Q&A: How Yields Work, Why Dividends Matter, And Other Advice For Beginning Investors…

I recently became an uncle for the third time.

My brother-in-law, not one to waste any time, recently asked my wife who we use for our 529 plan.

Since we attended the same university, he’s all too aware of what it will take to send his son to our alma mater – a private school. (You don’t want to know.)

This got me thinking about what I will tell my nephews (and my own kids) about investing.

Gotta start ‘em early.

So, I went to my colleague Nathan Slaughter and asked him a few questions…

These are questions that I hope these kiddos will ask me one day in some form or another. And if not, well, I’ll happily lecture them. Sure, I may get a few eyerolls. But if I repeat it enough, it’s bound to sink in at some point.

By the same token, some of these topics may be familiar to longtime readers. But there’s no harm in reviewing the basics from time to time. My questions for Nathan are in bold.

Enjoy,

Brad Briggs

StreetAuthority Insider

One of the most common questions from newer investors is about dividend yields. Why can they sometimes be trickier than they seem?

Dividend yields can be calculated in several different ways. So, various websites may show different yields for the exact same security.

Dividend yields can be calculated in several different ways. So, various websites may show different yields for the exact same security.

When payments vary greatly, the most reasonable calculation involves taking the last 12 months of dividend payouts (trailing twelve months or TTM) and dividing that figure by the firm’s current share price. This is called a trailing yield.

For example, let’s assume Company XYZ’s current share price is $50. Let’s also assume the firm has made the following dividend payments over the past year:

March — $0.50

June — $0.50

September — $0.50

December — $1.00

As you can see, that’s $2.50 per share in total dividends over the past twelve months. So, in this example, the trailing dividend yield is 5% ($2.50 divided by $50). But it’s important to remember that this is just one way.

Unlike a trailing yield, a forward yield projects dividend payments over the next 12 months. It’s best used when these payments can be predicted with reasonable accuracy. The forward yield takes the stock’s latest payment and annualizes it over the next 12 months.

So, in our example, Company XYZ’s most recent dividend payment was $1.00 per share. Let’s say we can reasonably assume the quarterly dividend will remain at this new level over the next year. That means we’ll see $4.00 per share in dividends over the coming year. Therefore, Company XYZ’s forward yield is 8% (calculated by taking the $4.00 in projected future dividend payments and dividing that figure by a $50 share price).

This forward yield of 8% differs greatly from the trailing yield of 5% shown above. Both are correct. They’re just calculated differently.

To make matters even more complex, if a company makes a “special” one-time dividend, this may or may not be reflected in the yield you see on a financial website.

When possible, it’s best to go directly to the source. Most companies list their historical distributions on their website, and declared distributions can usually be found in their press releases. We generally use this data to calculate the yields we present over at High-Yield Investing.

The average S&P 500 stock yields less than 2%. So why should individual investors care about income stocks when they can focus on growth stocks instead?

Growth stocks tend to get the front-page headlines — not the stodgy dividend payers. But what’s lost in the shuffle is that dividends are a sign of financial strength, of a real business making real profits.

Conventional wisdom says that if you take on more risk, you’re repaid with more reward. Yet that’s not always true. According to S&P Global Research, dividends have been responsible for 32% of the total return of the S&P 500 Since 1926.

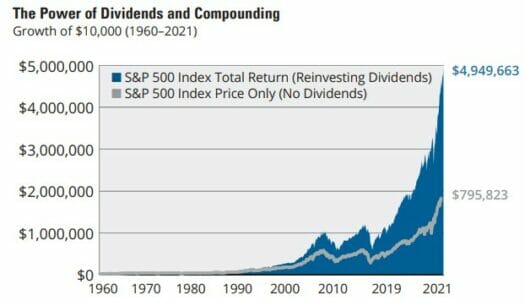

According to Hartford Funds, 84% of the total return going back to 1960 came from reinvested dividends and the power of compounding.

Source: Hartford Funds

The odds are so kind that it’s hard not to come ahead when investing this way. I am constantly amazed that more investors don’t help themselves with this delicious free lunch.

What’s your advice to someone just getting started with investing?

Do your own due diligence. Don’t buy any company you don’t thoroughly understand. During your research, ensure you understand how a company makes money and whether the economic environment seems favorable for the stock to perform well. You’d be surprised how many people don’t even check a security’s home page or read the latest press releases and earnings reports.

Next, go slowly. Experiment with small amounts of capital first, and be prepared to learn by trial and error. Investing is a lifelong learning process — sometimes you’ll be successful; sometimes, your investments may not work out as expected.

Take advantage of the magic of compounding by enrolling your investments into Dividend Reinvestment Plans (DRIPs). There’s no sounder way to grow wealth over the long term than to systematically invest in high-quality stocks and funds, hold on for the long haul, and reinvest your dividends. By plowing your dividends back into more shares, you harness the miraculous power of compounding. The beauty of compounding is that any little smidgen of money you can put to work now — no matter how small — can have an extraordinary effect on your wealth.

P.S. Want to know the only thing better than a dividend payout hitting your account every quarter? How about a dividend every month…

If you’re tired of waiting around for your income, I encourage you to check out my latest report. It reveals 12 simple stocks that pay out every month. There’s no day trading involved, no crypto, no fancy options plays… Simply put these 12 securities in your portfolio and watch the money roll in. Go here now to learn more.