Ballooning Credit Card Balances, Some Good Inflation News, And Moody’s Banking Scare…

In the 1976 film, The Graduate, a young, disaffected Benjamin Braddock (played by Dustin Hoffman) is at a cocktail party being thrown by his parents. An older neighbor pulls him aside and offers him some career advice.

“I have one word for you, ‘plastics.’”

The famous line sums up the Boomer generation’s discontent with the materialism of the previous generation. But we all know how that turned out. And if you don’t, well, that leads us to our first item of the day…

Credit Card Debt Hits $1 Trillion (Yikes!)

U.S. credit card debt crossed the $1 trillion mark for the first time ever.

Now, of course that sounds shocking. But let’s take a closer look at what’s really going on…

Credit card balances saw a whopping $45 billion increase in Q2 2023, reaching $1.03 trillion. That’s a brisk 16.2% increase from last year, according to the New York Fed’s latest report. But there’s a catch: credit card debt’s share of U.S. GDP is still lower than it was at the onset of the pandemic.

So, what should we make of this?

In the wake of high inflation and now facing rising rates, consumer confidence has remained surprisingly strong. Delinquency rates have returned to pre-pandemic levels.

Savings balances are still strong, too. In fact, credit card debt represents just 6% of total deposits households have in the bank. That’s the lowest level in 20 years.

It seems consumers have enough disposable cash to service their (rising) debts — for now.

Bottom Line

While the credit card market returns to normal after the pandemic, rising balances may present challenges for some borrowers. The resumption of student loan payments this fall may add additional financial strain. But overall, American consumers have shown resilience, and household credit shows early signs of stabilizing at pre-pandemic health.

The $1 trillion credit card debt milestone might sound alarming, but the context paints a more nuanced picture.

Still, I wonder if young Ben ever ended up getting into plastic? He could have made a killing…

Inflation In July: Cooling Down, But The Rent Is (Still) Too Damn High…

The dog days of summer may not be over yet. But according to the latest inflation data, things are cooling off.

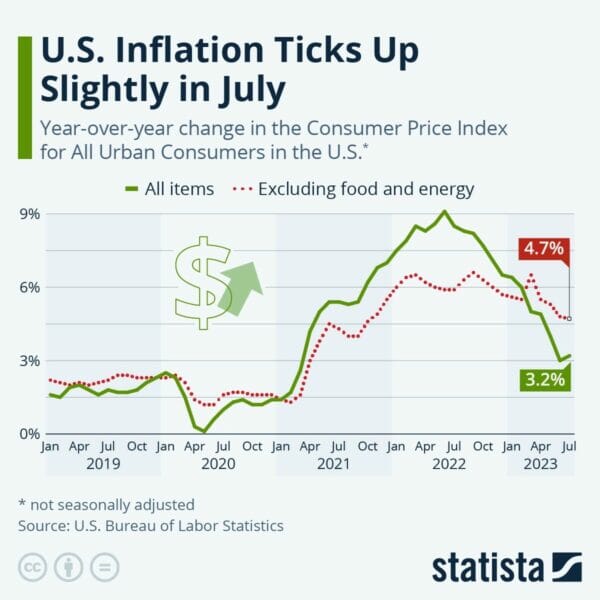

The Bureau of Labor Statistics released July’s Consumer Price Index (CPI) report, showing a 3.2% increase in July. That’s a slight uptick from the 3.0% in June. But before you start sweating, let’s do some digging.

July’s 3.2% was lower than the expected 3.3%. It’s also lower than any other month since March 2021.

On a month-over-month basis, prices increased by 0.2%, which was in line with expectations. The Federal Reserve’s preferred measure, “core” CPI, which excludes volatile food and energy prices, increased by 4.7% year-over-year. That’s the lowest rate since October 2021.

Source: Statista

Now, here’s where things get interesting. The largest driver of inflation in July was shelter. Rents and owners’ equivalent rents of residences increased 8.0% and 7.7% in July, respectively. All told, shelter accounted for more than 90% of the increase.

If we were to nix that out, inflation would have been just 1.0% last month.

“It is not quite ‘mission accomplished’ yet, but significant progress on the inflation front has been made,” said Sung Won Sohn, chief economist at SS Economics, per CNBC.

What’s Next?

It’s good to see things stabilizing. Economists seem to think the chances are increasing that we may indeed see a “soft landing” after all. But while inflation has come well off the 40-year highs of mid-2022, it’s still above the 2% level where the Federal Reserve would like to see it.

After hiking benchmark interest rates 11 times since March 2022, markets are pricing only a 9.5% chance of another hike in September. But what happens next is anyone’s guess.

Moody’s Puts A Damper On The Banking Sector

If you thought the recent kerfuffle with the banking sector was over, not so fast…

Moody’s just threw a curveball at the sector.

Late Monday, the ratings agency cut the credit ratings of 10 small and midsized U.S. banks. It also put some big Wall Street banking names on negative review.

Major lenders like Bank of New York Mellon, U.S. Bancorp, and Truist Financial are now under review for potential downgrades. Even Capital One, Citizens Financial, and Fifth Third Bancorp had their outlook changed to negative.

According to Moody’s analysts, U.S. banks are grappling with interest rate and asset-liability management risks. The wind-down of monetary stimulus and higher interest rates are causing some liquidity and capital headaches. Growing profitability pressures and a potential mild recession in early 2024 add to the gloom.

What This Means…

Remember the collapse of Silicon Valley Bank and Signature Bank earlier this year? That panic spread to Europe and even led to the emergency rescue of Swiss banking giant Credit Suisse.

Well, Moody’s is warning that banks with substantial unrealized losses might still be susceptible to sudden losses in a high-interest-rate environment.

With the Federal Reserve lifting its benchmark rate to a 5.25%-5.5% range, regional banks are not out of the woods yet, per the report. They’re at greater risk due to comparatively low regulatory capital, in addition to being hampered by fixed-rate assets (which were bought when rates were lower).

What’s next? Moody’s expects the stress on U.S. banks to continue, along with tightening credit conditions (bad news if you want to buy a house) and rising loan losses for U.S. banks.

P.S. What’s the only thing better than getting a dividend every quarter? How about a dividend every month…

If you’re tired of waiting around for your income, you need to check out our latest report. It reveals 12 simple stocks that pay out every month — no day trading, no crypto, no fancy options plays. Just put these 12 securities in your portfolio and watch the money roll in.