4 Classic Buffett Quotes To Make You A Better Investor, Plus: The Case For Monthly Dividends…

I hope you all are gearing up for a wonderful Memorial Day weekend.

As one of the most successful investors of all time and one of the richest men on Earth, Warren Buffett has offered a lot of wisdom over the years. And while there’s a lot of wise words to choose from, his timeless principles over the years have made his reputation in the investing community as good as gold.

As we head into the weekend, let’s examine some of Buffett’s sage investing advice to see how we might improve our own portfolio performance. Later in today’s issue, my colleague Nathan Slaughter will take things over by talking about monthly dividends (and why they’re awesome).

Good Investing,

Brad Briggs

StreetAuthority Insider

4 Buffett Quotes To Guide Your Portfolio

1. “Our favorite holding period is forever.”

It may not be trendy or sophisticated… But buy-and-hold investing — Buffett’s favorite strategy according to Berkshire Hathaway’s 1988 letter — is one of the few strategies actually proven to consistently make money over the long term. The proof comes from an Oppenheimer study, which found that the S&P 500 never suffered a loss over any 20-year period going all the way back to 1950. The extensive study also showed that short-term investing can be a bad idea, as the S&P 500 lost money 16 times in a one-year-period since 1950.

2. “If a business does well, the stock eventually follows.”

2. “If a business does well, the stock eventually follows.”

Don’t just buy stock if you want strong returns. Buy shares in a business you’d be proud to own, and be prepared to reap the rewards. Much of Buffett’s investing success has come from buying well-managed companies with solid economic moats (i.e. lasting competitive advantages), consistently high return on equity (ROE), and low debt. He also admires companies with leaders that readily admit mistakes, have the interests of shareholders at heart, and own a large portion of the company themselves. (You can see Buffett’s full criteria on page 23 of his 2014 shareholder letter.)

3. “Investment must be rational; if you don’t understand it, don’t do it.”

Buffett advocates owning established companies with household name brands and understandable business models. One look at Berkshire Hathaway’s portfolio should illustrate this point, as well-known and simple companies like Coca-Cola (NYSE: KO) and American Express (NYSE: AXP) continue to be some of its largest holdings, making the firm ten times (or more) than the original investment.

It doesn’t always work out, though… Buffett famously missed out on the initial big run-up in tech stocks like Apple and Amazon — but that’s because he always admitted that he didn’t quite understand tech. It was only years later after bringing on trusted, experienced money managers into the firm that he later decided to invest in Apple, for example. The point is most investors would be better off knowing when to “stay in their lane” and avoid what they don’t know, too.

4. “Diversification is protection against ignorance. It makes little sense for those who know what they’re doing.”

Yes, it’s true Buffett recommends that non-professional investors buy shares in diversified, low-cost S&P 500 index funds to avoid risk. But how can you beat the broader market when your portfolio is the market?

Buffett compares this to putting Lebron James on the bench during a basketball game: “If it’s your game, diversification doesn’t make sense. It’s crazy to put money into your 20th choice rather than your 1st choice. It’s the ‘LeBron James’ analogy. If you have basketball phenom LeBron James on your team, don’t take him out of the game just to make room for someone else.”

In other words, if you know an industry well (or work in it), you may have a better-than-average chance of spotting a good company and thus a potentially market-beating stock. And if you’re picking your own stocks, then it’s far more likely you’ve come up with only one or two really good ideas than a dozen. So as long as you’re aware of the risks, it can really pay to be “overweight” on your best ideas.

The Takeaway

We can argue whether Berkshire Hathaway itself is a “buy” today, but there’s no denying that we can all profit from Buffett’s wisdom. Learn from the man himself and try to adapt his principles to form a sound, profitable investing strategy.

In short: Buy well-managed companies with wide moats, understandable business models, and in industries that you know well.

4 Reasons Why You Should Love Monthly Dividends

Investments that pay a dividend every month aren’t a hard sell. After all, who doesn’t want a little extra monthly income to help tackle the monthly bills?

Investments that pay a dividend every month aren’t a hard sell. After all, who doesn’t want a little extra monthly income to help tackle the monthly bills?

Sadly, that’s where too many investors believe the benefits end. Indeed, many still think that buying a security paying $0.10 per share in dividends a dozen times a year gives them the same long-term payoff as buying one that pays $1.20 in dividends annually.

That idea couldn’t be more short-sighted. Beyond the convenient payouts that monthly dividend stocks and funds provide, these frequent dividend payers offer much more than most people realize when it comes to building wealth.

Here are few excellent reasons to love monthly dividend payers…

1. Higher Frequency Leads To Faster Growth

If you choose to wisely reinvest your dividends (assuming you don’t need to live on them right away), you will ultimately make more. You’ll build wealth faster with a monthly dividend payer than with an annual dividend payer.

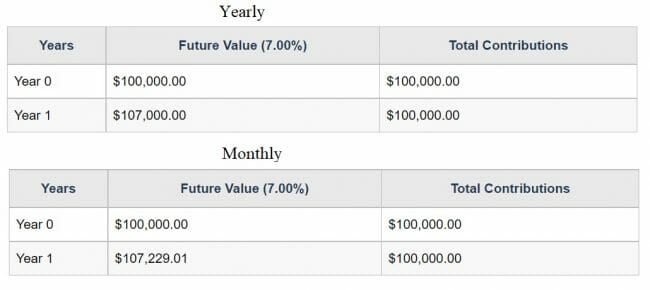

Let’s say you invest $100,000 in two securities that each paid a 7% annual dividend yield. One pays dividends monthly and the other pays once annually. For simplicity, let’s also say these investments don’t change in value over time (i.e. no capital gains or losses) and that you reinvest dividends as soon as they’re paid out.

