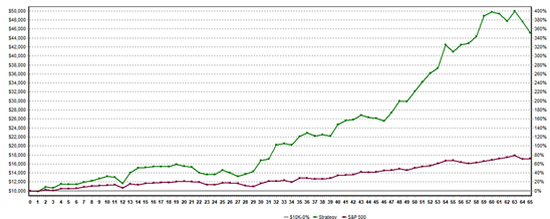

and applied to the S&P 500, using a four-week rebalance over a five-year lookback period, I was able to produce the following robust performance:

(click here for a larger version of this image)

As you can see, this simple two-filter scan yielded a five-year return of 227.6% ROI, an average compounded gain of 26.8% per year. At that rate, every $10,000 invested becomes $32,759 in just five years. I also showed you a list of five stocks produced by the scan. Of those stocks, while the S&P 500 itself was down about 2%, three of the five produced positive returns, including an 8.3% return for United Continental Holdings (NYSE: UAL) and an amazing 19.2% return for The Mosaic Company (NYSE: MOS).

#-ad_banner-#But we can do better. Let’s add one more filter to our scan and see whether we can’t amp up those returns a bit. As readers of Extreme Tech Profits know, one of the keys to finding winning stocks is to focus on companies that have strong support from analysts and institutional investors. This support creates positive sentiment around the company that encourages investors to buy shares and hold on for a while.

So here is the additional filter I’m adding in this new version of our scan of the S&P 500:

Average Analyst Rating < 3.0

This means that the average of all analysts that cover the company must be at better than “hold” (1 = “strong buy” and 5 = “strong sell”). In this way we exclude all companies that analysts are merely lukewarm on, or worse.

We will need to put this filter between our earnings estimates revision and Price-to-Sales filters, since we are using the last filter to get us down to a maximum of five stocks. Thus, in this month’s iteration of our scan, our strategy now looks like this:

— All S&P 500 stocks

— % Change in Q(1) EPS Estimates over 4 Weeks > 10%

— Average Analyst Rating < 3.0

— Price/Sales = Bottom #5 Stocks

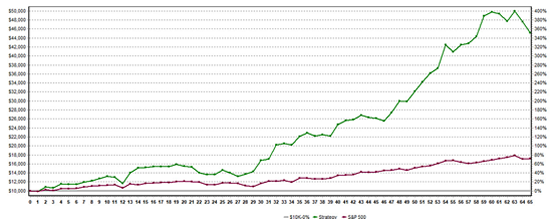

And here are the returns, using the same four-week rebalance period and the same five-year lookback period (November 2013 to November 2018):

(click here for a larger version of this image)

Wow! With this addition of one simple filter, we have improved our overall ROI from 228% to over 350%, which works out to a 35.2% average annual return. At that rate, every $10,000 invested becomes more than $45,000 in just five years. Moreover, our maximum drawdown for the period is only 16.9%. While that’s a bit steep for large cap stocks in a bull market, keep in mind that that the index of the 500 largest stocks printed a max drawdown of nearly 10% over the same period.

| —Recommended Link— |

| New Medical Breakthrough Could Save More Lives Than Penicillin And End Disease As We Know It We’ve just uncovered a bombshell that you NEED to see… One company is taking strides to stomp out disease… even if you’re genetically predisposed to them by creating custom coded cures. Best of all, you could make millions by getting in early. Discover the shocking truth here… |

Here are the top five stocks passed by the scan on a recent run (November 27, 2018), ranked in order from lowest to highest Price-to-Sales ratio:

1. Quanta Services (NYSE: PWR)

2. Marathon Petroleum (NYSE: MPC)

3. Centurylink (NYSE: CTL)

4. Newell Brands (NYSE: NWL)

5. Mosaic (NYSE: MOS)

Of these stocks, I especially like The Mosaic Company. The company is ranked a “strong buy” at Zacks Investment Research on the strength of improving earnings estimate revisions. The stock is well-loved by analysts and has received no less than 10 upgrades and raised price targets this year. And despite having a strong year (up 39.4% YTD), shares are still undervalued at just 1.5 times sales and 14.5 times forward earnings.

Editor’s Note: Interested in learning more about Tom Carr’s strategy for finding the best tech stocks the market has to offer? We’re talking about little-known companies that are innovating and growing like crazy. And because they aren’t your typical household names, they have the promise to deliver major gains once the crowd catches on. If you’d like to learn more about Extreme Tech Profits and what we’re researching, contact our sales director Nate Equall toll-free at (888) 308-6247.