4 Pharma Stocks That Could Swing A Major Deal Soon

Retail and institutional investors aren’t the only ones who used the fourth-quarter selloff last year as a buying opportunity.

Bristol-Myers Squibb (NYSE: BMY), one of the largest U.S. pharma companies by revenue, didn’t waste any time scooping up biotech Celgene (Nasdaq: CELG). Announced on January 3, the $74 billion acquisition is the second-largest pharmaceutical M&A deal ever (after the $87 billion merger of Warner-Lambert and Pfizer (NYSE: PFE) twenty years ago).

Despite the price tag, it was still a bargain. Even though BMY offered a 53.7% premium to CELG’s closing price on January 2, the latter, which lost $30 per share between August 30, 2018, and year-end, still trades below its 52-week high. This price action shows how unexpected the deal was, and how little of the future M&A premium was “baked” into the price of CELG before BMY has made its move.

Identifying potential M&A targets is a difficult process, but it can be worth the effort. After all, a jump of 30%, 50% or even more is a nice payoff… But it’s never wise to simply invest in a stock on the hopes that it will one day be acquired — hence the research part.

| —Recommended Link— |

| 9 Game Changing Predictions for 2019 Want to know where the money will be in 2019? Discover over a dozen potentially life-changing recommendations inside our special new report, 9 Game-Changing Investment Predictions for 2019. Click here for the full details now. |

I, for one, am keeping an eye on several companies that may be worth something to a larger peer. As I’ve explained several times recently, I think we’re on the cusp of a new wave of medical innovation that will prove to be one of the largest wealth creation opportunities of our lifetime. And while the big pharma players will certainly benefit — it’s the smaller companies that are often on the cutting edge of these developments.

As soon as I complete my research, my Fast-Track Millionaire readers will be the first to know about it in an upcoming issue of my newsletter.

Big Pharma Stocks In The Market For Deals

In the meantime, I am doing something else entirely. To start with, I wanted to see which companies in the large pharma and biotech industries could become the acquirers down the road. For that, I reviewed some of the largest companies in the industry for what they might have to lose due to upcoming patent expirations.

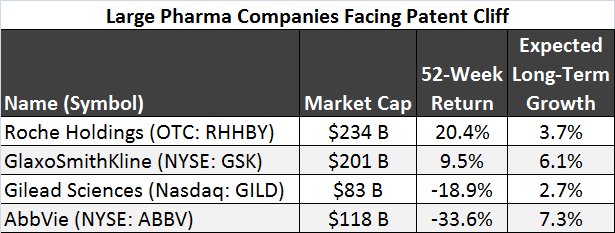

Here’s a list of four large pharmaceutical companies, all facing or about to face some of the most notable patent losses, along with a discussion of how these companies are addressing the challenge. I wouldn’t be surprised if a company or two from this list becomes an acquirer of a smaller peer down the road.

Swiss giant Roche Holding (OTC: RHHBY) owns several large drugs already facing or about to face the patent cliff, including Rituxan, Avastin, and Herceptin. Its near-term future, much like that of the rest of the companies in the table, will largely depend on how successfully it will continue to defend these drugs’ exclusivity.

#-ad_banner-#Rituxan, also known as MabThera, is a huge drug for Roche. It’s a biologic first developed by Genentech; this fact alone should tell you everything you need to know about that drug’s old age — Genentech was acquired by Roche 10 years ago. Rituxan was approved by the FDA nearly a decade earlier, in November 1997.

It was a pioneering treatment for cancer, and as such, it used to hold the title of the best-selling cancer drug in the world. In 2018, it generated $4.3 billion in the United States alone. Thanks to the difficulties of copying and approving of a generic version (called biosimilar) of a biologic drug, here in the United States, Rituxan/MabThera has been holding on: sales in 2018 have even grown compared to the previous year.

The picture in Europe is different, thanks to the easier process for approving biosimilars, and more dangerous for Roche: there, Rituxan/MabThera has already lost about half of its revenue.

Also acquired with Genentech, cancer drug Avastin is another potential revenue loss due to patent expiration. And here is one more Roche medicine that faces a biosimilar threat as soon as a few months from now (second half of 2019). Herceptin, another cancer drug, was first approved in 1998 and still brings in nearly $3 billion a year. The drug is set to lose its patent protection in June.

GlaxoSmithKline (NYSE: GSK) has fought for its asthma drug Advair, including the patented inhaler, for a few years now. Now, however, it seems to be finally facing off against generic competition. Just a month ago, on February 8, GSK announced that it plans to make an “authorized generic” version of Advair available. This is likely in a response to the FDA approving the first generic version of Advair on January 30, and an attempt to save at least some of the $1.4 billion in annual sales.

Here’s one more in the same vein: Gilead Sciences (Nasdaq: GILD). This venerable biotech has been fighting to protect slumping revenue from its Hep C treatment franchise. To do so, Gilead is also going the generic route: the company, much like GSK above, is going to sell generic versions of its own medicines Epclusa and Harvoni.

It’s a highly unusual move inasmuch as this decision to launch cheaper generics comes only a few years after the FDA approved these medicines (Harvoni in 2014 and Epclusa in 2016). But if this is how GILD wants to protect its Hep C franchise, if not the entire revenue stream (Harvoni alone sold $4.9 billion worth in 2016, although this number has been on the decline ever since, falling to $4.4 billion in 2017 and as low as $1.2 billion in 2018). This approach is worth watching — it may save GILD much of its otherwise lost revenue.

Of course, we cannot talk about patent cliff without mentioning AbbVie (NYSE: ABBV), the owner of the world’s bestselling drug, Humira. While Humira, a biologic for rheumatoid arthritis and other maladies, still sells as much as $20 billion a year — a massive number by any measure — the stock of ABBV has been in the dumps, down more than 30% year-over-year.

Even though ABBV has more than 100 patents covering Humira, and despite its 2017 patent win over Amgen (Nasdaq: AMGN) requiring AMGN to wait until 2023 before issuing its own copy of Humira, the battle for generic Humira isn’t over.

Just this January, ABBV reported a 17.5% decline in fourth-quarter revenue generated by Humira outside of the United States as the bestselling drug saw competition from biosimilars in Europe for the first time. The 2023 patent protection, which still stands domestically, resulted in a 9.1% increase in Humira’s U.S. revenue — a drastic difference that demonstrates why pharma companies try to keep patent protection at almost all cost for as long as they can. This year alone, Humira’s revenue will decline by some $2 billion, all thanks to the advances of biosimilars in Europe.

Action To Take

Let’s keep our eye on this group… While each has their own unique challenges with regard to patent expirations, any one of them could easily make the decision to put the cash flow from their blockbuster drugs to good use by acquiring a smaller pharma or cutting-edge biotech company in the near future.

In fact, I just recently profiled a small-cap biotech company in the most recent issue of Fast-Track Millionaire that would be perfect for one of these bigger players… It’s a younger company showing enormous promise in the field of cancer treatment by targeting at the cellular level. It just went public last year — and is already well on its way to blockbuster status. (To learn how to join us and get the name of this stock, go here.)

P.S. A revolution is happening in the world of advanced medicine — and faster than you know. Genetic editing, along with a host of other exciting developments, could lead to a colossal jump in our lifespans. What were once fatal diseases could soon become a thing of the past, while investors in just a few little-known companies in this space make a fortune. Learn more about this revolution right now…