Our Own Worst Enemy, What Makes A Good Investor, An Easy No-Brainer Pick…

I had to learn about this in college, but some of you may be old enough to remember the comic strip Pogo.

Artist Walt Kelly’s funny depiction of animals were used to deliver a biting political message that struck a chord with America in 1970.

In a special cartoon created for Earth Day, the character Pogo finds himself in a wasteland of what was once the great outdoors.

The caption reads: “We have met the enemy, and he is us.”

Here’s why I bring this up. There are a lot of people online who want to tell you how to “strike it rich” in the market. In fact, here’s my own personal “hot take” about investing.

You see, I don’t think finding a good stock pick is really all that hard. When it comes to successful investing, it’s often the boring, stupidly simple decisions that can help you win over the long run. The hard part is getting out of our own way.

Here’s what I mean…

Our Own Worst Enemy

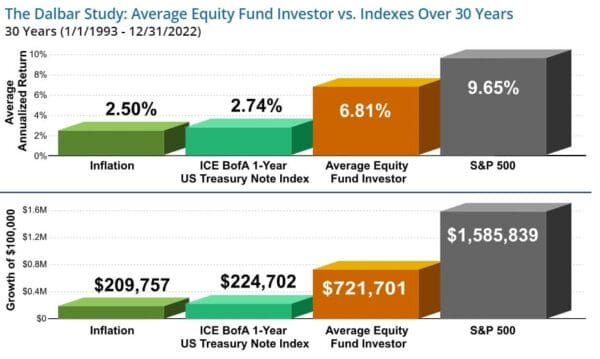

Study after study shows that individual investors consistently underperform the market. For example, a study from Dalbar shows that the average equity fund investor earned 6.8% annually over 30 years. The S&P 500, meanwhile, returned 9.65% annually.

Source: Index Fund Advisors

In other words, the average individual chronically underperforms the S&P 500. They would have been better off just parking their cash in an index fund and calling it a day.

While these studies always point to several reasons, the biggest culprit is always the same.

Investor behavior.

This, ladies and gentlemen, is the hard part about investing. I’m talking about overcoming your worst urges and not falling for some pretty simple mistakes… like having unrealistic expectations, trying to time the market, chasing yield, and listening too much to the media. I’ve included a handy list of the most common mistakes, according to the CFA Institute, here:

Source: Visual Capitalist

What Makes A Good Investor

If you can manage to avoid most of these mistakes (nobody’s perfect), you’ll be better than most of the crowd.

Being a good investor often means getting out of your own way. We often make it more complicated than it needs to be. We worry too much over what we can’t control. We try to time everything just perfectly. We overthink things and want to find that “magic bullet” stock pick that will deliver triple-digit gains overnight.

That rarely works out favorably. Meanwhile, there is usually low-hanging fruit out there in the market that’s staring us right in the face. All we have to do is reach out and grab it.

I’m talking about “easy win” stocks that deliver consistently, year after year. And if they ever take a dive, you back up the truck and load up on shares. That’s because what they may lack in sexiness, these businesses are efficient profit machines that help you weather the storm — and make you rich in the long run.

Trust me, they’re not as hard to find as you might think. In fact, to show you what I mean, I’ll give you an example…

An Easy No-Brainer Pick

Right now, longtime readers of our Capital Wealth Letter premium service are sitting on a triple-digit gain from one of the most boring, reliable, well-known brands on the planet.

I’m talking about The Hershey Company (NYSE: HSY).

Founded in 1894 by Milton Hershey, the company sells and distributes products under more than 90 brand names in roughly 60 countries worldwide. The company dominates most of the markets where it operates in terms of market share.

Hershey bars have been in existence, virtually unchanged, for more than 120 years. People may be getting a little more conscious about what they eat, but chocolate isn’t going away anytime soon. A Hershey bar is about as iconic as a bottle of Coca-Cola. They were distributed to troops before they landed in Europe during WWII.

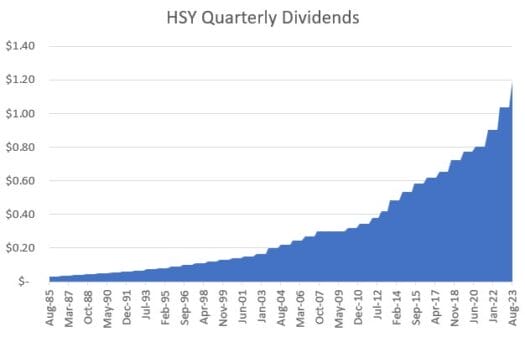

HSY has paid dividends for over 375 consecutive quarters — or more than 93 years. And except for 2009 (when it maintained the dividend), it has raised its payouts every year since 1974.

We added the stock to our Capital Wealth Letter portfolio back in October 2018. And through all kinds of wild market gyrations, it’s delivered steady (and staggering) growth over time.

As a result, this “boring” chocolate maker has crushed the market…

Now, here’s where things get exciting about a stock like this. When you find a company that consistently delivers the goods year after year, you’re bound to come across a situation where the stock takes a beating. That’s what’s happened to HSY lately.

Yet the business is doing just fine. According to the National Retail Federation, consumers are expected to have spent about $3.6 billion on Halloween candy this year – an increase of $500 million over 2022. It’s a safe bet that Hershey captured more than its share.

Meanwhile, third-quarter sales climbed nearly 11% to $3.0 billion. Most of that top-line growth came from price hikes. (It turns out that candy is inflation-resistant.) Hershey’s gross margins expanded by 240 basis points over the past year to 44.9%.

Hershey is now looking to close out the fiscal year with 11% to 12% earnings growth. It owns 45% of the chocolate market. But you wouldn’t know that by looking at the stock’s price action over the past year.

It doesn’t take a genius to know what to do with this pick. All it takes is a willingness to pull the trigger on the stock and be patient.

Hershey doesn’t have to grow sales by double digits year after year to deliver impressive returns to shareholders. Its business model doesn’t require massive investments in research and development or any complicated financial engineering. That leaves more money on the table for sensible acquisitions, stock buybacks, and dividends to put into shareholders’ pockets.

Closing Thoughts

Remember, this isn’t an explosive-growth company. And it didn’t take much research to find it. But when you spot an opportunity with a well-run company that operates with ruthless efficiency, you know what to do. You just get out of your own way and buy.

Most investors try to read the market’s tea leaves or find a “sexy” pick that could deliver overnight riches. Instead, our subscribers bought one of the easiest businesses to understand and then held on. And in a few short years, they blew by the rest of the crowd.

As I said before, finding a good stock pick isn’t hard. In fact, it can be incredibly simple. So, instead of spending all your time and energy trying to find a stock that nobody’s ever heard of, you should be looking for investments that look exactly like this.

This is why we constantly preach about how a well-run “Buffett-like” company can produce excellent returns over the long run… Hershey is a perfect example of how investing in a well-run company can produce market-beating returns.

All you have to do is spot the opportunity, pull the trigger, and wait.

P.S. Some of the market’s safest high-yielders go completely undiscovered by the vast majority of individual investors. But many of our readers are already living a worry-free retirement, thanks to my colleague Nathan Slaughter.

If you want to spend less time worrying about bills and more time doing the things you want, you need to see his latest report. Click here for details.