Putting On The Tinfoil Hat… Another Commodity Supercycle? It’s A Great Time To Invest In America…

Editor’s Note: I hope you’re gearing up for a great Independence Day weekend!

My colleague Jimmy Butts has been on fire lately — so I figured I would let him cook for a little while longer by handing things over to him for today’s issue.

Enjoy!

Brad Briggs

StreetAuthority Insider

Putting On The Tinfoil Hat For A Second…

A few weeks ago, I said that the recent attacks by the SEC and politicians on cryptocurrency could be seen as a good thing. In an update I sent to Capital Wealth Letter readers in April, I specifically said:

A few weeks ago, I said that the recent attacks by the SEC and politicians on cryptocurrency could be seen as a good thing. In an update I sent to Capital Wealth Letter readers in April, I specifically said:

“There has also been a lot of heat coming from the government. And while we don’t want to mess the US government — a usually unprofitable endeavor — it also tells me that cryptocurrencies are here to stay. After all, the government doesn’t go after something it deems “worthless.”

Since then, the attacks have leveled up. Perhaps this was all a distraction so traditional finance (aka TradFi) could sneak in the backdoor.

What do I mean? With the US government launching everything it could at major crypto players, TradFi has been plunging headfirst into crypto.

Wait, what? Yeah, typically, if there’s a house on fire (which one could argue the crypto world was on fire), you don’t go running in. But that’s exactly what TradFi did… Supposedly.

Heavyweights Charles Schwab, Fidelity, and Citadel teamed up to launch EDX Markets, an exchange to trade cryptos. One caveat is that it’s only open to the big boys in the room (institutional investors) at this time. It’s not just them jumping into crypto, either…

- BlackRock (the biggest name in town with $10 trillion in AUM) filed for a Bitcoin ETF.

- Invesco filed for a Bitcoin ETF.

- Deutsche Bank applied for a license to run a crypto custody service.

Perhaps it wasn’t a housefire… just a smokescreen.

Note: If you missed it, my colleague Brad Briggs launched a weekly Crypto Roundup that you absolutely don’t want to miss. You can read the first one here. And the second one here.

Even better is that it’s free. So, tell your friends about it…

Another Commodity Supercycle?

Everyone is focused on AI and other big tech gadgets right now. Investors have left “boring” energy stocks in the dust.

Today, energy is by far the cheapest sector in the S&P 500. But history tells us that times like these are exactly when we should be investing in commodities. Because we could be near a commodity supercycle.

What is a commodity supercycle? Well, that’s when prices of commodities rise above their long-term averages for long periods of time. The last supercycle started in 1996 and ended in 2016.

Commodity prices have reached a 50-year low relative to overall equity markets as measured by the S&P 500. Historically, lows in the ratio of commodities to equities have corresponded with the beginning of new commodity supercycles.

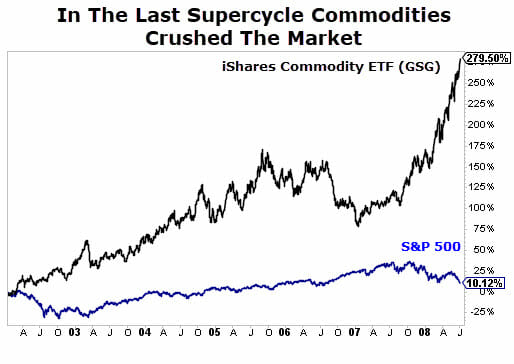

Take a look at the infographic below:

Commodities are notorious for their boom-and-bust cycles. If you can catch one of the booms and avoid most of the bust, you can make some spectacular returns.

If we had followed the above chart and bought the iShares Commodity Index ETF (NYSE: GSG) after the 2000 tech bubble and rode it to 2008 when the commodity-to-equity ratio peaked, we would have crushed the broader market. And it wouldn’t have even been close…

That’s how powerful these supercycles can be. They can deliver market-crushing returns.

I can’t predict the future. But here’s what I do know… if we are entering a supercycle in commodities, well then, now may be the time to strike (if you haven’t already).

It’s A Great Time To Be An Investor In America

Not every human on this planet is so fortunate to have such a wealth-building machine at their fingertips as we do. Think about that for a moment.

Not only can we start or buy a business with relative ease in America, but we can enjoy the fruits and labor of other people’s success via the stock market. Many of us might take for granted that we can hop online, open a brokerage account with as little as $50 and begin investing alongside some of the greatest entrepreneurs on the planet.

Millions of folks don’t have access to this wealth-building marketplace.

Granted, investing in the stock market isn’t a sure thing. There will be ups and downs. Some investments will make us money, while some will lose us money. Too many people want overnight success and become frustrated when they don’t hit a home run on their first pitch.

But we can enjoy some fantastic long-term returns with some patience, good judgement, and a little luck. Consider some of the stocks we own at Capital Wealth Letter, my premium advisory service.

We’re up 218% on Visa (NYSE: V) – compared to the S&P 500’s 97% during that time.

Our investment in the candymaker Hershey is up 162% — compared to the S&P’s 52%.

We have two triple-digit winners in our portfolio by investing in one of Buffett’s personal favorite businesses: insurance (123% and 183%). In about four years, we’ve doubled our money on Google parent Alphabet (Nasdaq: GOOGL).

Here’s the thing… it didn’t take any kind of special genius to find these stocks. In fact, some of them are what I like to call “no-brainer” picks. They’re accessible to everyone. And remember, we didn’t show up to work at any of these American companies. We didn’t have to log into a Zoom meeting or commute anywhere. We haven’t done anything. We simply made a few clicks on our computer screen and taken part in their success.

It’s truly remarkable when you think about it.

So, while there’s a choir of people who want to harp on America’s shortcomings, I’d rather heed the advice of a 92-year-old mogul whose mantra is “never bet against America.”

P.S. Remember the last crypto boom? My team and I think cryptocurrencies will surge again very soon…

That’s because three “blue chip” cryptocurrencies are getting major upgrades this year, and they could unleash a massive crypto boom. This could easily be a once-in-a-lifetime chance to take a small amount and turn it into a life-changing gain.

That’s why I just released a bombshell briefing about how you can profit. Get the details here…