The Not-So-Secret Way To Get Rich That Most Investors Ignore…

The market has been in something of a holding pattern for the past couple of days. And there seems to be good reason for that…

On Capitol Hill, President Joe Biden turned down the $900 billion infrastructure counterproposal from Senate Republicans. Meanwhile, a bipartisan group is working on another $880 billion counterproposal to the President’s $1.7 trillion plan. Any legislation must include Republican support in the split chamber, unless Democrats decide to pursue a process of budget reconciliation, which may put the bill in jeopardy.

In other news, job opening data reached a record high in April, increasing by 998,000 to 9.3 million. We’ve discussed the troubling situation developing with the jobs recovery, and this serves to confirm the belief that businesses are indeed eager to hire. But the situation may take several months to resolve, as businesses will have to raise wages to attract talent, extra unemployment benefits expire, schools reopen in the Fall, the list goes on…

Also, keep an eye out for fresh inflation data on Thursday. This is another important metric we’ve touched on several times, and it will be important to watch throughout the recovery.

We’ll keep tabs on all of this as it develops. But in the meantime, I want to feature this timeless piece from my colleague Nathan Slaughter, Chief Investment Strategist of High-Yield Investing. As you’ll read below, Nathan will show you how stupidly simple way to make a fortune in the market. All you need is patience, a little starting capital, and time…

The Not-So-Secret Way To Get Rich That Most Investors Ignore…

It is one of the great investing secrets… But really, it’s no secret at all.

It doesn’t get much attention, partly because it doesn’t have a catchy name. But rest assured, it’s the key factor that helps the rich get richer.

If you’re not using it, to put it simply, it’s going to be extremely challenging for you to earn lasting wealth. You’ll have to worry about things like timing the market, finding the areas that are “hot,” trying to “beat the crowd”… and generally playing the market as if it were a lottery, which is typically a loser’s game.

I’m talking about compounding your dividends through reinvestment.

I know, I know… it’s not the sexiest thing to talk about. And it’s definitely not what most investors want to hear.

But rather than send you off chasing the latest fad in the market, we believe in telling our readers the truth about what it takes to be successful in the stock market over the long haul.

The Beautiful Math Of Compounding

The truth is that dividend payments generated by a modest investment might seem inconsequential at first. But through the magic of compounding, it won’t take long before they can begin to make a dramatic impact.

You see, when you buy shares of dividend-paying stocks, the dividends they pay can be used to purchase more shares, leading to increasingly larger dividend checks. These larger checks can then be used to buy even more shares and so on. In time, even a small stake in such stocks can grow into a tidy sum.

Let me show you just how powerful dividend compounding can be.

Let’s say you buy 1,000 shares of XYZ Corp for $10 each — that’s $10,000 invested. If XYZ pays a 5% dividend yield, you would expect to receive $500 in dividends in the first year.

Now, rather than simply pocketing that $500, imagine if you purchased 50 more shares instead.

Of course, those 50 new shares would then generate dividend payments of their own.

So if you reinvested your dividends and left your investment alone for the second year, your 1,050 shares would generate a little more than the first year — $525 in dividends.

If you reinvested those dividends to buy 52 more shares for the third year, your 1,102 shares (1,000 + 50 + 52 = 1,102) would pay you even more — $551 in dividends.

Fast forward through 30 years of dividend reinvestment, and your original 1,000 share stake in XYZ would have more than quadrupled to 4,322 shares.

Wait, It Gets Better…

Of course, that’s a simplistic example. You would hope your shares would gain value over time rather than just stay at $10 per share.

So to complete this example, let’s say XYZ’s stock price gains 8% per year — which is right around the historical average for the broader market. And let’s say the company raises that dividend by a modest 3% per year, on average.

Again, let’s say you take those payments and you reinvest your dividends every year. How much would you make?

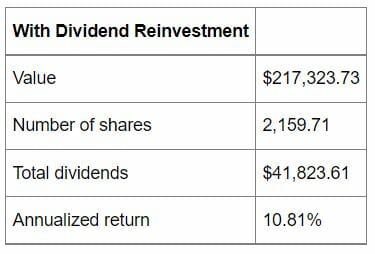

As the table below shows, this steady compounding process can yield amazing results over the long haul…

Your original $10,000 investment would have swelled to more than $200,000, without ever adding another penny!

But what would have happened if you didn’t reinvest dividends? The stock would still be worth about 10 times more than what you paid, thanks to capital gains. But without any reinvestment you would have only collected a measly $24,000 in dividends and you’d be left with the same 1,000 shares.

Bringing It All Together

Granted, this is just an example. And not everyone has 30 years to compound their money like this. But on the flip side, there are plenty of stocks that hike their dividends by a lot more than 3% a year, too.

Either way, the results are clear. Successful investing for the long haul is really nothing more than a game of compounding by earning a consistent return and reinvesting your profits back in the market over and over again. There are no shortcuts.

But here’s the fun part… When your portfolio is large enough, you can stop reinvesting and live off the dividends as a second income.

Compounding gives you more time to enjoy life. You don’t have to be glued to CNBC or your computer screen, looking for the next “hot” stock. And you don’t have to worry about what’s going on in China or Russia or the Middle East, either. Your portfolio remains largely unaffected.

The magic of compounding is most powerful when an investor focuses on established companies that throw off a steady stream of dividends. Simply find dependable companies that pay steadily rising dividends, reinvest your payments, and let the math take care of the rest.

That’s why I spend the bulk of my time over at High-Yield Investing searching for steady dividend paying securities that pay anywhere from 4% to 9% and beyond… Some of my readers are already retired and need income right away. But others choose to harness the power of dividend compounding to maximize returns over time.

To learn more about our portfolio, I invite you to view this special report.