3 Counterintuitive Ways To Improve Your Investing Results

Let’s face it: Much of what we’re told about investing (at least by the mainstream financial media) is just noise. It’s useless or unhelpful at best and downright harmful at worst.

Most novice investors are taught overly simplistic concepts. “Buy low, sell high,” or “diversification is key.” Sometimes, they can serve you well. Other times, they end up being just flat-out wrong.

Every investor has different goals. We all know that. But we also have different mindsets, risk tolerances, and preconceived assumptions… I could go on and on. Only on rare occasions will you come across a unique idea or approach that stands out above the rest. I like to think that several of our premium newsletters take unique approaches to investing that really work for our readers.

With this in mind, I spent some time thinking about lessons I’ve learned over the years. Many of them come straight from our expert analysts. And some of them fly entirely against what we’re taught about investing…

3 Ways To Improve Your Investing

1) Don’t Worry So Much About Beating The Market

Every time the mainstream financial media crows about “beating the street,” it fuels investors’ worst instincts. It makes you think someone is always doing better than you. It’s not healthy for your mind, and it’s not beneficial for your portfolio, either.

The research firm Dalbar has shown that the average equity fund investor consistently underperforms the market. The latest data I found said the average individual investor earned 7.13% annually over the last 30 years. Not bad, but it pales in comparison to the 10.65% for the S&P 500.

Source: Fidelity; Dalbar QAIB 2022 study

There’s a reason why the pros call individual investors “dumb money.” According to these findings, most people would have been better off buying an S&P 500 index fund and then walking away for 30 years.

According to Dalbar’s findings, most underperformance is attributable to investor behavior — lack of patience, poor timing, etc.

But if you spend less time worrying about beating the market and more time remaining patient and disciplined, you’ll be far better off in the long run. Stick to a proven strategy year after year, and you’ll find yourself in much better shape than the crowd.

2) You Might Own Too Many Stocks

This one might get me in trouble with my bosses… But you probably shouldn’t buy every single stock our analysts recommend.

But the truth is, I don’t think one of our analysts has ever recommended that. Everyone’s situation is different. Even Warren Buffett says that diversification is overrated. It’s for people who don’t know what they’re doing.

Buffett says he and his team can only manage a few really good ideas every year. Think you can do better?

Besides, if you take a glance at the average investor’s portfolio, you’ll find that it mirrors the market more than you think.

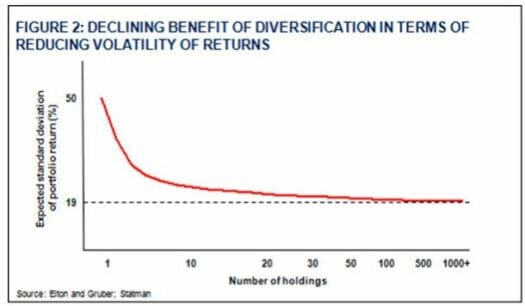

I won’t get too much into the weeds on this, but the truth is the more you own, the more your portfolio’s performance will look like the market. The chart below shows what I mean…

Part of the problem is that there are just too many choices out there for investors. As a colleague of mine once said, it’s like trying to drink from a fire hose.

Have money in Apple, Amazon, Microsoft, Tesla, and Google parent Alphabet? That’s about 20% of the entire S&P 500 right there. Throw in just a few more stocks, and suddenly your portfolio will start performing very close to the market — but probably with even more stomach-churning volatility.

Instead, assuming you have your 401k in a target-date allocation or in an index fund, focus the rest of your investing on no more than a dozen really good ideas.

Here’s another radical approach you might want to consider… Put 80% of your funds into an index fund, and don’t touch it. That’s 10% a year over the long run if history is any guide. Now take the rest and shoot for the moon. I’m talking about only picks that have the potential to deliver a triple-digit return minimum. I’m dead serious.

When done properly, this sort of “barbell” strategy will help you ride out the worst of what the market can throw at you while still offering the chance to reap the benefits of “high-upside” investments.

Either way, you may need to shrink your portfolio to a manageable size. Put more money into your best ideas. You’ll find it easier to keep up with, and your performance will likely improve.

3) Learn To Love Cash

There’s nothing quite like good, old-fashioned cash. Yet, for some reason, many investors think they need to be all in, especially when the market is on a bullish run. I get it. Cash brings down portfolio performance.

An index is fully invested at all times. You and I do not have that luxury. An index does not own a house that needs a new roof. It doesn’t have a daughter that wants to go to medical school.

We have a finite pool of cash to work with, and hopefully, we’re adding to it gradually along the way. But then life happens, and you need to access that cash. Alternatively, a global pandemic hits, sending the market into a nosedive. Suddenly, you’re looking at a once-in-a-generation opportunity to buy some of the market’s best names at fire-sale prices. But, oops… no cash.

See where I’m going with this? The best gamblers seem to understand this better than most investors. And they will tell you that you never have your entire bankroll in play at once, no matter how favorable the odds may be.

That’s because you always need to be able to live to fight another day.

Cash is not the enemy of a portfolio. It’s your friend.

Closing Thoughts

None of the things discussed here are meant to be the final word on anything. They may or may not apply to you. But they address some of the common flaws in thinking I’ve seen many investors take in their approach to the market.

Investing isn’t always easy. But these concepts have served me well over the years, and hopefully, they’ll get you thinking about your approach to the market and whether any changes are in order.

P.S. Want to get paid monthly from some of our favorite high-yield picks?

Most investors don’t even know monthly dividend payers exist. So, we wrote this report with one goal in mind… To reveal our favorite 12 monthly dividend payers that you can use to build an income-generating portfolio.

Each monthly payer has a high yield and a track record of paying more and more each year. Go here to learn more now.