Shocking Social Security Statistics… A Retirement “Meltdown Is Coming… How To Prepare…

Imagine a boat that has sprung a leak. The damage to the hull can’t be repaired, so the vessel is constantly taking on water. It’s not a good situation. Fortunately, there are 20 able-bodied passengers aboard to help bail, keeping the ship afloat.

Imagine a boat that has sprung a leak. The damage to the hull can’t be repaired, so the vessel is constantly taking on water. It’s not a good situation. Fortunately, there are 20 able-bodied passengers aboard to help bail, keeping the ship afloat.

But after a while, one of those exhausted passengers tires and stops bailing. Then another, and another. Soon, just 10 people are bailing, half as many as before, so the water level begins to creep ever higher. And the remaining bailers give up their efforts one by one until just two are left.

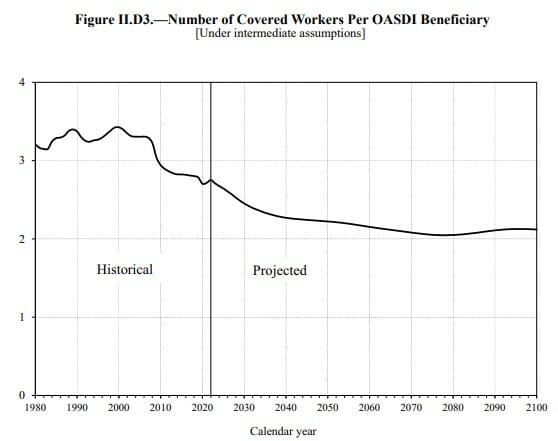

If you have a job right now, you’re one of these last two passengers. Your work, your “bailing,” keeps the Social Security system afloat. In the early days, there were 20 workers just like you depositing into the system for every retiree receiving benefits. Over the years, that ratio fell to 15:1, then 10:1, then 5:1. Now, there are just over 2 workers per beneficiary.

Source: Social Security Administration

Of course, when it comes to Social Security, the boat isn’t filling up. It’s being drained dry. But either way you look at it, we’re stuck with the same problem. All taxpayers and retirees are crammed in this boat, which is looking less seaworthy by the minute.

A Slowly Sinking Ship…

Don’t take my word for it. Here’s an excerpt straight from the Board of Trustees 2023 annual report:

“During the year, an estimated 181 million people had earnings covered by Social Security and paid payroll taxes on those earnings. The total cost of the program (i.e. expenditures) in 2022 was $1,244 billion. Total non-interest income (i.e. collections) was $1,155 billion. Social Security’s cost has exceeded its non-interest income since 2010.”

In other words, the Social Security system has been running a shortfall ever since 2010. Last year, it paid out $89 billion more than it took in. That huge deficit is projected to get wider with each passing year.

You don’t need a Ph.D. in mathematics to understand that this dire situation is untenable.

To help bridge the gap, the government is tapping into interest earned on the $2.83 trillion cash surplus built prior to 2010. Last year, that interest amounted to $66 billion. But even with that help, total collections still fell short ($1,155 + $66 = $1,221) of the $1,244 billion disbursed. That means the trust fund was forced to sell off assets to maintain benefits.

The asset reserve shrunk by a troubling $22 billion last year and is expected to continue dwindling…until there is nothing left.

Demographics aren’t in our favor. Every day, 10,000 Baby Boomers reach the retirement age of 65 and are eligible to start drawing benefits. That’s 300,000 fewer people paying money in each month — and 300,000 more taking it out. We’ve got maybe another decade for politicians to find a solution (don’t hold your breath).

That’s when things really start getting ugly.

The Trust Fund report uses terms such as actuarial deficit and unfunded obligations. But here’s the long and short of it. When the asset reserve is exhausted, there will only be enough ongoing tax collections to pay out 77% of promised benefits. The government will have no choice but to hike payroll taxes or slash benefit payments by 23% across the board.

Neither alternative is appealing.

Moving On From A Broken System

Imagine an independent money manager approaching you with a 401(K) proposal. But instead of a menu of investment options, you have zero control over the assets. They are invested in Treasury Bonds that yield little and don’t appreciate in value. You also have restricted access to your money and can’t transfer it elsewhere. Ever.

There is also a good chance your future proceeds will be cut at some point. Remember, these “benefits” are not Uncle Sam’s generosity but simply a return of your own money. Except in this case, you can’t pass any of it down to children or grandchildren. And if that wasn’t bad enough, any withdrawals might be taxable — even though you were already taxed on the deposit.

Nobody would willingly volunteer to sign up for a program like this.

Yet, every paycheck, you have money forcibly withheld (some would say confiscated) whether you like it or not. And neither political party wants the fallout from enacting the reforms to make it solvent once again.

Advocating for a reduction in benefits is tantamount to political suicide. And it’s hard to ask hardworking families to surrender any more in payroll taxes than the current 12.4% (split between employer and employee).

We could raise the retirement age to 70, as some have suggested. But I don’t relish the idea of punching the clock that long.

There just aren’t any easy solutions. And that’s why there hasn’t been any real legislative push to shore up Social Security since 1983.

Action To Take

Personally, I’m not relying on Uncle Sam to meet my retirement needs. If there is still money in the system in 2036, that’s great. But at the rate the system is hemorrhaging money ($230 million per day), I’m taking charge of my own financial future well before then.

Let this be the year you decide to free yourself from relying on the fragile Social Security system and take charge of your own retirement. Because the truth is, you don’t have to rely on Social Security if you save enough and invest in the right mix of income-paying securities. It may not happen overnight, but you’ll be glad you did.

P.S. That’s why I created my latest report about an “alternative” system that delivers the income you need in retirement.