After one year, the annual payer would be worth $107,000 (my original $100,000 investment plus $7,000 in dividends) at the end of the year. By comparison, the monthly payer would grow to $107,229 as long as you reinvested dividends every month and let them compound. That’s $229 more growth than the annual payer in just one year.

Source: Investor.gov

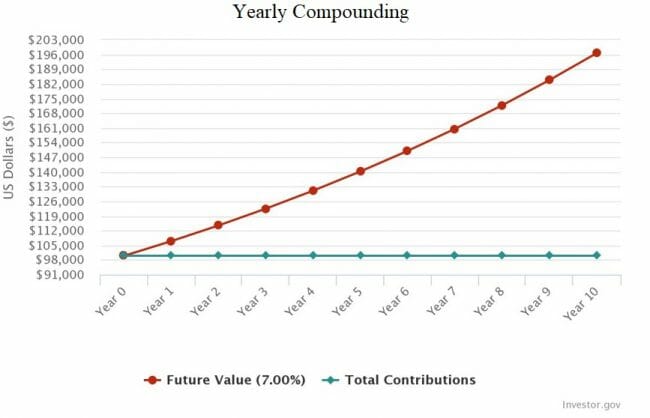

As you continue to reinvest dividends and let them compound over time, the rewards of the monthly payer only get better. After 10 years, the yearly compounder grows into $196,715.14. Not bad at all.

Source: Investor.gov

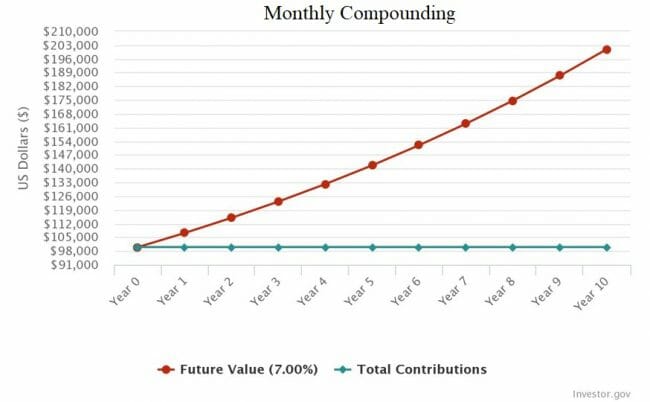

But the monthly payer in this example would be worth $200,966.14 — $4,251 more than the annual payer.

Source: Investor.gov

The key here is that the more often you reinvest your dividends, the more time they have to compound and grow.

2. Less Market Risk

When you buy an annual payer, you only have one day a year to buy additional shares through a dividend reinvestment program. But what if the stock hits an all-time high price on that day? You could get unlucky and reinvest in shares at a high price — and get stuck with a low dividend yield.

A monthly payer on the other hand lets you reinvest dividends to buy shares 12 times a year. This spreads out your market risk by letting you buy a few shares at a time. This gives you a greater possibility of buying shares when they’re cheaper, for higher potential returns if the security gains in value.

3. Peace Of Mind

When you buy dividend-paying stocks, it’s often best to hold them for the long haul. But sometimes the unexpected happens. Maybe market conditions get too risky for a specific asset class. Maybe a company runs into trouble. Or maybe the cash is needed for a personal emergency.

You could face difficult and expensive choices if a stock you own pays dividends annually and an unexpected situation comes up. I’d hate to hold on to a stock for 11 months, only to have to sell it right before its payoff date and miss out on the dividend income. I’d also hate to hold on to a problem stock just for its dividend — who’d want to see their stock fall $2 in price just to collect $1 in dividends?

In contrast, a monthly dividend payer gives you easier decisions and greater peace of mind. You don’t need to wait around as long for a dividend if you ever need to quickly get out of the investment. And you don’t have to worry about payoff dates or “missing out” on dividends as much.

4. Convenience

While many of my High-Yield Investing premium subscribers use dividend reinvestment as the growth engine for building a retirement fund, many will eventually need to start living off the income from their portfolio. Some are already at that point.

Regardless, monthly dividend payers will give them a convenient way to pay bills every month. They might use monthly dividends to pay the final mortgage bills to pay off their home. They also might use them to pay a monthly electric bill, a monthly cable bill, and a monthly phone bill.

The Takeaway

There are hundreds of monthly dividend-paying securities on the market, with more launching every day. Unfortunately, the vast majority of monthly dividend payers are fixed-income securities (i.e. bond funds), which are interest-rate sensitive and can lose value if interest rates go up.

Stocks and exchange-traded funds (ETFs) that pay a monthly dividend are less common, but they do exist… unfortunately, most investors don’t realize this, so it doesn’t even factor into their investment decisions. (As a side benefit, they may also be the better choice compared to bond funds, as they are less exposed to interest-rate risk.)

Either way, I’m fond of monthly dividend payers because they help my readers grow their retirement fund faster while also helping them sleep better at night. And when they’re ready to stop reinvesting dividends and start living off the income, they’ll be handy toward paying the bills every month.

In High-Yield Investing, we hold over a dozen monthly dividend payers in our portfolios. As a nice bonus, many of these carry annual dividend yields of 5%, 6%, or more.

It’s this kind of approach that has allowed our readers to build a sizeable nest egg to live off of in retirement. And it’s not too late for you to get started, either. That’s why I created my latest report, which reveals 12 of my favorite monthly dividend payers.