More Gains Ahead From The High-Yielder Up 40%

Most people know the name Wayne Gretzky.

#-ad_banner-#For years he was nearly universally regarded as the best hockey player in the world. Yet his astounding success had very little to do with superior athletic abilities.

“A good hockey player skates to where the puck is,” Gretzky would say. “A great hockey player skates to where the puck is going.”

Although investing doesn’t require the same physical prowess as hockey, this same principle is key to identifying stocks at the cusp of a big upward move.

You see, the key lies in spotting big picture themes that are likely to unfold, and then understanding the likely winners or losers based on these long-established relationships in the global market.

Let’s be clear: I’m not talking about localized events that could be gone tomorrow, but big-picture developments that could take months or years to play out.

For example, when the world began recognizing the potential of fracking and horizontal drilling to optimize the extraction of natural resources from shale rock formations, it was obvious that well-positioned oil and gas producers would benefit. But, those who understood the causal market relationships involved knew how to collect on the money everyone else was missing.

You see, the increase in oil and gas production pushed most oil pipelines to full capacity, and building new ones is a long and costly process. So, producers turned to a different mode of transportation.

Railroads.

Shortly after fracking and horizontal drilling’s rise in popularity, railroads saw a 200%-plus increase in crude oil transportation, which led to companies like Union Pacific (NYSE: UNP) experiencing a 44.5% share price gain in 2014.

While the majority of investors were trying to figure out how to get more overpriced oil and gas stocks into their portfolios, they were oblivious to the huge gains in related sectors.

In short, they were skating to where the puck was, not where it was going.

Here’s an example of a similar opportunity I came across recently.

I had long been bullish on the commercial aviation market. Growing middle-class populations (with rising disposable incomes) were taking to the air in record numbers and recent consolidation in the sector meant that airlines were operating leaner and meaner than ever before.

That meant more planes and infrastructure were needed to accommodate the increasing number of travelers. A key industry report forecasted that the world’s airlines would need to add 36,770 new jets to their fleets over the next two decades just to keep pace.

Initially, this led me to invest in Southwest Airlines (NYSE: LUV) in one of my premium advisories. Since then, I’ve netted a 94% gain in less than a year.

It was only later that I realized that some of the biggest profits in the airline world could actually fall to the few specialists involved with leasing activities.

That’s what led me to Aircastle (NYSE: AYR), a Connecticut-based aircraft leasing firm.

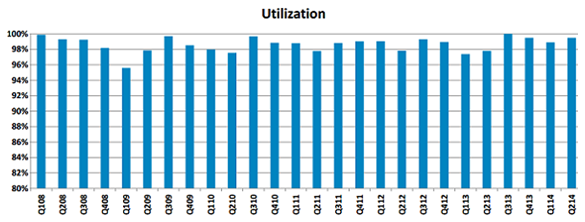

Check out this fleet utilization chart of the company.

As you can see, the firm’s available jets have been consistently booked between 98% and 100% over the past six years. That rate dipped to a low of around 96% just once — and that was during the darkest days of the recession.

See, new jets don’t come cheap. Boeing’s popular new 737s carry a price tag of approximately $115 million each. So for many airlines, the most economical way to expand their fleets and add new routes is to lease rather than buy.

Few people realize it, but of the 17,000 commercial aircrafts flying worldwide today, more than one-in-three are leased. And there still aren’t enough.

You see, understanding the connections that go beyond the surface level within the market is one of the keys to long-term investing success. That’s the opportunity investors currently have with Aircastle.

My High-Yield Investing readers and I have enjoyed a nice 40% gain on the stock since October. And the stock offers a dividend of more than 4% — more than twice the market average. I think there’s plenty of gains left to be had for investors who want to consider the stock today.

But these aren’t my only high yield picks. In fact, I just released a new report that details how I’m locking in a paycheck of $16,200 for every $100,000 I invest… and our dividends keep growing… sometimes overtaking our original stock price. Invest like this and it just might change the way you think about investing forever. To access the report, click here.