The Fisherman And The Investment Banker (Plus: The Case For “Game-Changers”)

I watched as they carried my neighbor out in a body bag. She wasn’t very old, maybe in her early 40s. And she sadly died alone.

When something shocking happens in our lives, it can make us introspective. It can also shine a light on the precious nature of time. Of course, it doesn’t have to be as dramatic as death. It could be the loss of a job, a divorce, or a sudden financial failure that makes us stop in our tracks and reflect on our lives and situations.

I realize this is an odd way to start off today’s issue, but it’s good to occasionally take a step back and see the bigger picture.

It’s easy to get buried in the market, trading stocks (or options). Eagerly waiting for that next earnings report or Fed announcement. Or searching for that next trade. But as I’ve said repeatedly, time is our most valuable asset.

As we strive for success in trading or life, we mustn’t lose sight of what is truly important to us. So, before we get to this week’s essay, I want to share the parable of the fisherman and the investment banker. I think about it frequently. Because while winning, building wealth, and finding success is great, it can consume us, and we can forget to enjoy life.

Here it is…

A wealthy investment banker goes on vacation to a tropical fishing village…

As he walks along the docks one afternoon, he comes upon a small, run-down fishing boat with several large fish on its deck.

“How long did it take you to catch those fish?” the investment banker asks.

The fisherman looks up from his work and smiles at his new visitor.

“Only a little while,” he replies.

The investment banker is caught off guard. He wants to help.

“Why don’t you fish for longer so you can catch more fish?”

The fisherman shrugs and explains to his new friend that he has all he needs.

“Each day, I sleep late, fish a little, and spend time with my children and beautiful wife. In the evening, I go to town, drink wine, play the guitar, and sing and laugh with my friends.”

The investment banker wants to help his new friend.

So he lays out a plan for the fisherman…

“First, you spend more time fishing, so you can catch and sell more fish. You buy a bigger boat, then a fleet. You hire a team, move to the city, take your company public and make millions!”

The fisherman looks confused, but smiles.

“And then what?” the fisherman asks.

The investment banker laughs at the silly question…

“Well, then you could retire to a quiet town! You could sleep late and spend time with your children and beautiful wife. In the evening you could go into town, drink wine, play guitar, and sing and laugh with your friends.”

Not realizing the irony, the investment banker stood silent, waiting for the fisherman to express excitement with the plan.

The fisherman smiled broadly, thanked his new friend for the advice, and wandered off slowly into the warm afternoon soon.

This parable illustrates the importance of perspective and the precious nature of time. Again, as we strive for success, we can’t lose sight of what’s important to us.

So, the next time you are stressing about the economy, markets, politics, a losing trade, or something else, remember the story of the fisherman and the investment banker.

The Case For “Game-Changers”: Why They Belong In Your Portfolio

There are many ways to make — and lose — money in the markets.

Some investors might use options, while others might find them too confusing and risky. Some folks might play it safe with a conservative index fund or even bonds. Others might instead focus on the high-growth biotech or technology sector. The list goes on and on.

Each method has its advantages and disadvantages. But regardless of which approach someone uses, I have found that most investors all have the same thing in common. They all have the same expectations — that they will strike it rich in the market.

This is why so many people gamble on some “hot tip” or penny stock that will make them a fortune overnight. The idea of risk management is thrown out of the window. But as I’ve said before, investing in the market is the hardest way to make easy money. Trust me, I’ve tried my hand in just about every corner of the market… stocks, bonds, options, futures, warrants… You name it, I’ve likely invested in it.

I’ve made good money using options or speculating on futures and currencies. But of course, I’ve also lost money as well. As exciting as these things can be, it can also be extremely frustrating and nerve-racking… not to mention a quick way to lose money.

But despite what I usually preach, that doesn’t mean there isn’t a place for it. I’ll explain what I mean in a moment…

Take Care Of The Basics First…

Through it all, some of my most profitable trades have come with the least stress. Some might find it boring, but it works. For example, one of my best-performing stocks is an insurance company that I purchased back in 2010. The stock is up over 630% since then, and I have no plans of selling.

Over at Capital Wealth Letter, I can cite numerous examples of incredibly profitable “boring” long-term positions we’ve had, from Hershey to Visa to Starbucks… they all crushed the broader market when we held them in our portfolio.

I don’t tell you this to brag. My goal is to simply point out that investing this way can be quite profitable.

I don’t have to worry so much about every earnings season. These well-established businesses will be around for years to come. They generate large amounts of free cash flow and reward shareholders through dividends and share repurchases. They are the type of stocks you can build your portfolio around.

But here’s the thing… they aren’t “sexy” stocks that will make you rich overnight.

These aren’t the kinds of investments I get asked about by friends and family. That would be things like pot stocks, cryptocurrencies, or some penny stock that trades over the counter. They are all disappointed when I try to tell them that I think Alphabet (Nasdaq: GOOGL) is undervalued. Or that we’ve done quite well with insurance stocks or credit card companies.

While these folks would be better off with these kinds of stocks, they simply aren’t exciting enough for them.

These folks are looking for what I call a “Game-Changer.”

Why You Should Look For Game-Changers…

I know I just pounded the table on purchasing wonderful companies at fair prices. And believe me, stocks like this deserve a place in every investor’s portfolio.

But once you have these “core” holdings in place, there’s nothing wrong with keeping some cash on hand to take a “home run” swing occasionally.

In fact, just one or two of these home runs a year can really add some extra juice to your portfolio over time. Even better, your core holdings should make it much less painful whenever you “strike out” (and believe me, you will). Moreover, shorter-term aggressive trades usually tend to be less correlated to the broader market.

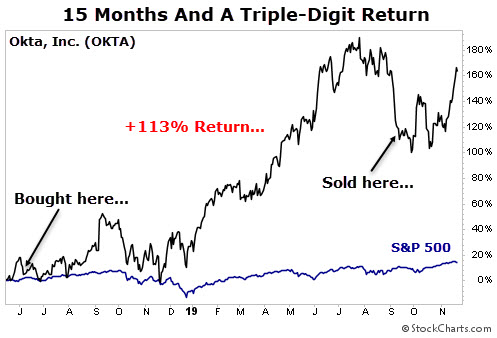

A trade we made with Okta, Inc. (Nasdaq: OKTA) is a great example. This smaller company doesn’t turn a profit or reward shareholders with increasing dividends. It’s a growth stock that operates in the burgeoning and increasingly important cybersecurity space.

We held Okta for just over a year (we booked our profits in September 2019). During that span, we greatly outperformed the broader market:

This brings me to the second advantage of having part of your portfolio dedicated to shorter-term opportunities: It recycles capital quickly. This is good because it allows you to move on to other trades. Even better, if a market downturn comes, you’re more likely to have the cash to buy elite businesses at a discount to their true value.

Action To Take

My advice: If you have a stable of solid “boring” stocks like the ones I’ve described above, keep at it. But do yourself a favor and consider incorporating the occasional short-term “Game-Changer” into your strategy.

Of course, not every pick will be a home run. But go into each Game-Changer trade with a plan. Know the downside risk and have certain price points that will be your line in the sand. If your investing thesis is off, or your timing is off, do not hesitate to cut it for a modest loss and move on to the next promising idea.

If anything, you’ll learn some valuable lessons along the way. And on the upside, let’s just say that booking a few triple-digit returns each year never hurt anyone’s brokerage account.

If you’re looking for a “game-changer” to add to your portfolio, you should consider cryptocurrency…

We believe NOW is the most important time to buy crypto… if you haven’t yet. That’s because our team thinks a select few cryptos are about to go on another monster run — and we just released a bombshell briefing about how you can profit.